2024-04-10 00:16:13

[창간 104주년]

[신성장엔진 아시아 뉴7]〈4〉 SK becomes Singapore’s resource hub

Grinding electronic waste, extracting battery raw materials… Diversification of the supply chain of materials procured from China

‘Resource circulation’ collaboration with global automobile companies

Singapore, FTA with US… subsidy benefits

Competition between Korea, China and Japan heats up over ‘urban mining’

“Do you see the black powder pouring out over there? It contains rare metals used as battery raw materials. That’s why we call this factory an ‘urban mine.’”

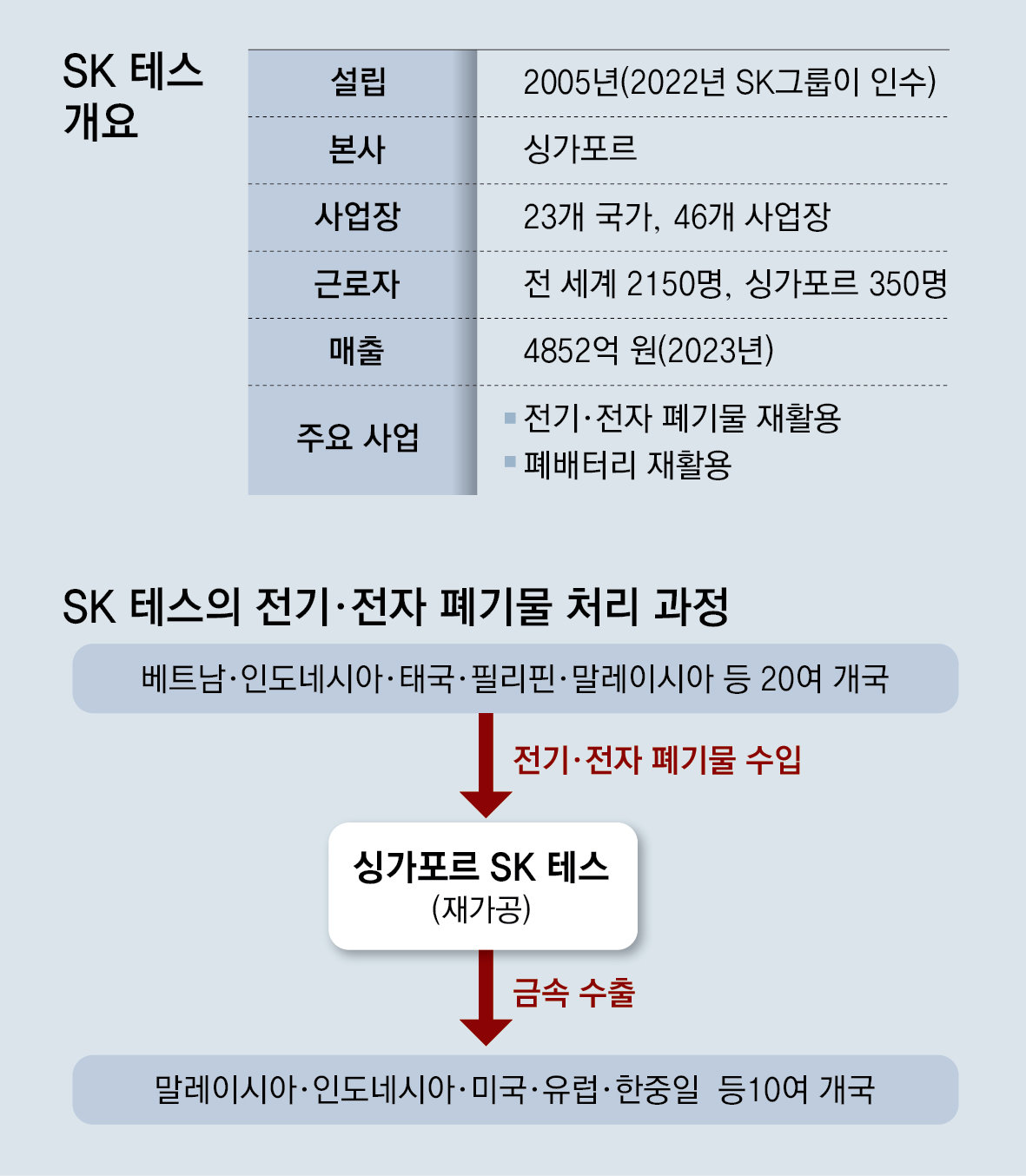

On the 26th of last month (local time), the factory of SK TES, a company specializing in electrical and electronic waste recycling, located in western Singapore. Oh Jong-hoon, Chief Strategy Officer (CSO, Vice President) said this while pointing to the black powder pouring out through the pipe. This powder is ground electrical and electronic waste called ‘E-Waste’. SK TES was mining minerals such as battery raw materials in the city.

