[조영광의 빅데이터 부동산] ‘Real demand market’ formed as real demanders move into new homes

As global interest rates move, the real estate transaction volume is also unusual. However, unsold properties are at an all-time high and the government has begun to tighten household debt, causing the housing market to fall into chaos. At times like these, we should not be swayed by groundless rumors, but rather listen to the signals of real estate big data accumulated over 10 years. Based on real estate big data, we looked for answers to issues that will lead the real estate market in the future.

August National Rising Transaction Share 47%

Q1. Is the recent rebound in housing prices a temporary phenomenon?

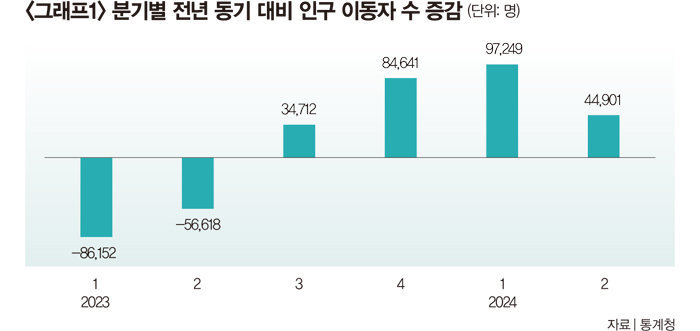

The proportion of rising transactions and population movement can tell us whether the recent real estate uptrend is temporary or a trend. Rather than simply looking at the increase and decrease in transaction volume, compare the proportion of rising transactions with the proportion of falling transactions to find the answer. If the proportion of falling transactions is high even though the transaction volume has increased, this means that only quick sales transactions are being made, and that further declines are awaiting. In the month of August, the proportion of rising transactions was 47% of the actual transactions nationwide, the proportion of flat transactions was 13%, and the proportion of falling transactions was 40%, indicating that rising transactions are gradually increasing. In other words, the market cycle has bottomed out and is entering a recovery phase. In addition, if the transaction volume increases without population movement, this means that the proportion of investment-oriented transactions, not real demand, is high, which is evidence that vague expectations of an increase are inflating the ‘bubble’. The real estate market in 2006 was like this. Population movement was minimal, but the transaction volume exploded due to expectations of an increase, and the metropolitan real estate market fell into a long-term recession when it was hit by the global financial crisis in 2008. So what is it like now? The number of people moving nationwide stopped declining year-on-year as of the second quarter of last year, and has been rising since the third quarter of last year, and has been rising for four consecutive quarters now (see Graph 1). In other words, the current housing transaction is a ‘real demand market’ that occurs as real demanders move their residences. Both ‘ratio of upward transactions’ and ‘population movement’, the two data that distinguish a trending increase, prove that the current upward trend is a trending increase.

Supply and demand stabilization expected due to licensing cliff

Q2. Will the unsold inventory, which is about four times the low point in 2021, decrease?

The number of unsold apartments nationwide in July was 71,822. Normally, when the number of unsold apartments nationwide exceeds 60,000, it can be considered that the first round of subscriptions for all apartment complexes has ended and the boom period has ended. After that, when the number of unsold apartments increases further and exceeds 80,000, almost all apartment complexes will fall short of subscriptions, and it can be said that a recession has begun when unsold apartments rapidly increase after completion. The 70,000 unsold apartments, which are between the 60,000 units that graduated from the boom period and the 80,000 units that entered the recession period, are neither boom nor recession, but a “gray zone.” It can be said that this is a polarized situation where buyers only accept the subscription prices of apartments in good locations and with good supply and demand. In fact, if we look at the subscription market in the first half of this year, the subscription price ceiling system subscription complexes in Seoul’s reconstruction, Gyeonggi Province’s Gwacheon, and Paju’s Unjeong New Town recorded subscription competition rates of hundreds to one. On the other hand, Incheon and local urban development projects showed a low subscription competition rate of less than 2 to 1 for the first round of applications. Whether the current unsold units of 70,000 will surpass the recession level of 80,000 depends on the supply and demand conditions in Gyeonggi, Daegu, and Gyeongbuk, where unsold units are concentrated. However, in Gyeonggi-do, unsold units in Pyeongtaek, an area where unsold units are concentrated, have turned to a downward trend, and in Daegu and Gyeongbuk, it has been over two years since construction companies stopped receiving orders due to the extreme recession, so supply and demand are expected to stabilize due to the cliff in permits. In the future, if construction companies start supplying to some areas where they can no longer delay supply, the unsold units may soar to the late 70,000s, but it is unlikely that the three major unsold areas will surpass 80,000 and enter a recession phase due to stability.

Q3. Why are housing prices not returning to a ‘good level’ despite the unprecedented number of properties for sale?

