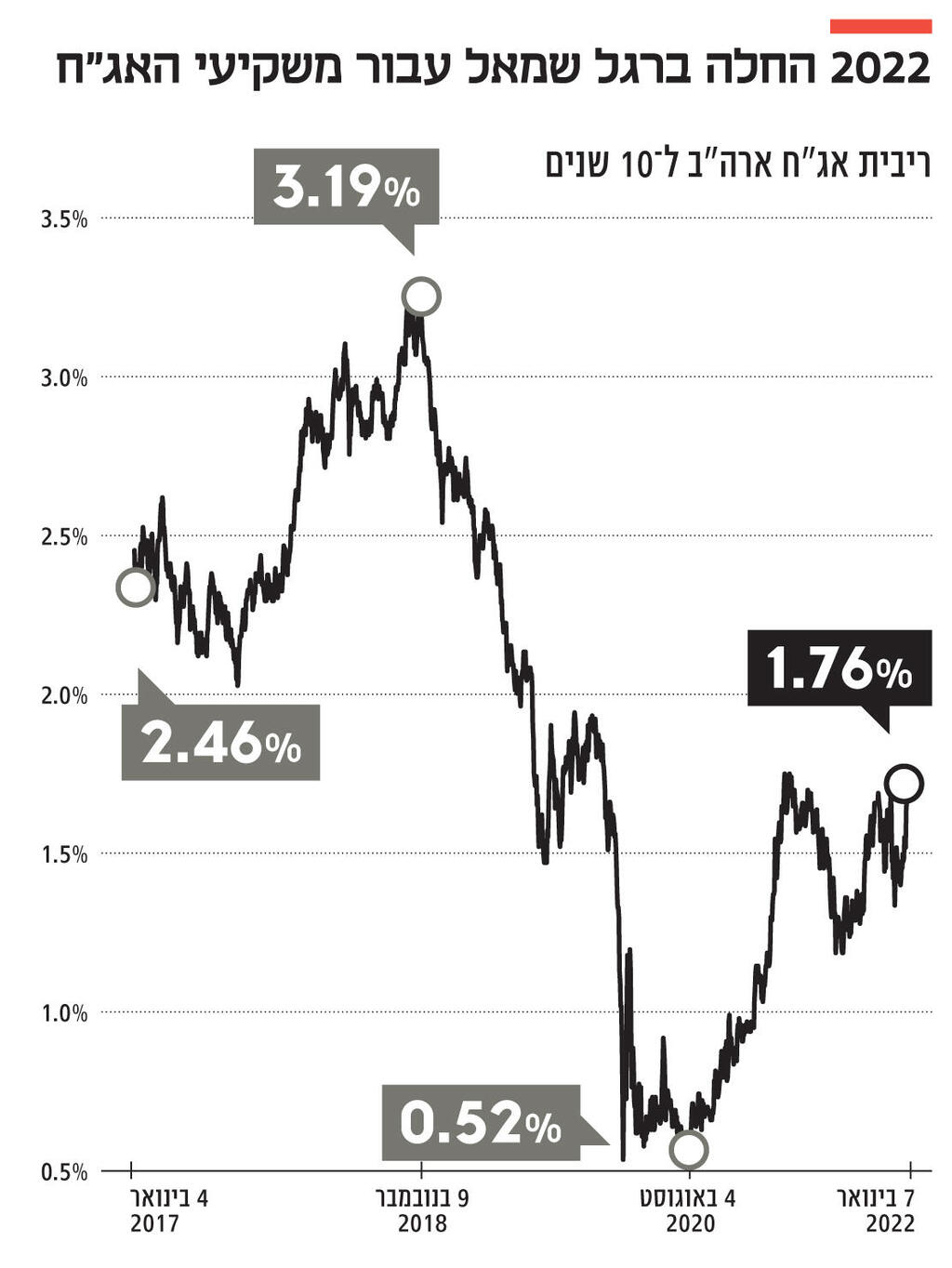

The year 2022 began on the left foot for investors in the US bond market. The 10-year US government bond yields jumped by 25 basis points, to a level of 1.75% within a few trading days. This rise in yields came amid clear signals from the Fed (Federal Reserve) that the reduction in quantitative easing will accelerate and US interest rates will rise faster than forecast and start rising as early as next March.