● “Reduce resource dependence on China”

When SK Group acquired TES in 2022, it paid attention to the fact that e-waste, which is just waste if left alone, can create infinite value if processed. Presidence Research, a market research firm, predicted that the e-waste processing market will grow from $73 billion (about 98 trillion won) in 2024 to $241 billion in 2032.

The need to diversify the battery material supply chain also influenced the acquisition of TES. Korean battery companies, including SK On, are procuring a significant portion of the key raw materials for secondary batteries, such as lithium, cobalt, and graphite, from China. Graphite’s dependence on China is about 90%. In this structure, if China weaponizes resources and controls exports, it will inevitably suffer an immediate blow.

Vice President Oh said, “The metals obtained from SK TES are supplied to battery material companies that are cooperating with SK On. It is still in the early stages, so the supply is not large, but as the SK TES plant operates more, the proportion of self-procured metals will increase.” He said.

Another advantage is that Singapore, where TES is located, is a country that has signed a free trade agreement (FTA) with the United States. In accordance with the U.S. Inflation Reduction Act (IRA), minerals made in Singapore, an FTA partner country, can receive various subsidies if they are used in American electric vehicles.

Recently, SK TES signed contracts to receive orders for waste batteries from Volvo Cars and other famous automobile companies in China, Japan, and Germany. In the future, we plan to enter into contracts with automakers to provide rare metals. SK TES said, “There is a trend among global automakers to simultaneously process waste batteries and recover rare metals in order to secure resources stably,” and added, “Having such a resource circulation ecosystem can reduce battery manufacturing costs.”

● ‘Business-friendly’ Singapore government

TES currently operates 46 factories in 23 countries. SK TES is using the Port of Singapore, which handled the second largest volume of cargo among ports in the world last year, as the axle of the wheel. Overseas TES factories in the Philippines and Thailand are collecting e-waste and sending it to Singapore. The Singapore government is reducing the cost burden on companies by not imposing taxes on imported and exported waste. On the other hand, Korea imposes a tariff of 5-9% of the import value on imported waste.

Vice President Oh said, “The Singapore Economic Development Board (EDB), which is in charge of attracting foreign investment, has designated a civil servant in charge of TES. “If you are having trouble securing manpower, the person in charge immediately reviews related support and policies and provides practical help,” he said. “We even have public officials create groups of businesspeople of the same industry to interact with them.” “We also bring about new investments through meetings,” he said.

To operate an e-waste processing business, a ‘Basel Permit’ is required. The Basel Permit is an international permit required to receive batteries and electrical/electronic waste from other countries. In Asia, the only countries eligible to receive the Basel permit are Singapore, Korea, and Japan. Since TES was originally a Singaporean company, it has currently secured Basel permits from about 30 countries.

● Competition in urban mining between Korea, China and Japan is heating up

Last month, a Japanese businessman visited SK Test. He asked, “Can we cooperate in urban mining?” In Japan, the government is directly securing urban mines and fostering e-waste processing companies. Japan’s Ministry of the Environment recently planned to double metal resources recovered through urban mining by 2030. The public and private sectors are negotiating to receive waste from Southeast Asian countries, and in that regard, SK TES has also been approached for cooperation.

In Korea, some small and medium-sized enterprises engaged in the waste disposal business are interested in urban mining. Because it is still in its early stages, the domestic market is not large, but waste disposal companies are expanding the market by signing business agreements with domestic battery companies.

The situation in China is complicated. There are several waste recycling companies in China and they are large in scale. However, China does not meet the Basel permit requirements, so electrical and electronic waste cannot be imported from outside China. There is a limitation in that only waste within China can be processed.

Kim Hee-young, a researcher at the Korea International Trade Association, said, “Korea is ahead in waste battery recycling technology. “By stably securing raw materials from overseas and systematically establishing a waste battery recycling system, a sustainable battery industry value chain will be created in terms of the resource supply chain,” he said.

Singapore = Reporter Byeon Jong-guk [email protected]

2024-04-10 00:16:13