A decade after the Hodak Committee ended its activities, the Capital Market Authority is examining the provision of relief to institutional entities with regard to investing in tradable bonds, while changing the rules established following the Hodak Committee’s conclusions. This emerges from remarks made by the Commissioner of the Capital Market, Moshe Barkat, as part of the Fair Equity Forum at Reichman University. The headline of last week’s meeting was “Recommendations of the Hodak Committee – Rethinking on the Decade of Their Implementation.”

Read more in Calcalist:

During the discussion, in which Barkat participated, the head of the forum, CPA Shlomi, once again asked the commissioner of the capital market whether in his opinion the rules set as a result of the Hodak committee should be eased. Barkat replied: “Yes. We want to examine where there are things that are interfering with the market, release and let the market work. “

3 View the gallery

Moshe Barkat

(Photo: Shatterstock, Amit Shaal)

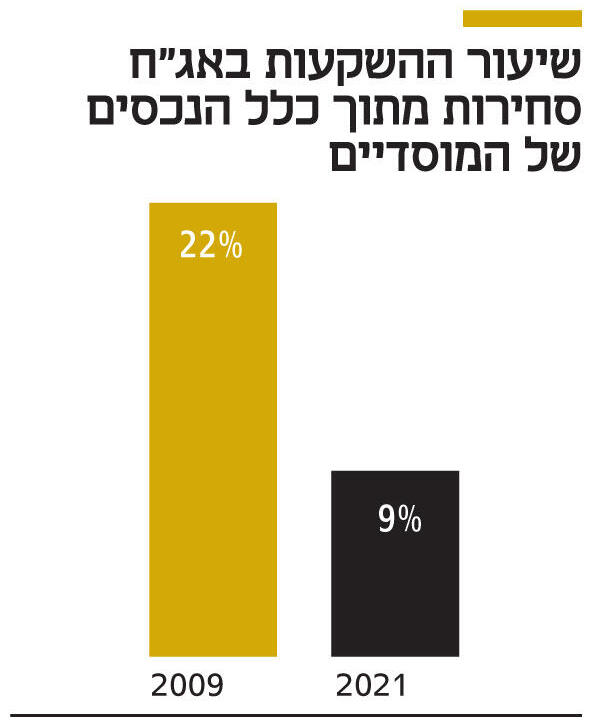

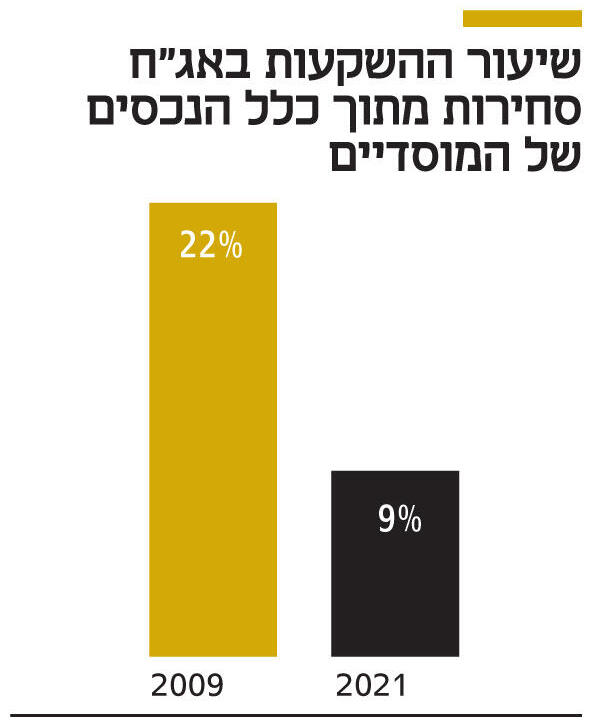

The committee, headed by David Hodak, one of the top lawyers in the field of economic law, was appointed in 2009 by the Ministry of Finance. The background to its establishment was the global financial crisis, which also hit the institutional bodies in Israel very hard, because their exposure to tradable bonds was 22% of all assets. In-depth the company data, while making purchases by filling out forms blindly.

