2024-06-03 18:46:36

Because the President’s Workplace proposed the abolition of the excellent actual property tax, tax authorities additionally started a full-fledged evaluate. It’s identified that the federal government is wanting into numerous reform plans, reminiscent of reducing the heavy complete actual property tax price for multi-homeowners with three or extra homes.

In accordance with the federal government on the 2nd, the Ministry of Technique and Finance has begun an inside evaluate concerning complete actual property tax. The President’s Workplace introduced on the thirty first of final month that it will take into account abolishing the excellent actual property tax fascinating. An official from the Ministry of Technique and Finance mentioned, “We’re contemplating numerous measures beneath the route of easing the excellent actual property tax burden.”

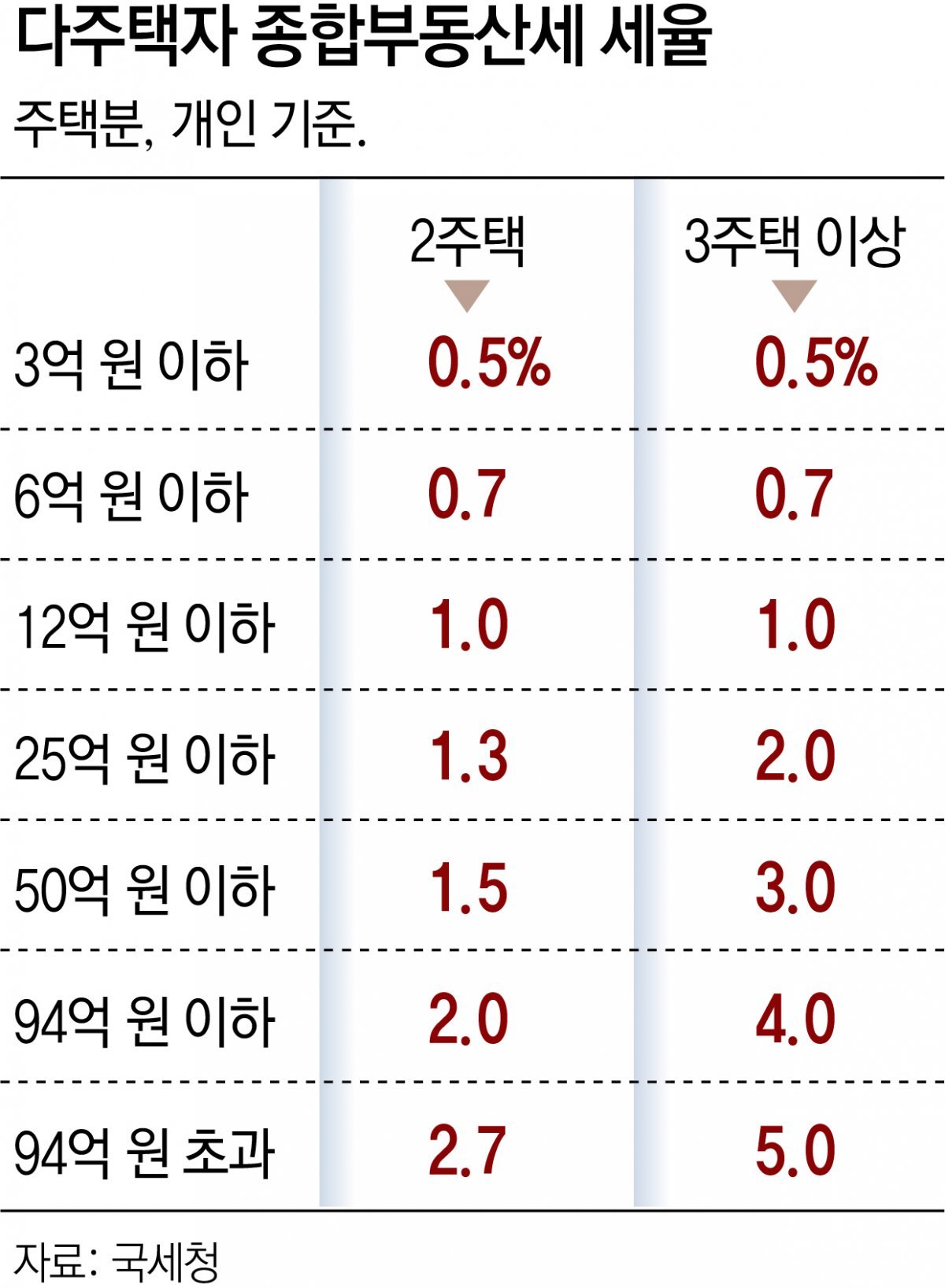

It’s reported that the federal government is contemplating abolishing the heavy tax price for a number of owners, which is a ‘punitive taxation system’. The federal government started reforming the tax system to remove the heavy tax price for individuals who personal two or extra houses in 2022, however solely the heavy tax price for individuals who personal two houses was abolished throughout discussions within the Nationwide Meeting. Presently, a heavy tax price of as much as 5.0% is utilized to those that personal three houses. The intention is to place an finish to the normalization of punitive taxation that was pursued within the first yr of the federal government’s launch by permitting those that personal three houses to use the overall tax price (0.5-2.7%). There’s a cautious ambiance concerning the abolition of complete actual property tax for single-home house owners. It’s because there are considerations that the concentrate on the so-called ‘good one’ might turn into extra extreme. The Ministry of Technique and Finance mentioned, “At current, nothing has been determined concerning the excellent actual property tax reform plan.”

