Bank of Korea cautious about further interest rate cuts

The Bank of Korea lowered the base interest rate by 0.25% points, ending monetary tightening after three years and two months and returning to an easing stance.

On the 11th, the Bank of Korea’s Monetary Policy Committee held a meeting at the main building of the Bank of Korea in Jung-gu, Seoul and lowered the base interest rate from 3.50% to 3.25%. The monetary tightening policy that has continued since August 2021 has come to an end after 38 months. Six out of seven members of the Monetary Policy Committee agreed to lower the base interest rate, with only Monetary Policy Committee member Jang Yong-seong expressing the minority opinion of freezing the interest rate.

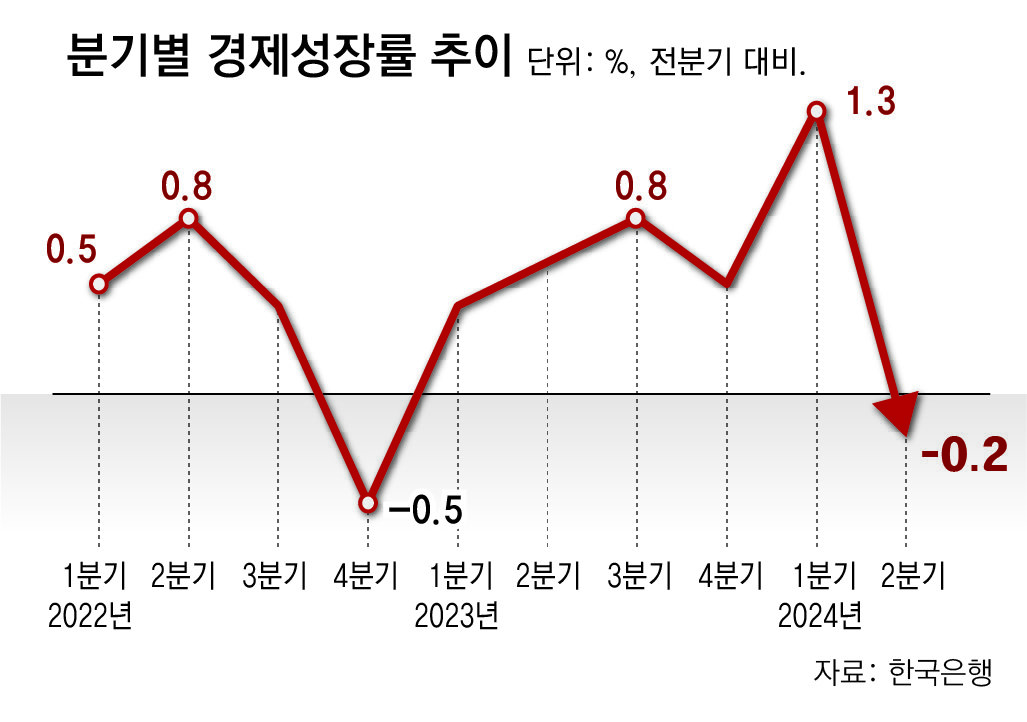

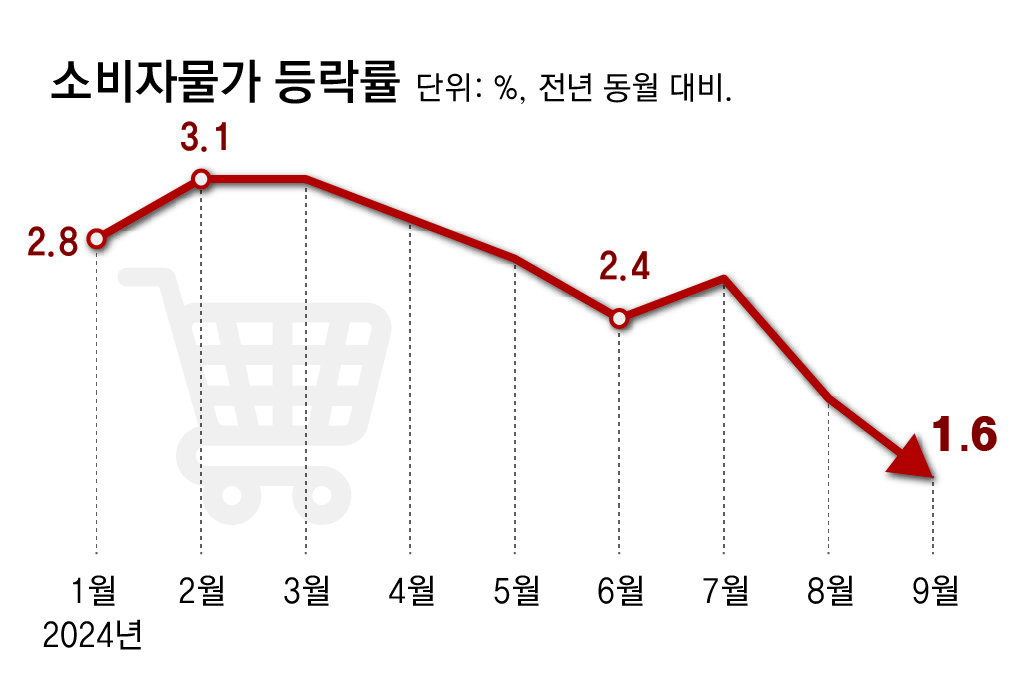

The reason why the Bank of Korea, which had been hesitant to cut interest rates due to concerns about overheating housing prices in the metropolitan area, finally implemented a pivot (change in direction of monetary policy) is interpreted as the need for economic stimulus increasing due to the severe slump in domestic demand caused by prolonged high interest rates. Concerns about an economic recession are serious, with the Korean economy showing a negative growth rate of 0.2% in the second quarter of this year (April to June). At a press conference after the Monetary Policy Committee, Governor Lee Chang-yong explained the reason for the interest rate cut, saying, “As uncertainty in the growth outlook increases, the need to ease austerity has increased.” Last month, the U.S. Federal Reserve implemented a big cut (lowering the base interest rate by 0.5 percentage points), which narrowed the interest rate gap between Korea and the U.S., which also gave a breather to the Bank of Korea’s monetary policy. With the end of austerity measures, low-income borrowers who suffered from high interest rates can take a breather. There are observations that warmth could spread to companies that had a heavy funding burden or frozen real estate project financing (PF) businesses.