Read more in Calcalist:

The Fed, which for a long time saw the high-inflation environment in the U.S. as something temporary, recently updated a version in its reference to the inflation environment so that U.S. government bond prices made the adjustments to the current Fed spirit. The U.S. labor market reflects the warming of the U.S. economy, while the U.S. wage rate, which has stood at about 4.7 percent over the past 12 months, is the best available predictor of future price pressures – and this has also been internalized by the Fed.

2 View the gallery

Yields on U.S. government bonds are a major indicator of pricing of financial assets in the U.S. and abroad. Indeed, the rise in yields has led to the opening of a red year in the U.S. stock market. U.S. technology stocks are the biggest victims of the change in the debt yield environment, given the sensitivity of growth companies’ valuations to the long-term interest rate.

On the other hand, these were the value stocks that have performed better recently, leading the shares of the energy sector and the shares of the financial sector, which are better positioned than their sectoral counterparts in a rising interest rate environment. The Israeli bond market, which in the past reacted strongly and correlated to a sharp rise in the US debt market, reacted very moderately in relation to the relatively sharp rise in US yields, with most domestic and corporate bond indices showing price stability from the beginning. This year.

This response of the domestic debt market is first and foremost an outgrowth of the monetary horizon in Israel, compared to the monetary horizon reflected in the US: while in the US inflation over the past 12 months amounted to 6.8%, then in Israel inflation in this period amounted to a combined 2.4 %.

The bond market in Israel, which in the past responded in a high correlation to the sharp rise in yields in the US debt market, reacted very moderately in relation to the current sharp rise

Given the gaps in the inflation environment between the two economies, then the pressure on the Bank of Israel to start a smaller monetary tightening, and the local bond market understands this well. Opening a positive interest rate gap between the dollar interest rate and the shekel interest rate will also serve the Bank of Israel in the foreign exchange arena, so that for the Bank of Israel it is convenient for the Fed to tighten and it will probably be able to wait with monetary tightening.

The Israeli stock market is also relatively resistant to the negative trend imported from the US, also due to the assessment of some local investors that the Fed’s monetary challenge is expected to have a minor impact on the local interest rate environment in 2022. A high presence of bank shares and real estate shares supports the overperformance of the Israeli ratio relative to its counterpart in the United States, given the interest rate path mentioned here.

The weight of the 7 largest technology stocks in the Nasdaq index and the S&P 500 index stands at about 52% and 27%, respectively, and therefore any downward pricing of these stocks shocks these indices, while the indices on the Tel Aviv Stock Exchange depend much less on paper performance. Individual value and therefore also less vulnerable to realization in the technology sector, which includes in Israel mainly small companies.

In addition, in the last month and a half, there has been an increase in trading volumes on the Tel Aviv Stock Exchange. This increase is, among other things, an expression of the current relative advantage of local indices.

The resilience of the Israeli capital market relative to its US counterpart does not indicate the immunity of local investment channels to the scenario of a sharp rise in US government debt yields, and is a derivative of Israel’s monetary and fiscal conditions in the foreseeable future.

If US government debt yields continue to soar sharply, then it is likely that downward pricing of the domestic debt and bond market will occur, as investing in financial assets is first and foremost a derivative of an alternative in the risk-to-equity equation. Moreover, if the inflation environment and / or inflation expectations in the Israeli economy continue to climb, ie, actual inflation will be higher than the inflation expectations inherent in the market and stand at about 2.7% for the various ranges, then the Central Bank of Israel may change the monetary tone from June to hawkish tone And here lies a considerable risk.

2 View the gallery

Jerome Powell, Chairman of the Federal Reserve. The Fed updated a version in its response to the inflation environment

(Photo: AFP)

However, it is not wise to have experience, so it is important to mention that in the corresponding quarter last year we saw a peak of about 80 basis points in the US government bond yields to 1.74%, which brought significant capital losses, but later this year yields Where they descended relatively quickly. Therefore, it is proposed to be patient in such events and not to act recklessly based on an interpretation of a discrete economic figure. The rise in yields last year indicates that the pressure on the global bond market because of the long-term debt of the US government may continue in the short term and may even exacerbate.

However, should a sales panic arise, arising from a sharp rise in yields in the US debt market, it is worth remembering that experience shows that the potential rise in yields at present is relatively limited. Unusual in the world of zero long-term interest rates in Europe and Japan, and therefore these investors are expected to take advantage of the sharp declines in US government debt prices in order to increase position.

In addition, the corona is still circulating among us and is expected to have significant effects on real activity in the US and around the world. Inflation.

The author is a senior vice president and director of the trading, derivatives and indices department at the Tel Aviv Stock Exchange

.