Colombia’s Minimum Wage Hike: Impact on Pensions and State Finances

Table of Contents

A substantial increase in Colombia’s minimum wage, confirmed by President Petro last monday, is poised to reshape the financial landscape for pensioners and the state pension system. The new minimum wage, rising from $1,423,500 to $1,750,905 – effectively $2 million COP with transportation support – will have a varied impact across the Colombian retirement system, creating both benefits and potential challenges.

Pension Adjustments Tied to the Minimum Wage

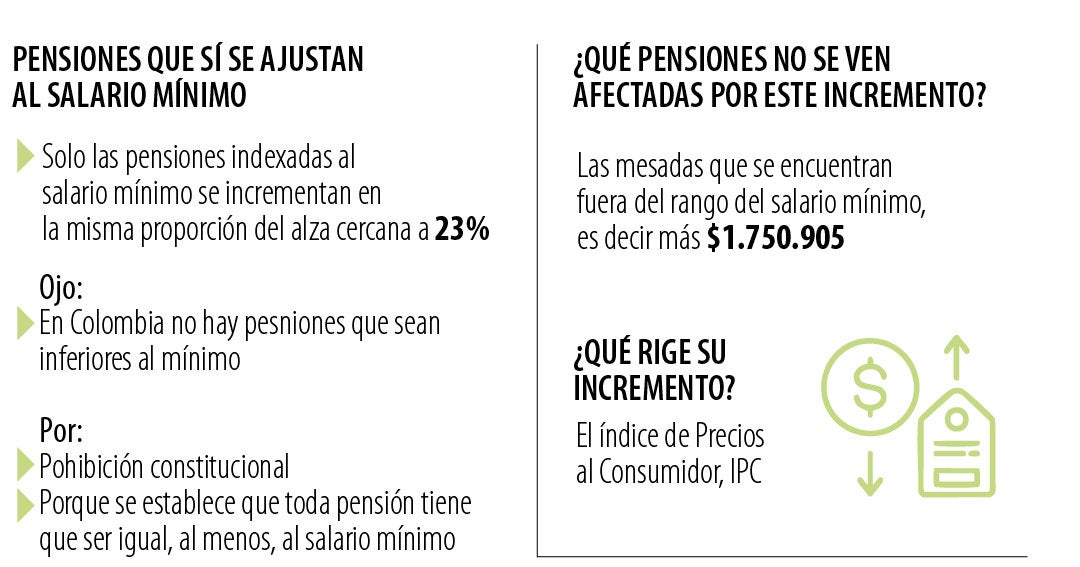

Not all colombian pensions will be directly affected by this increase. Adjustments will primarily impact those receiving payments equivalent to the Legal Minimum Wage Current Monthly (Smlmv), roughly $1.4 million COP as of 2025.Retirees earning above the minimum wage will see their pension increases tied to the Consumer price Index (CPI), with adjustments reflected in January based on CPI variation.

Increased Costs for Colpensiones

The wage hike is expected to substantially increase the financial burden on Colpensiones, Colombia’s largest public pension fund. A senior official stated that the increase in the minimum wage will raise Colpensiones’ payroll costs considerably, as a majority of its beneficiaries receive allowances near the minimum wage level. “What the state is going to have to pay for Colpensiones pensions will increase by a figure close to 20%,” the official assured.

Why did this happen? President Gustavo Petro’s governance prioritized increasing the minimum wage as a key component of its economic policy, aiming to reduce income inequality and boost domestic consumption. Who is affected? The increase directly impacts approximately 6.5 million Colombian workers earning the minimum wage, and also pensioners receiving benefits tied to the Smlmv. What is the impact? The wage hike will lead to increased pension costs for Colpensiones, challenges for private pension annuities, and potentially strain the Minimum Pension Guarantee Fund. How did it unfold? After negotiations, President Petro confirmed the increase last Monday, setting the new minimum wage at $1,750,905 COP (approximately $437 USD) plus a transportation allowance. The long-term effects are still unfolding, but the government is preparing to manage the financial pressures.

Challenges for Private Pension Annuities

The minimum wage increase also presents difficulties for private pension annuities offered by insurance companies. According to one analyst, it is becoming increasingly challenging for insurers to assume the payment of pensions close to the legal minimum wage due to the risk of future wage increases outpacing inflation. “It is indeed becoming increasingly arduous to find insurance companies that assume the payment of pensions close to the legal minimum wage as they cannot bear the risk of a president raising the pension four times the inflation rate,” they explained.

Impact on Individual Savings and the Minimum Pension Guarantee Fund

For those contributing to the individual savings retirement regime, the increased minimum wage makes securing a minimum pension more expensive. This is because a larger number of individuals may be unable to finance a minimum pension with their savings and will need to rely on the Minimum Pension Guarantee Fund. The potential shortfall in this fund could ultimately be borne by the State.

The long-term implications of this wage increase on Colombia’s pension system remain to be seen, but it is clear that the government will need to carefully manage the financial pressures created by this significant economic shift.