2024-04-25 06:18:20

It was found that Korea’s rich are maintaining their asset portfolios this year and observing the market. However, there was also an atmosphere of cautious anticipation of a recovery in the real estate market and consideration of investment.

According to the ‘2024 Korea Wealth Report’ published by Hana Financial Management Research Institute on the 25th, the proportion of rich people with a positive outlook on the real and real estate economy this year increased compared to the previous year, but 65% still had a negative outlook.

Based on this, when asked about their plan to adjust their asset portfolio this year, 7 out of 10 rich people responded that they would keep it the same as last year. Compared to 5 out of 10 in the last survey, the number of rich people taking a ‘wait-and-see approach’ has increased.

However, while the proportion saying ‘I will increase financial assets compared to last year’ decreased by 10 percentage points, the proportion saying ‘I will increase real estate’ increased slightly, showing cautious anticipation of a recovery in the real estate market.

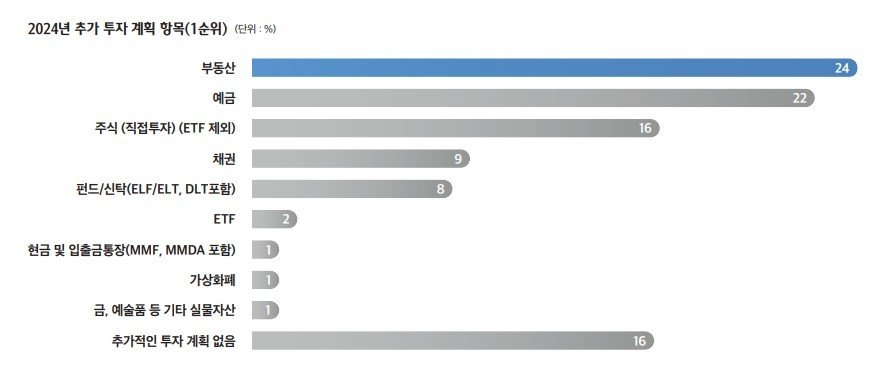

As for the asset with the highest intention to make additional investments this year, real estate still ranked first at 24%. However, the response rate decreased significantly compared to the previous year’s 32%, narrowing the gap with deposits (22%), which ranked second in investment intention.

It is noteworthy that despite the recent favorable outlook for interest rate cuts, the intention to invest in ‘deposits’ was higher than in stocks. Stocks accounted for 16% of the total investment intention, ranking third after deposits.

Hana Financial Group said, “If it was determined that real estate prices, which had been falling last year, had passed the inflection point, it was interpreted that there would be a need to safely deposit waiting funds because one would have to wait and see the market and wait for the right time to purchase.”

Meanwhile, the number of rich people who have no additional investment plans is approximately 16%, a significant increase from the previous survey (5%). Hana Financial explained, “This is in line with the increasing number of responses saying that there are no plans to rebalance assets this year,” and “They seem to judge that this is a situation in which they cannot expect significant positive news.”

(Seoul = News 1)

-

- great

- 0dog

-

- I’m so sad

- 0dog

-

- I’m angry

- 0dog

-

- I recommend it

- dog

Hot news now

2024-04-25 06:18:20