With bank loans blocked, people are rushing to get emergency financing

Credit card loans exceed 40 trillion, the largest ever

Car collateral loan inquiries surge 118% in one year

Vulnerable groups are being pushed out by illegal private lending

“I have been asking credit card and capital companies for short-term loans for over half a year, but I have been rejected one after another. I can now see myself having to borrow money from acquaintances. I am finally contemplating whether I should contact a private financial institution.”

Mr. Park (44), who works at a small business, complained to a reporter on the 13th. As I am responsible for taking care of both of my sick parents, I cannot live comfortably on my salary, and the 200 million won or so that I have saved up little by little has now completely dried up. Mr. Park said, “I have no collateral such as real estate or a car, and my credit score is below 600, so I have nowhere to borrow money for living expenses.”

As the economic recession continues, the balance of credit card loans and insurance policy loans has skyrocketed, and more and more ordinary people are using their cars as collateral to secure emergency funds. If you have collateral, your situation is better, but vulnerable groups like Mr. Park who do not have collateral are being pushed into ‘blind spots’ such as illegal private lending.

According to the financial sector on the 13th, the balance of ‘card loan’ (total of 9 card companies), which ordinary people seek out first when their finances are cut off, has been tallied at 40.6059 trillion won, the largest ever, and the balance of deposit-secured loans is also skyrocketing. The number of cases of auto loan (car loan) limits checked through the loan comparison platform ‘Finda’ during the first half of this year (January to June) was 14.84 million, an increase of about 118% compared to the same period last year. It is a figure that has increased by 226% compared to the second half of last year (July to December). Car loans are loans that can be received regardless of income conditions or credit score as long as you own a car, and are classified as representative ‘recession-type loans’ along with card loans, insurance policy loans, and deposit-secured loans.

