Did you also receive a message from the bank that your bank ID card is ready? If so, this guide is just for you. The bank identity card is an important document that can help you save hundreds and even thousands of shekels a year, without effort. Calcalist arranges for you:

What is a bank ID?

A report that shows every bank customer an overall picture of his bank account: what are the total assets in the bank (current account, deposits, securities, etc.), what are the total liabilities (loans and mortgages), the income and expenses throughout the year and most importantly – how much money You paid the bank for fees and interest (spoiler: probably too much).

In fact, reading the ID card is like going to the family doctor to measure blood pressure, do blood tests, check your weight, etc., except that it is relevant to anyone who owns a bank account, regardless of their age and the level of cholesterol in their blood.

Why is this so important?

The identity card is a tool initiated by the banking supervision in 2016 and is designed to help the customer understand the status of his account, whether it is being managed properly and whether he should negotiate his terms with the bank: the interest he receives on his assets, the interest he pays on his loans and the fees he pays for the bank’s services .

where do i find her

The certificate is waiting for you in the personal area of the bank under the section “Documents and messages”, “Producing certificates” or another title in a similar spirit. It is produced every year until 28.2 and shows the data as of 12.31 of the year ended. There are two versions – a narrow one and a detailed one, and since in most cases the narrow one presents a sufficiently broad point of view we will focus on it. If you have a portfolio of securities in your account, you should also look at the detailed version.

What do I need to do to read it?

Leave for fifteen minutes, it’s better now and have a little patience. Calcalist will accompany you throughout the reading.

Part I – General

Start calm. This is the most basic part that shows the general account details: who is registered as the owner, who has a power of attorney to act on the account, etc. It’s always a good idea to make sure the details are correct, especially if you’ve recently added a power of attorney to the account.

Part B – Balances as of 12/31/22

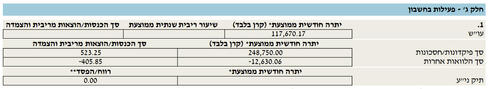

Here you can see the status of the balances as of the end of the year that ended. The total balances are divided into assets (the money you have in your checking account, deposits, securities) and liabilities (minus, loans you have taken).

Please note – if there is a mortgage in the bank, it will only be displayed if the people registered on the mortgage are registered in the account. That is, if you took out a mortgage with a spouse and you have a private account in the same bank without your spouse, the mortgage will not appear in the section of your obligations and also in the other relevant sections of the certificate.

In the attached example, you can see current account balances totaling NIS 88,000 and deposits totaling NIS 275,000, in contrast to loans totaling NIS 7,950. This situation speaks volumes, and it is probably better for the customer to use the current account funds or check when the next exit point of the bank deposit is to close the loan.

Part C – account activity

This part is divided into four sections, the most important of which is the fourth, and it shows average data of your assets and liabilities, and the income and expenses on interest and linkage. We will explain right away.

Part III, Section 1 – Accounts Payable

The most important part is the total expenses you paid for interest and linkage due to loans or going into the red. A loan is not a cheap thing, certainly not these days, and although it is unpleasant it is very important to know how much money it cost you this year. In the example above, the account holder paid NIS 406 in interest against the loan taken, and received NIS 523 in interest for the deposits. Please note: this is only part of the money you paid to the bank this year. In section 4 it will be possible to find the total fees you paid.

In addition to interest and linkage expenses, you can also see the average monthly balance in the current account and in the securities portfolio, if you have one. For example, in the example above, they took the average balance each month in the current account throughout the year 2022 and divided it by 12. The result is an average of NIS 117,670. Similarly, calculate the average balance in deposits and loans.

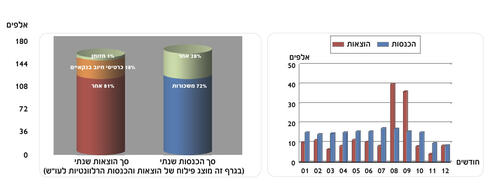

You can see in the graph your expenses and income every month during the year and get a general impression of your situation. Please note: if you transferred funds to an example deposit or securities portfolio, this will be recorded as an expense, and this may explain high expenses such as in the months of August and September in the above example.

In addition, you will be able to see a segmentation of income and expenses by sections. Please note, in the attached example, the “other” section makes up 81% of the expenses, and it probably includes non-bank credit cards and bank transfers.

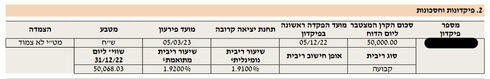

Part III, Section 2 – Deposits and savings

In the second section you can see the total of your deposits and savings, their maturity date and the interest you receive on them. Since the Bank of Israel raised the interest rate significantly throughout the year, if you have an old deposit with a fixed interest rate (which is not linked to the prime interest rate or the index), the interest on it may be very low and you should release it at the nearest exit station and re-deposit it under better conditions.

Part C, Section 3 – Credit

In the third section of this section, you will be able to see the total amount of existing loans in your account and the interest you pay on them, including the mortgage, as well as the remaining balance that also appears in section B. Please note: this section shows your credit limit and the interest you will pay on it if you exceed it. The frame is divided into two amounts – from the minus one shekel up to a certain amount (in the attached example up to NIS 32,500) you will be charged a certain interest rate (in the example 7.85%), and beyond that amount the interest rate will increase. Either way, it is probably a very high interest rate, so if you understand that it is a permanent minus, it will probably be cheaper to take a loan.

Part III, Section 4 – Fees

The fourth part is particularly important and shows the total fees you paid to the bank by type. In the above example, the bank was paid 300 shekels for an extended current account fee track, and an additional 48 shekels for a credit allocation fee, which is a fee the bank charges for the possibility of going into the red. Please note: there are banks that do not charge a credit allocation fee at all, and if you are charged such a fee, you should bargain and even consider switching banks. And in general, you should bargain for any commission you pay.

In total, throughout the year in the current example, fees totaling NIS 348 were charged, this is in addition to interest totaling NIS 406 that was paid on a loan and appeared in section C-1.

Please note, if you have a portfolio of securities at the bank, the total fees you paid will appear in this section, as shown in the following example:

In this example you can see the total fees paid for buying and selling securities (NIS 171) and the management fees charged by the bank (NIS 370). Please note: as a rule, banks charge significantly higher fees than investment houses for activity in securities. It is recommended and advisable to negotiate the amount of the fees and, if necessary, transfer the securities to another bank or investment house. For the purpose of the transfer, you are not required to sell the securities so that no tax event occurs.

The total fees do not include the fees you paid for buying foreign currency on the credit card (usually between 1-3% on each purchase), and these by themselves can reach thousands of shekels per year. Today, you can find various benefits on non-bank credit cards with a relatively low interest rate (about 1% ).

Let’s summarize

Now that you have gone through the entire bank ID card, you can know how much money you paid this year in fees for the services the bank offered you and in interest on the loans it provided for you. In addition, you know how much money you received for your deposits.

It is possible and recommended to negotiate on each section. Regarding the interest rates on loans and deposits, the Bank of Israel has begun to publish a monthly comparison that will allow you to see where, on average, better terms are offered, including how the terms you receive compare to the average and median in the banking system. It is also possible to call banks or other financial entities (that offer loans or securities trading services) and receive an offer. After you received a better offer, call your bank and ask to compare the terms. Do they disagree? move on A little over a year ago, the Bank of Israel launched the “Moving in a Click” system that enables a simple and automatic transfer of your bank account.