| Rafi Gozlan, Chief Economist, IBI Investment House

- * While the markets embody a near-US interest rate hike, the signal of a near-term contraction has taken them by surprise. The liquidity factor played a crucial role in the positive trend in the financial markets and therefore reducing the balance sheet will be a significant challenge for risk assets.

- * The rise in yields in the US bond market was led by real yields, and in our estimation the upward adjustment in the real interest rate environment is expected to continue until the moderation in the inflation environment.

- * Some improvement in the supply chain may gradually moderate commodity inflation, but the inflationary pressures from the U.S. services and labor markets, which appear to be close to full employment, remain high.

The signal of a near-reduction in the balance sheet caught the markets by surprise

The optimism that characterized the beginning of the first trading week of 2022 and was also supported by the continued flow of funds to equity mutual funds, was quickly replaced by sharp declines in the leading stock indices after the December US interest rate decision was announced. Rapid yields in the bond market, which stood out more in real interest rates.

The rise in bond market yields was accompanied by an increase in expectations of about 1% at the end of 2022, and hovered around 20-25 bps in nominal yields in the medium and long term and of 30-35 bp in real yields. The rise in yields led to sharp declines in growth and real estate stocks Compared to increases in cyclical stocks with an emphasis on energy and finance. This response of the cyclical industries reflects an assessment, which is not trivial, according to which the transition to monetary restraint will lead to a moderation in inflation but will not be accompanied by a significant slowdown in activity.

In our opinion, the Fed will find it difficult to lead to such an outcome, since the high inflation environment, with a slow response from the supply side and rising wages, pushes it to adopt a policy to slow down demand in order to moderate inflation.

An improved situation relative to the previous rate hike cycle will lead to faster restraint in the US

The background to the discussion that emerged from the interest rate protocol included a positive real picture, an improvement in the labor market, inflationary pressures on the part of demand and the supply chain (which are expected to continue in the coming year, albeit with less intensity) and favorable financial conditions. In terms of the labor market, some members see the labor market as very tight in light of the rapid rise in wages, and think that the labor market is in full employment.

This estimate was strengthened by the December employment report, published over the weekend, and indicated a decline of less than 4% (the Fed estimates that this is a long-term equilibrium level) and a rapid rise in wages. In terms, inflation was significantly higher than previous estimates. Most members expect a moderation in 2022 and 2023, compared to the one recorded in the past year, but they have all raised inflation forecasts, especially in 2022, when the risk of inflation is upward.

The main surprise factor in the protocol was mainly the understanding that the Fed is going for a faster monetary reduction, which includes raising interest rates in combination with reducing the balance sheet. While the estimate for a faster rate of interest rate hikes should not have come as a surprise, since theDOTS We have been significantly updated upwards, it seems that the main surprise was the expectation of a transition to a faster reduction of the balance sheet. The discussion on the route of monetary policy focused on policy normalization, on ways to reduce expansion, including reference to the scope of the balance sheet in the long run. The comparison between the balance sheet reduction move and the recent interest rate hike cycle reflected a diagnosis that the current situation is characterized by a stronger economy and higher inflation, and therefore supports faster monetary contraction (interest rate and balance sheet).

The set of factors leads to the fact that almost all members believe that it is appropriate to start reducing the balance sheet after the first interest rate increase, in contrast to the last cycle in which the balance sheet was reduced only after about two years from the date of the first interest rate increase. In addition, some members felt that it was appropriate to raise interest rates earlier or at a faster pace, and to start reducing the balance sheet shortly after the first interest rate hike. Given the current pricing in the markets, which embodies a first rate hike as early as next March, the balance sheet reduction could begin during the second quarter. Thus, the liquidity factor, which played a major role in the prolonged positive trend in the financial markets, is expected to undergo a significant change in the direction of restraint, to the point where there will be a significant decline in the inflation environment.

The liquidity factor played a crucial role in the positive trend, so reducing the balance sheet will challenge risk assets.

The negative reaction of the markets to the “hawkish” message from the protocol is understandable given the past experience of reducing purchases and in particular the reduction of the balance sheet.

The cessation of bond purchases at the end of 2014 and the reduction of the balance sheet and the increase in interest rates in 2017-2018 challenged the markets, even if not immediately, although they were carried out very gradually spread over several years. Commodity prices and the strengthening trend of the dollar In 2017, the global economy enjoyed a synchronized improvement and expectations of an aggressive reduction in the Trump administration’s taxes, factors that provided a boost to risk assets despite the restraining policy. , A development that marked the end of the interest rate hike cycle.

Today, given that inflation is significantly higher than in the last cycle, and in the background the labor market is approaching full employment, the restraint is expected to be faster and to tighten financial conditions, strengthen the dollar and lower commodity prices.

Fed interest and balance sheet and S&P 500 index

In terms of the bond market, the emphasis is on a long process of adjusting the real interest rate upwards, when it comes from low negative levels (the graph shows the linked interest rates TIPS 2-5-10-30), i.e. a significant upward adjustment is expected. In the past week, there has been a rapid increase in real yields, of about 20 bp in the short term and 30-35 bp in the medium and long term, and this trend is expected to continue until there are clear signs of a moderation in the inflation environment.