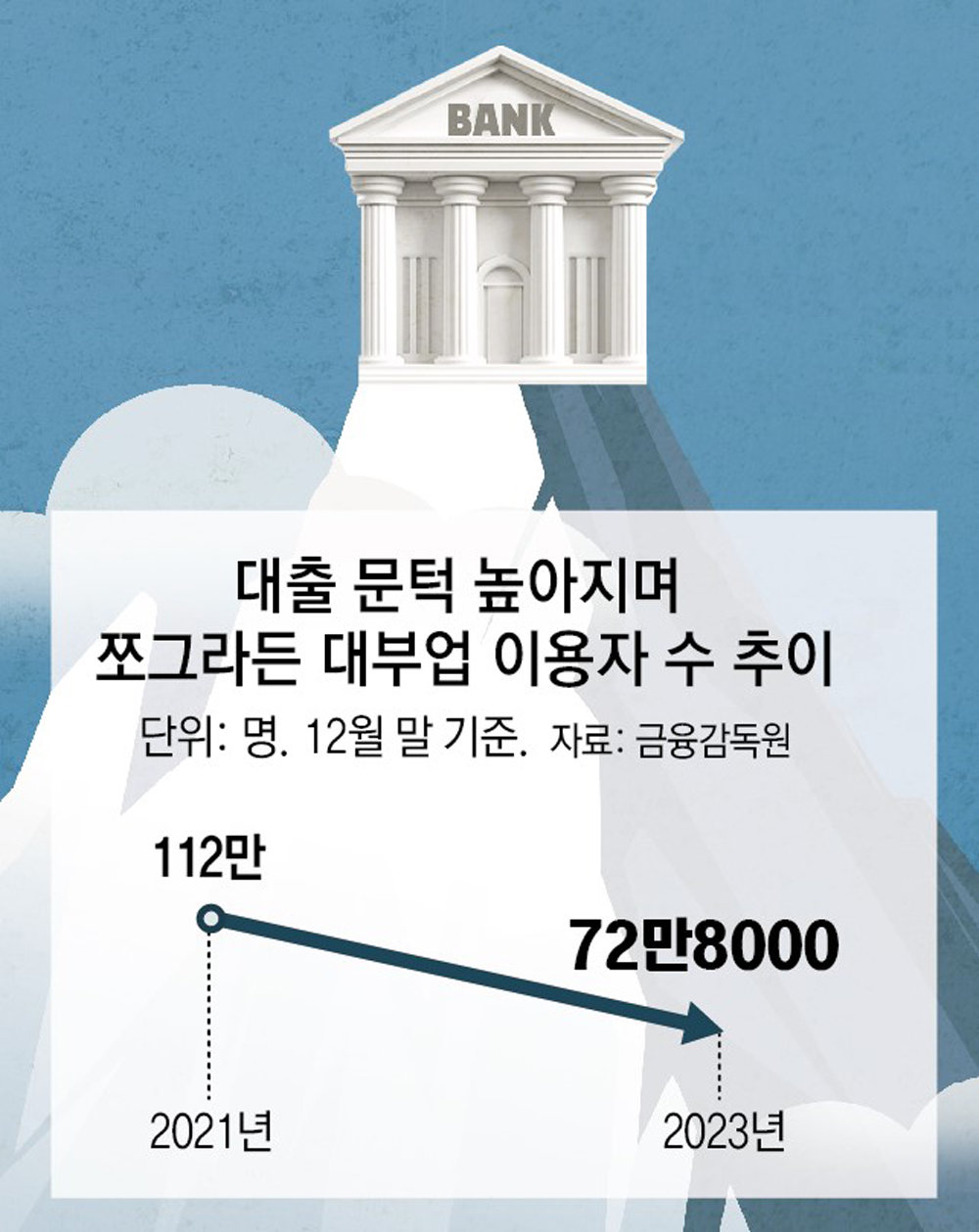

With high interest rates overlapping with the recession, and secondary financial institutions such as savings banks reducing loans to low- and medium-credit borrowers due to the burden of delinquency rates, ‘recession-type loans’ are increasing day by day. If even this is not enough, the vulnerable class who are pushed out of the system will inevitably increase. Seo Ji-yong, a professor of business administration at Sangmyung University, pointed out that “since secondary financial institutions are reluctant to lend to low- and medium-credit borrowers, demand for funds has shifted to recession-type loans such as mortgage loans,” and “(Since supply is limited) the vulnerable class who have no choice but to knock on the doors of illegal private lenders will inevitably increase.”

Common people, emergency loans with insurance money as collateral… Middle class invests in houses with ‘main collateral’

[늘어나는 ‘불황형 대출’]

Polarization of loans is becoming increasingly severe

Deposit loans up 25% in 3 years, insurance up 12%… Common people without collateral are being hit by private finance

Middle class increases loans to ‘purchase real estate’… Secondary financial sector also lends only to those with good credit

![[단독]‘Car loan’ also uses deposits as collateral… Common people forced into recession-related loans [단독]‘Car loan’ also uses deposits as collateral… Common people forced into recession-related loans](https://dimg.donga.com/wps/NEWS/IMAGE/2024/08/14/126517310.2.jpg)

Ms. Lee (38), a department store employee, recently received a consultation for a car loan (car loan) through a loan counselor. Ms. Lee, who was in dire need of living expenses because she had used up her housing loan and overdraft limit, barely managed to receive a car loan of 15 million won from a capital company. Ms. Lee said, “This year, my first child entered elementary school, so my expenses for extracurricular activities and private academy fees have increased significantly in a short period of time.” She added, “The savings bank said, ‘We won’t give you a loan without collateral,’ so I had no choice but to use the car loan.” While ordinary people are struggling to even afford living expenses due to the ‘loan cliff,’ they are using their cars as collateral, but those with high credit scores and high incomes are significantly increasing their household loans for things like purchasing real estate. The polarization between high-credit borrowers and those with medium and low credit is also widening in the loan market.

● Surge in recession-related loans such as car loans

The reason why demand for car loans has been increasing recently is because loans can be received regardless of income conditions, credit scores, etc. The loan limit is higher than that of credit loans, but the interest burden is also higher. As of the end of June, the interest rate for new car loans handled by savings banks was a minimum of 9.80% per annum and a maximum of 19.99%.

According to the loan comparison platform Finda, among the customers who inquired about the limit of a car loan in the past month, the proportion of customers in their 30s and 40s was 30.2% and 37%, respectively. Seo Gwan-soo, the general manager of Finda Partnership, diagnosed, “This shows that the demand for emergency funds has increased among the 30-40 age group, which makes up the middle class of the Korean economy.”

