Posted Apr 5, 2023, 10:09 AMUpdated on Apr 5, 2023, 6:58 PM

France Strategy, the think tank attached to Matignon, sounded the alarm in November: macroeconomic thinking around the impacts of environmental transition in the next few years is “worryingly late”. The upheavals linked to this massive transformation, comparable in the eyes of certain experts to the shocks of the industrial revolutions, will not be without consequences for the economy. But quantifying them remains complex.

“The possible effects on activity and inflation during the transition can vary significantly depending on the shocks considered”, underline experts from the Banque de France, who analyzed four major scenarios calibrated to reflect “abrupt but plausible” transitions. , in a study published on Wednesday.

Carbon tax and techno optimism

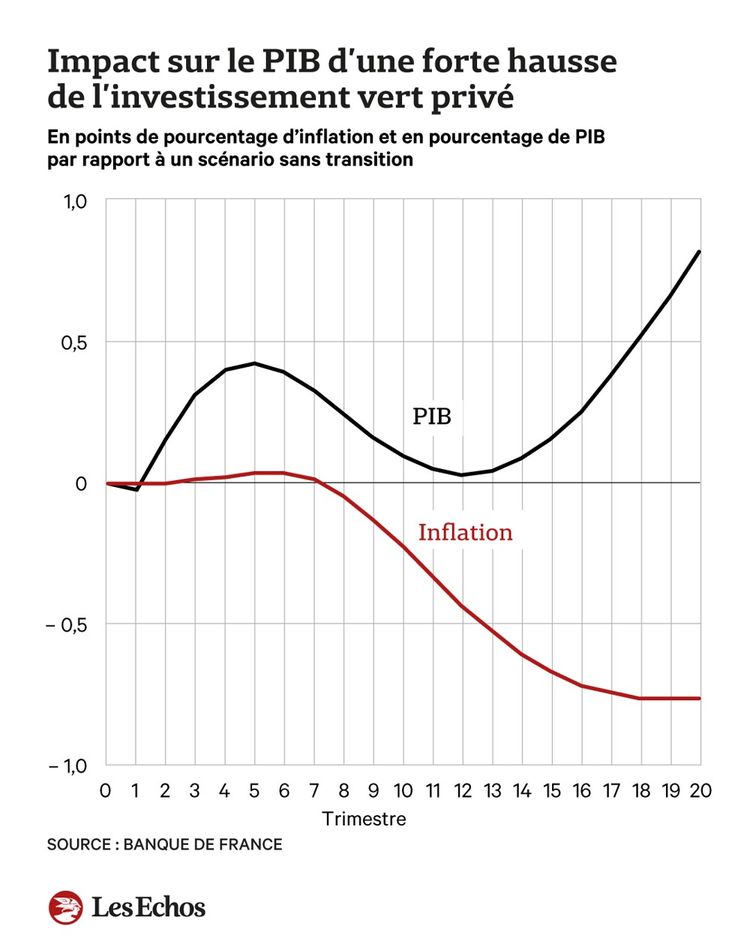

This shows very different impacts in the short and medium term, whether on economic activity or prices, depending on the transition strategies chosen (carbon pricing, subsidies in green innovations, public spending on infrastructure, etc.). .): the effects on inflation could range from -0.8 point to +0.6 percentage point after five years, and from -1.1% to +1.6% on GDP.

Source: Bank of France

A “disorderly” rise in the carbon tax, i.e. sudden and unanticipated, would lead to a rapid rise in inflation linked to the rise in energy prices (up to 1.75 percentage points per year , and 0.6 points after five years). Initially, the effect on growth would be neutral, but it would become negative after two years, leading to a drop in GDP of around 1.2% after five years, say the authors.

On the other hand, a “techno optimistic” scenario where we bet – very uncertainly – that technical progress will spread throughout the economy, with a sharp increase in private investment to the detriment of the consumption of households, would be disinflationary and expansionary: French GDP would be 0.8% higher after five years and inflation would be 0.8 percentage point lower (year-on-year).

A transition that would take place thanks to a sharp increase in public green investment would have a more favorable impact on activity, with GDP that could reach +1.6% five years later. But the first year would have to go through strong inflation, which would rise to 1.75 percentage points, before falling.

In a last scenario, the study insists on the fact that the longer the uncertainty on the transition policies would last, the more the downward pressures on prices and GDP would last. With, at the end of the day, a “certain” volatility.

The truth will probably lie somewhere in the middle of these big typical scenarios. But, whatever the case, “the best thing is to quickly put in place orderly transition policies, which are announced in advance, credible and ambitious with economic agents. The impacts on growth or inflation will be less abrupt because the changes can be anticipated,” explains Stéphane Dées, head of the climate economics unit at the Banque de France and co-author of the study. “The earlier we start, the less costly the transition will be from a macroeconomic point of view,” he sums up.

He points out that “the risks of price volatility would also be reduced, thus avoiding a much less favorable situation for monetary policy”.