The year 2021 has been a dream come true for savers. The low interest rates and high liquidity in the markets that the central banks flowed painted the stock markets in most of the world a bright green.

Read more in Calcalist:

The TA-125 and TA-35 stock indices climbed 31% and 32%, respectively, and both reached new highs. In the US, the S&P 500 and Nasdaq were up 27% and more than 21% respectively and set new highs as well. Accordingly, the study funds in the general track, whose exposure to equities ranges from 45% to 55%, recorded double-digit returns throughout 2021.

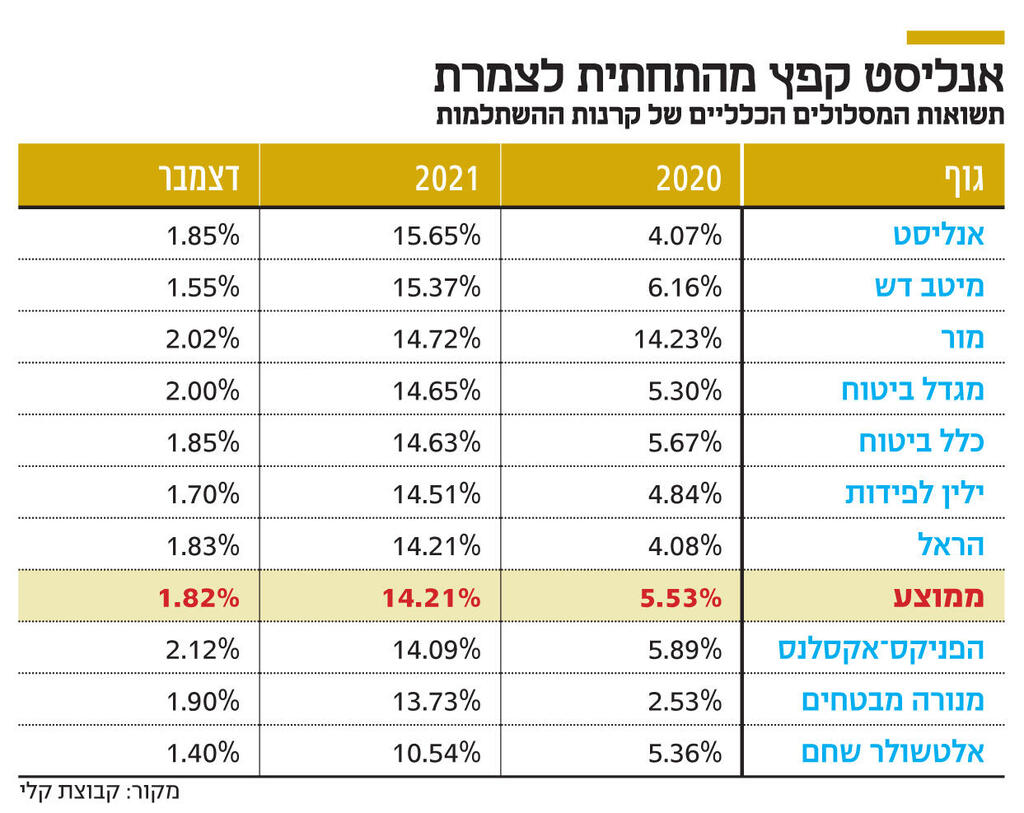

According to the first indications of the Kelly Group, the average return of study funds in 2021 was 14.3%, almost three times the average return of 5.5% recorded in 2020, the year in which the corona broke and led to a sharp drop in indices. Accordingly, the study fund market grew by 18% in the past year to NIS 314 billion, compared with a growth of 4.6% in 2020.

