2024-05-10 00:07:30

98.9% in the first quarter… Decreased by 2.6% in one year

“High interest rate burden – result of strengthening government management”

There are concerns that it will rise again when the real estate market rebounds… “DSR regulations, etc. must be lowered to the 80% level.”

Corporate debt is 1.2 times GDP… 4th place

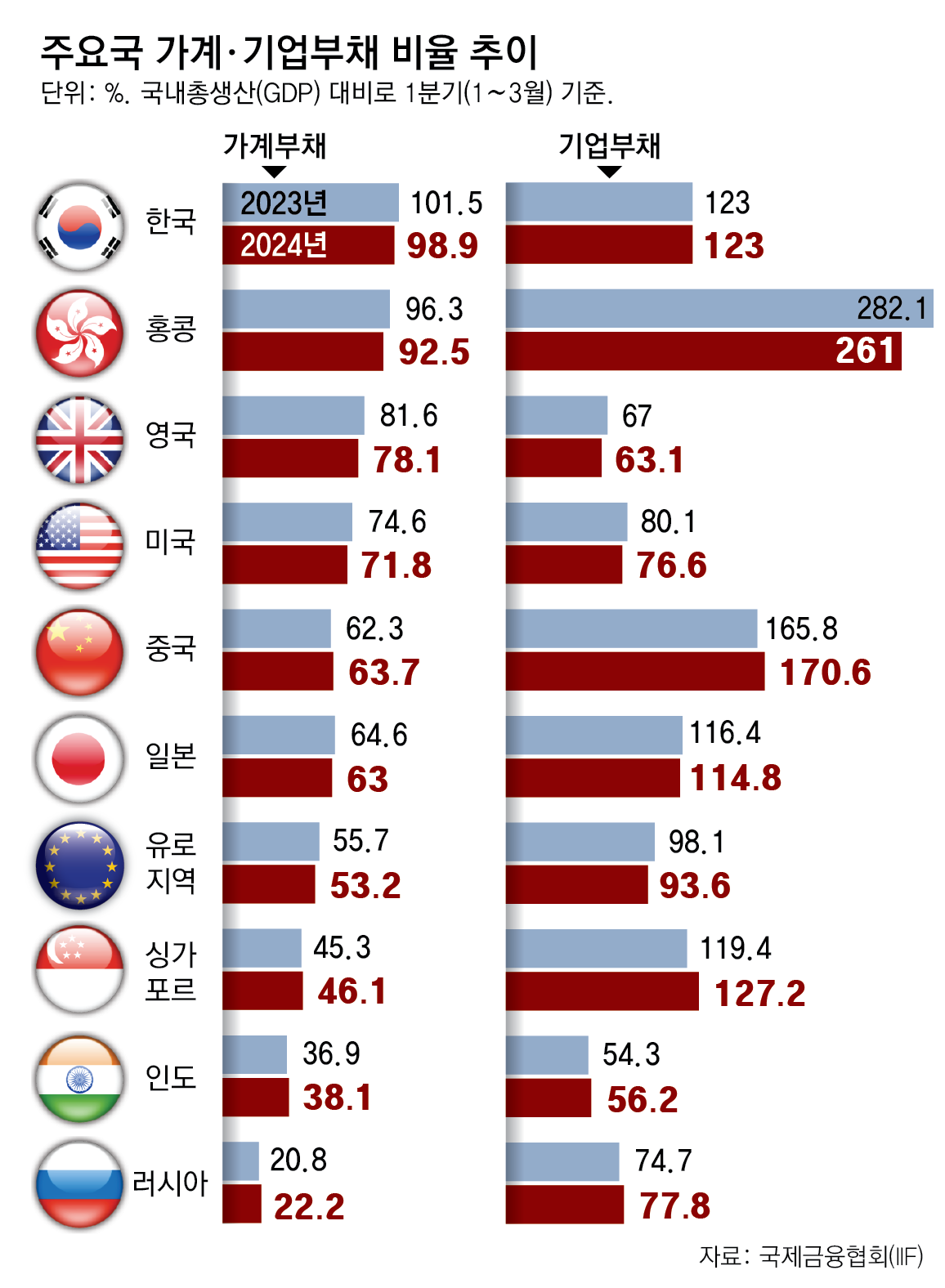

《Korea household debt, ranked 1st among 34 major countries

Although Korea’s household debt to gross domestic product (GDP) ratio fell below 100% in the first quarter of this year (January to March), it was still the highest among the 34 major countries in the world counted by the International Finance Institute (IIF). Although the household debt ratio is falling due to the high interest rate trend, delayed real estate economic recovery, and the government’s policy of tightening household loans, it has maintained its position as the ‘world’s largest household debt country’ for four years since 2020. The corporate debt ratio was 123.0%, the fourth highest among 34 countries, following Hong Kong, China, and Singapore. While domestic demand recovery is slow, there are concerns that the interest burden due to high interest rates could hinder companies if future export performance does not support it. 》