As for nominal interest rates, yields are expected to rise with an emphasis on the short-to-medium sections while the curve continues to flatten. Today, the market is pricing a high probability that the Fed will launch the interest rate hike cycle in March and raise the interest rate to around 1% by the end of the year. The route of raising the interest rate embodies an expected cumulative increase to an environment of 2% -1.75%. The degree of increase in the nominal interest rate will be determined by the degree of deterioration in financial conditions, when in contrast to the previous restraint cycle, the rate of decline in the inflation environment, but because it is at high levels (actual + expectations), a delay can lead to complicated markets And deterioration in financial conditions.

Moderate impact of the omicron so far on the macro environment and financial markets

The spread of the omicron in the world continues at an accelerated pace and the weekly verified average has crossed the 2 million mark. Most of the increase is still in Europe, but the US is closing gaps quickly and recently it seems that India and Australia are also entering the cycle of rapid spread. The morbidity is relatively high.

In addition, developments in South Africa are encouraging, as after a rapid spread under the influence of the omicron from mid-November, the morbidity wave has declined since the peak in mid-December, so if this pattern characterizes the rest of the world, the current wave is expected to peak towards the end of January.

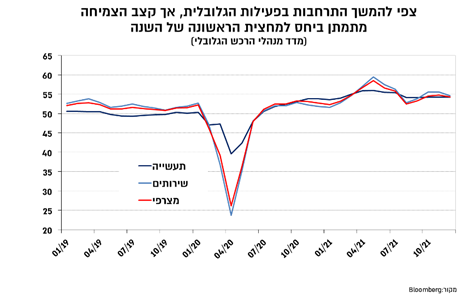

In terms of the macro environment, the Global Purchasing Managers’ Index for December indicated a slight decline compared to November (54.3 vs. 54.8), and generally continues to reflect continued expansion in activity but at moderate rates than those recorded in the first half of 2021. In addition, Relatively limited, with among the leading countries a more significant injury was recorded in the services industries in Germany, which also dragged its overall index to levels slightly below 50.

Global Purchasing Managers’ Index

In China, on the other hand, there has been a slight recovery in both the official purchasing managers’ index and in and it seems that the effect of the credit restraint taken at the beginning of 2021 has reached its peak, hence a certain improvement is expected in the near future. However, it will be recalled that the more significant test continues to be around tackling a change in China’s growth model while attempting a challenging “soft landing” of the real estate market.

Looking to the coming year, a more moderate growth environment is likely to be expected (unless the administration returns to it, ie will reactivate to a significant inflow of credit), given the negative impact of declining real estate investment and a negative wealth effect on private consumption. .

Some improvement in the supply chain may moderate commodity inflation, but pressure from the services and labor markets remains high

In the US, there was a decline in the indices in manufacturing and services in December, but their level continues to be high, so that the services index is above 60 while in manufacturing slightly below 60. These levels reflect high growth from the trend, and are consistent with expectations of accelerating growth in the last quarter of 2021 However, the trend emerging from the narrowing gap between new and full orders in manufacturing industries reflects an expectation of a gradual moderation in the growth rate of these industries in the coming months.

The indications of the degree of disruption in the supply chain and price pressures were mixed, but with a tendency to moderate the degree of pressures, especially in industry. Thus, as the following graphs show, the components of delivery times in the manufacturing and services indices, which are an indication of the supply chain situation, fell sharply in December. Although the current level still reflects longer-than-usual delivery times, there has been an improvement over the situation over the past year, particularly in manufacturing, and similar indications have also been received from the Global Purchasing Managers’ Index.

In terms of price components, there was a sharp decline in manufacturing, a development that strengthens the assessment of a moderation in the rate of inflation of industrial products over the coming year. In contrast, the price component in the services industries remained around peak levels, indicating a change in the inflation mix, ie expecting a higher contribution from services inflation than from commodities. Inflation in the services industries is more affected by the acceleration in wages, and may be more prolonged, hence further support for a rapid reduction in monetary expansion.

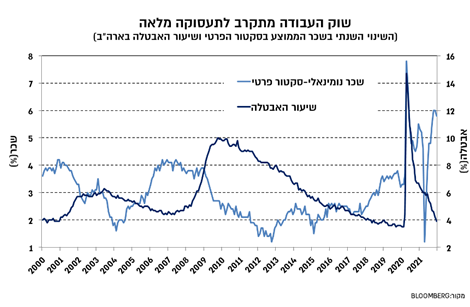

This was also reinforced by the employment data for December in the United States. Although in November the increase in employed persons was lower than expected (199,000 compared to the expected 400,000), the data for October-November were updated upwards by about 140,000 employed persons. Unemployment continued to decline at a rapid pace in December, reaching 3.9%, compared with 4.2% in November and 4.6% in October. The decline in the unemployment rate in December placed it slightly lower than the Fed’s equilibrium forecast (4%) and from the end of 2022 to 3.5%, meaning that the unemployment rate fell in December to the term perceived as full employment. When in the background a significantly higher inflation environment than the target, a clear mix is obtained that signals toFED Switch to rapid monetary reduction.

The annual change in the average wage in the private sector and the unemployment rate in the US

The authors of the article and the Israel Stock Exchange and Investment Services Company – IBI Ltd. (“Stock Exchange Services”) do not have an investment marketing license and are not insured with the insurance required of license holders in accordance with the Law Regulating the Investment in Investment Consulting, Investment Marketing and Portfolio Management. 1995. At the time of publication of the article Stock Exchange Services and the authors of the article have a personal interest in its subject arising from their holdings in the securities mentioned in the review or the existence of business relationships with the companies mentioned. It will be clarified that the aforesaid in the review does not constitute a substitute for investment marketing that takes into account the data and the special needs of each person.