Authorities considers 2.7% normal tax price as a substitute of as much as 5% tax on ‘multi-home complete actual property tax’

Begin of complete actual property tax reform

Considerations over skyrocketing housing costs in ‘Sensible Hanae’… Be cautious concerning the abolition of complete actual property tax for single owners

Challenges reminiscent of burden of extra tax cuts amid tax income shortfall

“Proper now isn’t the time to debate”

As the federal government’s considerations deepen because it evaluations plans to reform the excellent actual property tax, there are speculations each inside and out of doors the federal government that it’ll start a phased reform. In an effort to go the Nationwide Meeting, the cooperation of the Democratic Celebration of Korea, which has 171 seats, is crucial, and there are lots of points to contemplate, reminiscent of controversy over equity and lack of tax income. Inside the Democratic Celebration, there may be additionally a cautious opinion raised concerning the dialogue of complete actual property tax reform, saying, “Now isn’t the time.”

●Abolition of the heavy tax price for a number of owners, which resurfaced after two years

In accordance with the related ministries, the Ministry of Technique and Finance is alleged to be cautious concerning the ‘abolition of complete actual property tax for single owners’. It’s because there are considerations that the focus towards high-priced flats, so-called ‘good flats’, might intensify, pushing up housing costs in sure most popular areas reminiscent of Gangnam, Seoul. An official from the Ministry of Technique and Finance mentioned, “There are numerous sensible points that should be addressed.”

There may be additionally a excessive risk that fairness with multi-homeowners who personal a number of comparatively low-cost houses might be controversial. Presently, if you happen to personal three homes price 500 million gained, you might be topic to a most tax price of two.0%, however if you happen to personal just one home price 2 billion gained, the utmost tax price is just one.3%. An official from the Ministry of Technique and Finance defined, “If the tax burden of those that personal a home price greater than 2 billion gained is lowered, even when they’re a single home-owner, the dissatisfaction of those that personal a number of homes with low costs might enhance.”

The discount in taxes if complete actual property tax is eradicated can also be a burden. Your complete complete actual property tax is transferred to native governments as a ‘actual property grant’ in accordance with the Native Allocation Tax Act. It’s inevitable that there might be requests from native governments to compensate for the dwindling actual property grants. This yr, the emergency gentle has already been turned on for tax income. Taxes collected by way of April this yr decreased by 8.4 trillion gained in comparison with a yr in the past. Even when extra taxes have been collected from Could to December than final yr, it will be 31.6 trillion gained wanting the federal government’s estimate (335.7 trillion gained).

For that reason, there are predictions that the federal government might transfer ahead with the entire abolition of the heavy tax price for a number of owners, which was introduced two years in the past. The federal government promoted a plan to remove all heavy complete actual property tax charges for a number of residence house owners within the 2022 tax reform, however solely the heavy tax price for double residence house owners was abolished throughout the Nationwide Meeting dialogue. In response to opposition from the opposition celebration, which mentioned it was ‘encouraging actual property hypothesis,’ an settlement was reached to keep up the heavy tax price for three-home house owners. Nonetheless, the best tax price for three-home house owners was lowered by 1 proportion level to five.0%, and the heavy tax price was utilized solely to these exceeding the tax base of 1.2 billion gained.

●No: “Proper now isn’t the time to debate complete actual property tax.”

The Democratic Celebration targeted on mitigation moderately than abolition. Park Chan-dae, flooring chief of the Democratic Celebration, who advised the abolition of complete actual property tax for one-home house owners, mentioned on this present day, “A system known as complete actual property tax is critical,” and “There’s a have to ease the tax just for one home per family and precise residence.” He added, “I’m not suggesting that we ease it unconditionally,” and “however it’s proper to maneuver within the route of relieving the burden on the folks.”

Park Seong-joon, senior vice-president of the Nationwide Meeting, additionally mentioned, “Complete actual property tax ought to in the end be eased, not abolished,” and added, “Discussing complete actual property tax isn’t a precedence proper now, and there are too many pending points, such because the Particular Prosecution Act, so it’s tough to debate complete actual property tax instantly.” Ground spokesperson Kang Yu-jeong additionally mentioned, “Proper now isn’t the time to debate complete actual property tax.” It’s interpreted that this displays considerations that coverage management might be handed over if one rapidly responds to the reorganization dialogue.

Some level out that supplementary measures ought to be ready to handle the growing variety of aged individuals who should pay complete actual property tax though they haven’t any revenue. Woo Seok-jin, a professor of economics at Myongji College, mentioned, “In the end, easing complete actual property tax is the best route, however there isn’t a concern about the best way to remedy the issue of taxation for the aged who solely personal one home and haven’t any revenue proper now.”

Sejong = Reporter Lee Ho [email protected]

Reporter Yoo Chae-yeon [email protected]

-

- nice

- 0canine

-

- I am so unhappy

- 0canine

-

- I am indignant

- 0canine

-

- I like to recommend it

- canine

Sizzling information now

2024-06-03 18:46:36