The committee’s recommendations, which sought to improve credit granting procedures, referred to the determination of many contractual and legal terms (covenants) and orderly financial criteria for the series of bonds issued, for the purpose of assessing their quality and controlling the issuing company. Simultaneously with the increase in the supervision of investment in corporate bonds by the institutional investors, significant costs were also added to the institutional entities when they came to invest in the bonds.

Barkat’s move to re-examine these conclusions – and decide whether to change some of them – comes against the background of a study conducted by the Authority in collaboration with the Bank of Israel. The people in charge of the study were Itai Kedmi from the Bank of Israel and Guy Lakan from the Capital Market Authority.

The study showed that following the implementation of the Hodak Committee’s recommendation, the institutional entities changed the preference for their investments in corporate debt. In the decade since the committee submitted its conclusions, the rate of investment in debt to companies has hovered around 9% of the total assets of the institutional assets, and their mix of investments has changed substantially.

The rate of investment in marketable debt of all debt fell to 50% of all credit given to companies, while the rate of exposure to private debt tripled and reached a similar (and even slightly higher) rate to that of tradable debt. This one, which pushed the institutions to prefer non-tradable bonds – an area in which they were not required to the same resolution that required them to invest in tradable bonds.

3 View the gallery

Adv. David Hodak

(Photo: Uriel Cohen)

A study by the Bank of Israel and the Capital Market Authority determined that the lack of incentive among investors to make investments in the tradable debt market, which is characterized by a large number of investors, is the reason for reducing investments in corporate bonds. However, they only partially benefit from its benefit. Therefore, the institutional body prefers to invest in a non-negotiable debt – the private lending channel – in which it enjoys exclusively and fully from all the monitoring activities it performs.

Whoever opposes the repeal or change in regulation based on the Hodak committee’s conclusions is Hodak himself: “, And that the investment methodology they have helped institutionalize to develop is also applied in the non-negotiable market.”

Some of the institutions also oppose the abolition of the conditions for investing in bonds, determined by the Hodak Committee. Erez Migdali, acting director of the investment division at Migdal Insurance, told Calcalist that The terms of the note for investors. In addition, the legal and financial conditions provide lenders with tools in the event of a deterioration in the corporation’s business.

3 View the gallery

Asked if it is worthwhile to draw Hodak’s conclusions on the world of private debt as well, Migdal answered: “Much of the world of private loans is made up of project financing, which requires us to examine characteristics different from those recommended by the committee, suitable for negotiable debt. “In the analysis of a company, the rating or leverage of the bonds is important. In projects, the coverage ratios, the flows that the project has or the concession period are especially important.”

This is not the first time that the Capital Market Authority is considering revoking or changing the conclusions of the Hodak Committee. In March 2020, with the eruption of the corona, Barkat ordered to freeze for three months the Hodak stipulations. At that time, tens of billions of shekels in redemptions were recorded in the mutual fund industry, which forced the bond fund managers to sell the bond holdings in the fund. Therefore, the Authority allowed institutional investors to purchase corporate bonds, which do not include all “sting conditions” – an exemption from a complete sting analysis in writing if not valid, and instead an economic analysis, in order to minimize the negative consequences on savers’ portfolios. Institutional facilitators will be able to permanently replace the Hodak analysis, which includes the legal rights promised to the institutional body, with economic analysis only.

The temporary freeze on terms was tightened at the start of the corona crisis and has, in effect, equated institutional investment terms with those of mutual fund managers. The latter are not subject to strict conditions, mainly due to the fact that the funds are under the supervision of the Securities Authority and not under the Capital Market Authority.

Hodak, for his part, believes that a decade after the founding of his committee’s conclusions on the institutional ones, the time has come to apply them to mutual fund managers as well and put an end to regulatory gaps. Barkat claimed that “a regulator is like a shoemaker. Just as every problem with a shoemaker is solved with a nail, with the regulator every problem is solved with another regulation. So I really think we, as regulators, sometimes need to know how to let go, let the market work, and when there are problems “.

.