2024-06-24 22:28:32

FSC registers development of insured individuals and internet belongings in obligatory funds managed by “POD DallBogg: Life and Well being”

Just lately, the Monetary Supervision Fee printed the ultimate knowledge on the supplementary pension insurance coverage exercise for the primary quarter of 2024. The outcomes monitor the state and growth of the pension funds and the return on investments, clearly outlining the tempo of growth of this necessary sector within the Bulgarian economic system.

For the primary reporting interval – within the final two years, the youngest pension insurance coverage firm “POD DallBogg: Life and Well being” EAD achieved a 5.58% return in his Skilled Pension Fund (graph 1). The interval covers the extreme results of the Covid disaster in addition to the devastating power disaster, together with two main wars, all of which impacted international product and monetary markets. Excessive inflation and excessive lending charges additionally affected inventory markets all over the world in numerous methods. The volatility of the markets brought about uncertainty amongst traders, resulting in vital volatility within the costs of funding devices, and even indices such because the S&P 500, NASDAQ and Dow Jones skilled giant fluctuations. In response to rising inflation, rates of interest have risen, which largely stay at excessive ranges all over the world, and lots of traders have shifted their capital from shares to lower-risk belongings.

In opposition to the background of those upheavals, the PPF “DallBogg: Life and Well being” not solely managed to get well after the tough 2022, but in addition in the top of 2023 to carry a yield of 9.49 p.c on the person batches of its prospects. For the interval 31.03.2022 – 29.03.2024 the fund outperforms all different occupational pension funds by way of profitability, exceeding by 1.09% the utmost calculated by the FSC for these 24 months. Thus, the youngest PPF within the nation has put aside a reserve that can function a future assure for the insured individuals – this brings extra safety for his or her pension investments.

Within the interval 2022-2023, worry, panic and irrational choices have been main, and solely probably the most far-sighted and courageous managed to beat them in time and reap the fruits of their perception and arduous work. “UNDER DallBogg: Life and Well being” invested efforts and assets to adapt in time to the altering financial and geopolitical parameters. By means of versatile and skilled administration, the corporate supplied extra advantages to its insured individuals.

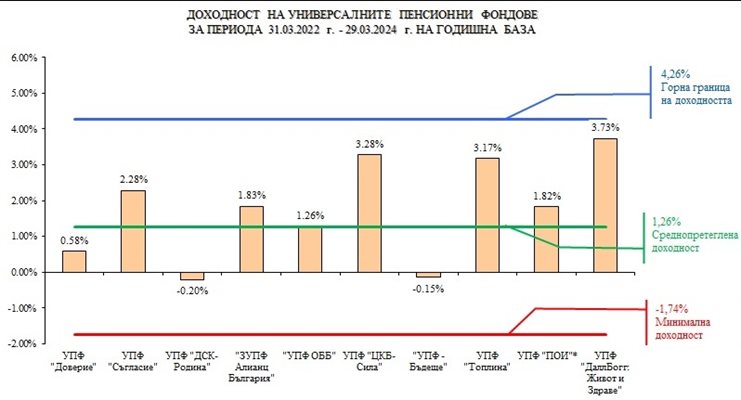

Monetary specialists take word the success of the Common Pension Fund “DallBogg: Life and Well being”, which for 2023 achieved an enviable yield and introduced a rise within the funds of its shoppers’ heaps within the quantity of 10.08%. For the interval 31.03.2022 – 29.03.2024, it achieved a yield of three.73% and ranked forward of all different common funds (graph 2).

For the required 24-month interval, the common fund managed by “POD DallBogg: Life and Well being” not solely overcame the volatility of the monetary markets, but in addition, by way of an satisfactory technique and skilled strategy, managed to outperform the opposite 9 funds of the identical kind (some with achievements under the weighted common yield, and others – even detrimental).