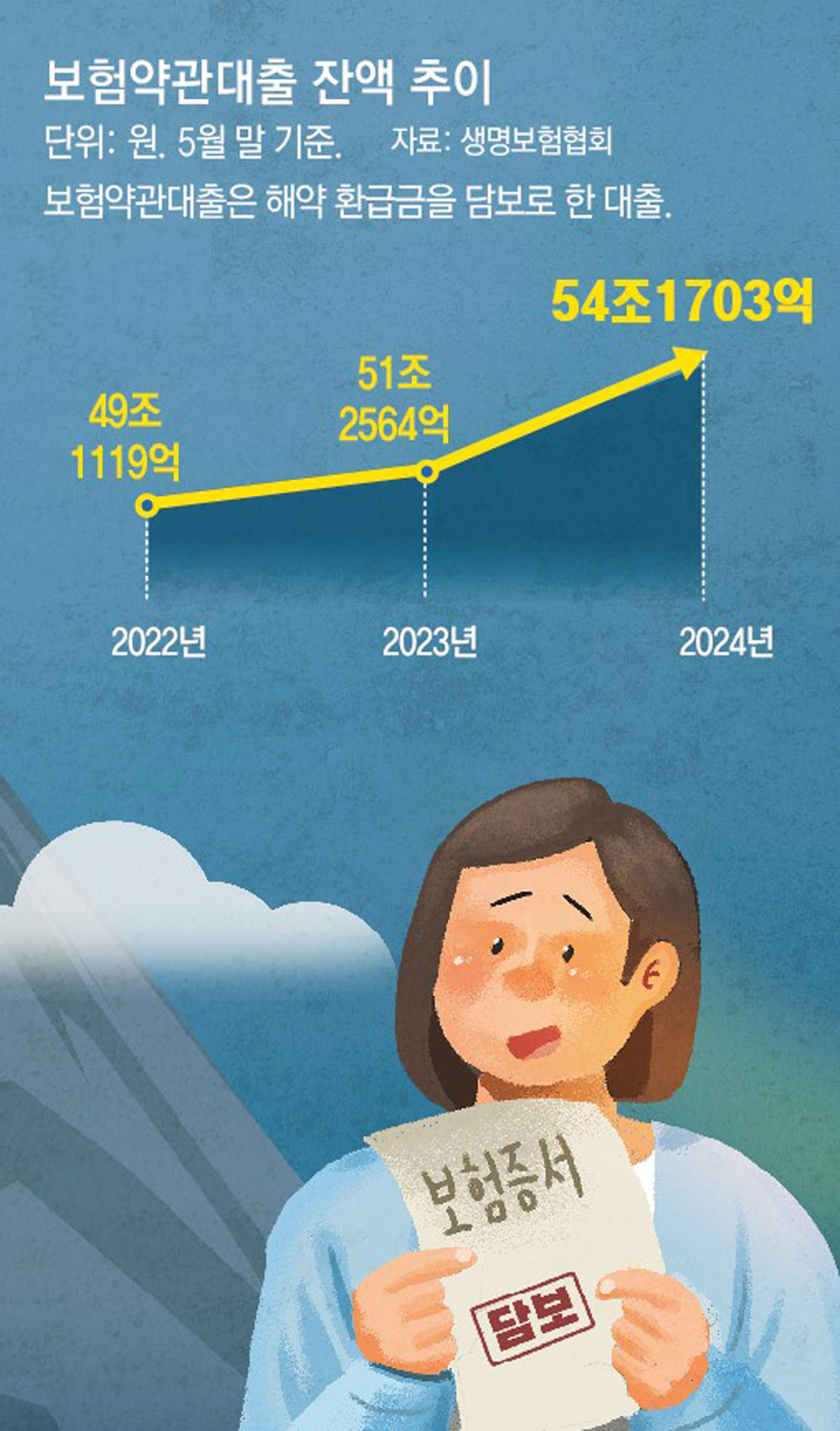

The balances of products considered as ‘recession-type loans’ along with car loans are also skyrocketing to all-time highs. The card loan balances of nine major domestic card companies, including Lotte, BC, Samsung, Shinhan, Woori, Hana, Hyundai, KB Kookmin, and NH Nonghyup, were 40.6059 trillion won as of the end of June, showing an increase for six consecutive months since December of last year. The deposit-secured loans of the four major commercial banks, including KB Kookmin, Shinhan, Hana, and Woori, also increased by 25% compared to three years ago to 4.7831 trillion won as of the end of June. The balance of insurance policy loans, which secure funds using one’s own insurance contracts as collateral, also increased by 12% compared to three years ago to 54.1703 trillion won as of the end of May.

It is interpreted that the balance of recession-type loans with relatively low thresholds but high interest rates has skyrocketed as secondary financial institutions such as savings banks, Saemaul Geumgo, and Capital have been reluctant to lend to mid- and low-credit borrowers.

● While the common people are running out of money, the middle class’s housing loans are skyrocketing

Those who can borrow money by providing collateral such as deposits, insurance, and automobiles are in a better situation. People who cannot afford to provide additional collateral or whose loan limit is full are being forced to resort to private lending as they have no way to secure emergency funds. Mr. Noh (42), who is currently looking for a job, is looking for a place to borrow money to pay off his credit card bill, but is considering consulting with a private lender as his loan limit is full. Mr. Noh said, “I know that private lending interest rates are hard to afford, but I am looking for a way to pay off my credit card bill by searching on portal cafes and making phone calls.”

Policy finance products designed for the vulnerable class with low credit are also not functioning properly due to budget shortages. The small-sum living expenses loan launched by the Korea Small Business Finance Promotion Agency in March of last year is in a situation where it must operate the system with the remaining financial sector donations and loan recovery funds. According to government officials on the 13th, it has been confirmed that the budget for operating the small-sum living expenses loan system next year is highly likely not to pass the final review of next year’s budget.

As such, the flow of money is drying up for those with low and medium credit scores, but the growth of household loans is not slowing down. This is because high-income and high-credit borrowers are going on a ‘real estate shopping spree’, and the balance of housing mortgage loans is rapidly increasing. The common people are requesting that secondary financial institutions such as savings banks lower their loan thresholds, but these institutions are also expressing reluctance, citing the management of real estate project financing (PF) defaults and delinquency rates. The secondary financial institutions, which used to call themselves ‘the common people’s emergency cash cows’, are turning a blind eye to common-person loans and focusing only on secured loans and loans to those with good credit scores.

Kim Dae-jong, a professor of business administration at Sejong University, diagnosed that “since ordinary people have nowhere to borrow money, they are using credit card loans, insurance policy loans, and even cars as collateral to receive loans,” adding that “this is evidence that people with low and medium credit scores are being pushed to the limit.”

Reporter Kang Woo-seok [email protected]

2024-08-13 19:43:44