2 View the gallery

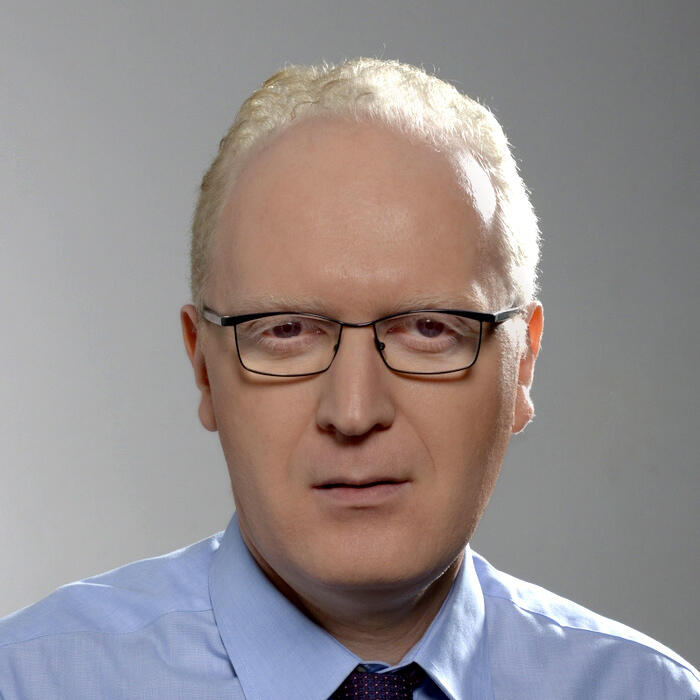

The outstanding fund of 2021 belongs to the analyst with a return of 15.65%. The fund, managed by Noam Rokach, is relatively small and manages about NIS 4 billion with overexposure to shares (almost 55%) compared to competitors. According to Kelly, the fund recorded a return of 1.85% in December, an average return on the general track, but its excellence in October and June gave it the top spot, after the fund shuffled to the bottom of 2020, and one of the leaders in 2020, the Altshuler Shaham fund, finished 2021 at the bottom. The table.

“According to Rokach, increasing the fund’s exposure last year to the income-producing real estate sector, with shares such as Big, Melisron and Azrieli, led to an excess return compared to the market.” pharmacist.

2 View the gallery

Noam Rokach. Manages the Outstanding Training Fund of 2021

( Alon Porat)

In overseas markets, we held the share of Invidia in technology chips. All of these positions rose by tens of percent throughout 2021. In general, we preferred “exposure to the United States” and “exposure to Europe and Asia”. Rokach adds that “although it was a great year for equities, corporate bonds also returned a handsome return following the expectation of a rise in inflation. “We define the bond yield at home as the ‘oil can miracle’, because unlike stocks, no one predicted or hoped that this particular component would yield a return of up to 10% per year.”

What was your miss this year?

“Asia’s shortfall yield surprised us. We increased some exposure at the beginning of the year to Asia and it did not benefit the fund. Green energy also did not work this year, the market preferred to invest in fossil energy that was significantly more affected by the crisis. “And so we are keeping exposure to it. The multipliers (FFOs) of some companies in the field today reflect a more reasonable profitability of between 3 and 4 years ahead.”

In 2020, your fund will be established in the lower third with a return of 4%. Did you change the methodology as a result?

“It’s important to look at provident fund returns over the years. I think the 2020 return was because we bought stocks a little too early, but the fruits of the move have ripened this year.”

2020 was also a year of new offerings in the domestic market. Did they help you increase your return?

“No. The market was characterized by an IPO of quality companies but also by those that should not have reached the market and the sharp decline in the value of some a few months after the IPO indicates this. “

What about next year?

“The return of 2021 is one-time and will not return. We believe that in 2022 the stock markets will converge to a high single-digit return. Our assumption is that the economy will continue to grow but at smaller rates. The challenge for markets is price and not economy. – This is true for stocks, for corporate bond spreads and we feel this also in the daily prices that create inflation. The challenge next year is also to raise interest rates in the market and stop the central bank’s support, this is a counter-spirit to the markets. “If the economy is reasonable and interest rate increases are measurable and inflation is controlled, the stock market will survive next year and the markets will be reasonable.”

Will you settle for a 6% return on the stock market next year?

“Yes, after such a year, 7% -6% is enough.”

Meitav Dash’s fund is the runner-up for 2021 and the most outstanding of the large funds, which manage more than NIS 7 billion. The fund, managed by Guy Manny, rose 15.37%. The projected return of the fund, which manages NIS 10.5 billion in December, is estimated at 1.55%. The fund ended 2020 with a return of 6.2%, the highest return among the large funds. Meitav Dash’s fund is biased towards the local stock market with high exposure to the shares of the banks in which Leumi, Leumi and Discount operate, and to real estate shares in which Damari operates.

In third place is the Moore Fund with a return of 14.7%. The fund, managed by Uri Keren, is at the top for the second year in a row after generating the highest return in 2020 – 14.2%. As a result, Moore became the largest fundraiser in the provident fund market and its study fund grew from NIS 2 billion to NIS 6 billion.

2021 was not the year for Altshuler Shaham, the investment house with the largest continuing education fund, with assets close to NIS 70 billion. The Altshuler Shaham fund ended 2021 with a return of 10.5%, a very high return in ordinary years, but disappointing compared to an average annual return of more than 14% in the industry. The relatively low return on the Altshuler Shaham fund, which closes the yield table, made it the fund with the highest negative mobility (the transfer of savers from one company to another). The company also lost the top of the table with a return for three years, after holding this title for a long time, and has now lost it to Meitav Dash’s continuing education fund.

The fund’s shortfall was mainly due to Altshuler Shaham’s exposure to the Chinese market in general and to giant Chinese companies such as Alibaba and Tenest in particular, in the first three quarters of the year. The Chinese stock market posted a negative return this year following difficulties the Chinese government has inflicted on the country’s major technology companies to weaken their power. In recent months, Altshuler Shaham has changed his view regarding technology companies, while also eliminating his investment in Alibaba and moving mainly to investing in general indices in the Eastern markets.

.