Most of the listing statistics we see in the news are provided by the real estate statistics site ‘Asil’. If the number of listings on the market is not resolved and continues to pile up, the number of listings will rapidly increase, and it is logically reasonable to judge that the market is entering a recession due to this backlog of listings. Looking at the listing statistics for sales transactions in Seoul, it has been steadily increasing since 2021, but after a brief decrease in early 2023, it has reached an all-time high this year. There are currently more than twice as many listings as in 2021. If we only look at the listing statistics, the current housing prices in Seoul should be half of those in 2021 due to oversupply. However, even with the ‘highest number of listings ever’, the price of houses in Seoul is still too expensive to purchase with earned income. The reason for this is that the listing statistics provided by the site are from August 2021. The statistics are new statistics that are less than 5 years old. Furthermore, 2021 was the most boom period in the 20-year history of the Korean real estate market, while last year was the worst recession period in the history of the Korean real estate market. The new statistics only show the hottest and coldest times in the history of the Korean real estate market. Can we use the expression ‘unprecedented’ with time series statistics of less than 5 years? It is impossible to estimate the ‘appropriate level of listings’ with unstable listing statistics that have gone through ‘unprecedented’ booms and recessions in that short period of time. Close your eyes when news about listing statistics comes out in the future. Only when 10 years’ worth of statistics are accumulated will we be able to estimate the ‘appropriate level of listings’.

Q4. Will people in their 30s and 40s, who have recently emerged as the main demand group for real estate, continue to be the main demand group in the future?

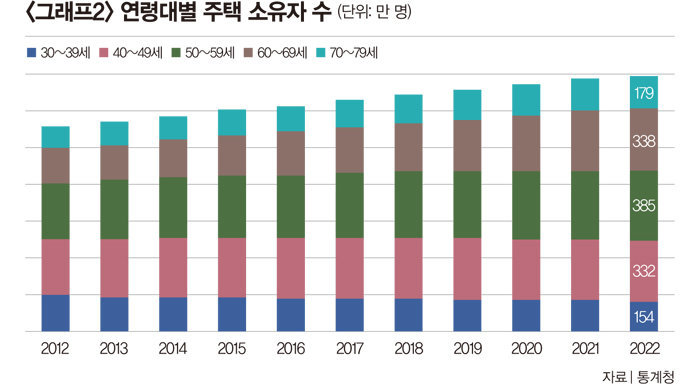

Recently, we often come across news that homebuyers in their 30s have surpassed those in their 40s, or vice versa. It is not true that the real estate market is in trouble just because people in their 30s have surpassed those in their 40s, or because people in their 40s have surpassed those in their 30s, or because people in their 30s and 40s have purchased the most real estate. So, are other age groups besides those in their 30s and 40s just sitting back from real estate? That is not true. According to Statistics Korea’s ‘2022 Housing Ownership Statistics’, the age group with the largest number of homeowners is those in their 50s, with 3.85 million homeowners (see Graph 2). Next are those in their 60s, with 3.38 million homeowners. Those in their 40s are in third place, with 3.32 million homeowners. How many homeowners in their 30s, who are often mentioned in the media as the top two buyers along with those in their 40s, own homes? It is only 1.54 million, half of those in their 40s to 60s. According to the statistics, the news that people in their 30s and 40s have emerged as the main buyers of real estate sounds strange. That’s because the Korea Real Estate Board has been publishing statistics on buyers by age since 2019.

Demand of the 3040 generation according to life cycle

The important thing here is that these are ‘buyer statistics’ and not ‘seller statistics’. As you can see from the home ownership statistics, the age group that owns the most houses is consistently those in their 50s and 60s. As they enter their 70s, the number of homeowners decreases by half, which means that they are reorganizing their assets due to retirement in their life cycle. The assets they reorganized were mainly purchased by those in their 30s and 40s. The natural ‘age pattern of selling and buying’ according to the life cycle is being distorted and reported as if some new trend has suddenly emerged simply because the statistics were released in 2019. If ‘seller statistics’ had been produced instead of ‘buyer statistics’, people would have been fooled by the comical news that “the rush to sell real estate among those in their 60s and 70s has begun.” Let’s stop giving too much meaning to age-based statistics. It’s just a natural pattern according to the life cycle.

*If you search for ‘Magazine Donga’ and ‘Twovengers’ on YouTube and portals respectively and follow them, you can find a variety of investment information, including videos in addition to articles.

〈This article Weekly Dong-A No. 1456〉 was published in

-

- great

- 0dog

-

- I’m sad

- 0dog

-

- I’m angry

- 0dog

-

- I recommend it

- dog

Hot news right now

2024-09-17 13:13:16