There are at least 5 positive cases for Bitcoin and crypto. And one that is very scary.

There are 5 stories who could prove who he is right bullish are Bitcoin and more generally on mondo crypto for the next few days and weeks. And there is also a story, just one, that could shatter the dreams of those who want to see

##There are 5 stories who could prove who he is right bullish are Bitcoin and more generally on mondo crypto for the next few days and weeks. And there is also a story, just one, that could shatter the dreams of those who always want to see the glass half full.

In this in-depth analysis, which will then be the subject of further analysis over the next week (because all the topics mentioned are hot and will be at the center of the next discussions also at the top levels). If you are considering whether to go long or short on BTC and crypto in the medium term, this is perhaps the ideal content from which to start.

What’s really at stake in the markets?

A lot. We are in fact facing a moment topical for classical financial markets, and that will end reflect also on the markets Bitcoin e crypto.

Pivot

Con pivot refers to the moment in which restrictive monetary policies are reversed. That is, when central banks they decide it’s time to get back to supporting the economy. How do they support it? By buying securities, lowering interest rates and in some cases even reducing the reserve requirement for banks (as in China). Always in Chinesewe can start (which was done this week) with more detailed programs to support the economy.

Without going into technicalities: this means a lot of money that will find its way to the markets. And when liquidity arrives on the markets, it is above all the hard asset to enjoy its benefits.

Trump or Harris, few differences

It’s true that Donald Trump it would seem to be more open to the crypto world. It’s true that Kamala Harris he tried to correct the situation in an unconvincing way so far. It is equally true, however, that neither candidate seems to have a serious plan to contain public spending and reduce debt. Several of the candidates’ plans will – in their own ways – potentially exert even more inflationary pressure.

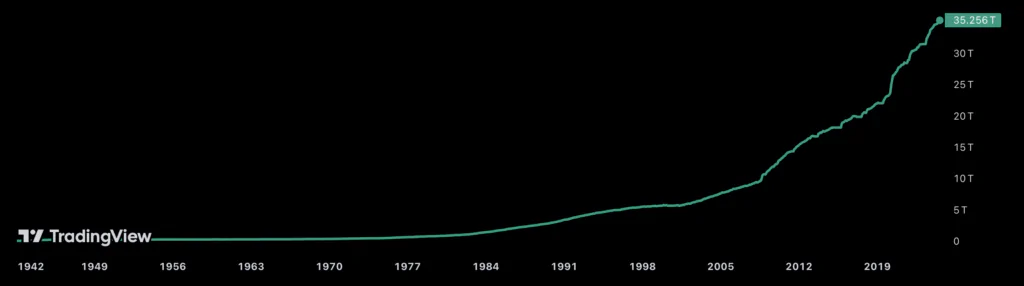

The trend of US public debt

The trend of US public debtFor a hard asset come Bitcoin it could be one of the welcome responses to the markets in a context that were to continue along the lines of the graph we attach, which is that of public debt USA.

If Athens cries, Sparta does not laugh

Someone is certainly sneering at the graph of US public debt. However, things are not much better in the second most economically significant bloc in the world. Even in Europe, there don’t seem to be many ideas for reducing public spending and stimulating growth.

Debt to GDP EU countries

Debt to GDP EU countriesThe latest plans received enthusiastic applause and called for more investments, once again public. Once again, probably to be financed by debt. And once again potentially inflationary. This context could also be interesting for Bitcoinwhich will exist at most in 21.000.000 of units and which now even large funds seem to have begun to appreciate for this characteristic.

Overall government debt trend in Europe

Overall government debt trend in EuropeThe appetite for risk

We are not just talking about the search for returns that should arrive if the percentages of easy earnings of US bonds are no longer there. We also talk about the fact that markets generally considered risky, such as those of liquidity pools in DeFi they could become much more attractive again in the market context that could arrive in the coming weeks and months.

It is a factor that we have been talking about for some time and of which we remain firmly convinced.

Japan will not do harakiri

The return to normality of Japan it will be much more gradual than the markets feared. Someone will ask us why Japan should interest us – and here we have a video from a few days ago that should explain the situation.

Market concerns would appear to be greatly exaggerated, even in light of what happened today. The next Japanese prime minister will be in favor, at least in words, of a tightening of monetary conditions and a return to normality in terms of monetary policy. Between saying and doing however…

The only opposite case

The only opposite case could be that of a hard landing, i.e. a hard and long-lasting recession in the USA. Although even in such a context there would be room for Bitcoin to not fare badly, it is the only case that is now on the table to think about a return to goblin townin the underground city made up of losses and negative trends.

Time will tell who will be right. For the moment, however, there seems to be very little reason to despair.