In accordance with the FCS knowledge, when evaluating the outcomes of the exercise on extra obligatory pension insurance coverage for the primary quarter of 2024 in comparison with the top of 2023, the expansion charge of the 2 obligatory funds (PPF and UPF) managed by “POD DallBogg: Life and Well being”, is quick and vital, which is a crucial indicator each for measuring the event of an organization and for the will of the insured individuals for change. For instance, the variety of shoppers and the quantity of internet belongings within the PPF “DallBogg: Life and Well being” will increase month-to-month, and on the finish of March 2024 the fund reported a rise of 17.80% (at 0.44% on common for interval for all skilled funds), respectively 15.57% (with a mean of three.66%) in comparison with the values on the finish of 2023. These achievements considerably exceed the outcomes of the opposite 9 occupational pension funds, whereas a few of them even noticed a decline within the variety of insured individuals.

Within the first three months of 2024, the variety of insured individuals within the DallBogg: Life and Well being UPF elevated by 14.99% (in comparison with a mean of 0.58% for all common funds through the interval), and internet belongings elevated by 15, 21% (on common 4.72%). Inside only one quarter, this development is indicative of excessive objectives, to this point adopted by anticipated outcomes. And that is not all. The info printed by the Monetary Supervisory Service for the earlier yr are additionally attention-grabbing, and upon cautious examination, it’s discovered that in all quarters of 2023, PPF “DallBogg: Life and Well being” and UPF “DallBogg: Life and Well being” are shifting up on each indicators – variety of insured individuals and internet belongings. In a single calendar yr, shoppers within the skilled fund have elevated by over 240% in comparison with December 2022, which is 120 occasions the common change for all skilled funds for 2023. On the finish of 2023, the web belongings of PPF DallBogg : Life and Well being” marked a rise of greater than 250% in comparison with the top of 2022, which is greater than 16 occasions above the common dynamics for the interval of the identical funds.

The achievements of the UPF “DallBogg: Life and Well being” in 2023, in comparison with the top of 2022, are additionally forward of all different common funds, and the numbers communicate for themselves: the dynamics of the variety of insured individuals within the fund is expressed in a rise of 115%, which is greater than 56 occasions the common change for all common funds, and the change in internet belongings is near 100%, i.e. virtually 5 occasions greater than the common development for the interval of funds of the identical kind.

The ahead and upward growth is clearly the primary objective of “POD DallBogg: Life and Well being” for the reason that begin of its supplementary pension insurance coverage exercise. The outstanding efficiency of the obligatory PPF and UPF of the corporate previously yr 2023, within the first quarter of 2024, in addition to for the previous two-year interval (31.03.2022 – 29.03.2024) clearly outlined the necessity for an alternative choice to the pension insurance coverage market, which the youngest pension insurance coverage firm supplied Bulgarians.

Developments all over the world and in our nation present that extra voluntary pension insurance coverage is changing into an more and more well-liked option to make investments. Anybody who needs to obtain skilled service and have their funds managed by a motivated staff with intensive expertise within the monetary discipline can contact the specialists right here.

_________________________Special Reserve __________________________

The indicated outcomes don’t have any relation to future outcomes and optimistic returns will not be assured. For the PPF “DallBogg: Life and Well being” it’s not assured that the funds contributed within the particular person heaps shall be stored in full.

Significance of indicators for achieved profitability and stage of funding danger

Nominal yield – that is the yield achieved when managing a fund’s belongings. It’s calculated because the distinction between the worth of 1 fund unit legitimate on the final working day of the related yr and the worth of 1 fund unit legitimate on the final working day of the earlier yr divided by the worth of 1 unit legitimate on the final working day of the earlier yr.

Customary deviation – is a statistical measure of the dispersion of the values of a random variable round its arithmetic imply or anticipated worth. The usual deviation is accepted as one of many foremost indicators for measuring the chance of the funding portfolio.

Coefficient of Sharpe – an indicator that compares the yield achieved from the administration of an funding portfolio and the chance taken to attain this yield.

The methodology used to calculate the yield and funding danger is in line with Appendix No. 15 of Regulation No. 61 of 27.09.2018 of the Monetary Supervisory Service.

You’ll be able to familiarize your self with the indications of achieved profitability, the extent of funding danger, the calculation methodology and the funding coverage of the fund at www.dallbogg.bg in Investments/Return and Threat.

A comparability with the information mirrored above may be made on the web site of the Fee for Monetary Supervision https://www.fsc.bg/panel Insurance coverage exercise/ Statistics/ Statistics and analyses/ 2023 and 2024