In the first quarter of this year (January to March), Korea’s household debt became smaller than its gross domestic product (GDP) for the first time in three and a half years, but it has still not been able to rid itself of the stigma of being the ‘world’s largest household debt country’. The corporate debt ratio also exceeded 1.2 times GDP, making it the fourth highest among major countries in the world. Some point out that if the real estate market picks up, the household debt ratio may rise again, so we need to take additional measures to manage household debt.

● World’s largest household debt country for 4 years

According to the latest report on Global Debt by the Institute of International Finance (IIF) on the 9th, Korea’s household debt-to-GDP ratio in the first quarter of this year was 98.9%. After exceeding 100% in the third quarter of 2020 (July to September, 100.5%), it fell to the 90% range for the first time in three and a half years. It is 6.6 percentage points lower than the first quarter of 2022 (105.5%), when the household debt ratio was the highest, and 2.6 percentage points lower than a year ago (101.5%). Among the 34 countries surveyed (single statistics for the euro area), this is the fourth largest decline following Hong Kong (-3.8 percentage points), the UK (-3.5 percentage points), and the United States (-2.8 percentage points).

This is interpreted as the result of the government’s strengthening of household loan management in a situation where the interest burden is increasing due to the high interest rate environment and the real estate economy is recovering slowly. In August last year, Bank of Korea Governor Lee Chang-yong said, “If the household debt-to-GDP ratio exceeds 80%, it may restrict economic growth or financial stability,” and added, “The ratio currently exceeding 100% will be gradually lowered from 90% to 80%. “That is the goal,” he said. As of now, the assessment is that the first goal has been achieved.

However, the household debt ratio itself was still the highest among the countries surveyed. The household debt ratio has remained at the highest level in the world for four years already since 2020, when the novel coronavirus infection (COVID-19) began to spread in earnest. Kim Sang-bong, professor of economics at Hansung University, said, “The largest part of Korea’s household debt is real estate loans, and if the real estate economy rebounds in the future, the household debt ratio may rise again at any time.” He added, “To lower the ratio to the 80% range, the total debt service ratio (DSR) ) He pointed out, “We will need to implement additional household debt management measures, such as strengthening regulations.”

● “High corporate debt ratio may return as a boomerang”

Unlike household debt, corporate debt is growing unabated. As of the first quarter of this year, the ratio of non-financial corporate debt to GDP in Korea was 123.0%, the same as a year ago. There were only three countries with higher debt ratios than Korea: Hong Kong (261%), China (170.6%), and Singapore (127.2%).

The problem is that as the high interest rate trend continues, companies’ interest burden is increasing and domestic demand recovery is slow. The average corporate loan delinquency rate of Korea’s five largest banks (KB Kookmin, Shinhan, Woori, Hana, and NH Nonghyup) jumped 0.05 percentage points in one year from 0.28% in the first quarter of last year to 0.33% in the first quarter of this year. Compared to the household loan delinquency rate that rose 0.04 percentage points from 0.25% to 0.29% over the same period, the rate of delinquency in corporate loans is faster than that in household loans. Depending on the economic situation, corporate loan defaults may increase further.

Seok Byeong-hoon, a professor of economics at Ewha Womans University, said, “The recovery of semiconductors is clear, but the performance of companies’ expansion of investment through loans will be determined by the export performance of automobiles and secondary batteries, which are continuing to slump.” “If we do this, the high corporate debt ratio could come back as a boomerang,” he pointed out.

Reporter Jeong Soon-gu [email protected]

-

- great

- 0dog

-

- I’m so sad

- 0dog

-

- I’m angry

- 0dog

-

- I recommend it

- dog

Hot news now

2024-05-10 00:07:30