Loan interest decreased by 6 trillion won per year due to interest rate cuts… Concerns about rising housing prices

[38개월만에 긴축 종료]

Base interest rate cut by 0.25%p amid sluggish domestic demand

In September, household loan growth decreased and calmed down… “Consumption will increase by 0.18% and facility investment will increase by 0.7%.”

Expectations for revitalization of domestic demand are growing… “It’s already been set… “It will have little effect.” Observations

The reason the Bank of Korea ended its monetary tightening stance after three years and two months and began a pivot (monetary policy shift) was due to the deepening slump in domestic demand due to prolonged high interest rates. Consumption is not picking up due to the burden of household debt, and investment is also decreasing as the number of marginal companies that cannot repay their debts even though they make money increases. In the end, the government decided to cut the benchmark interest rate before it was too late in the decision to give a breather to sluggish domestic demand by lowering the interest rate.

It is expected that the immediate interest rate cut will reduce the loan interest burden on households. According to the Korea Economic Association, it is estimated that with this cut, households’ interest burden will decrease by 2.5 trillion won per year, and corporate interest burden will decrease by 3.5 trillion won per year.

However, since expectations for an interest rate cut have already been reflected, there is also a prediction that the economic stimulus effect will not be significant if no further interest rate cuts occur. There are still concerns that housing prices will skyrocket, especially in Seoul, or household loans will rapidly increase due to the interest rate cut.

● Household and corporate interest burden expected to decrease by 6 trillion won per year

At a press conference after the Monetary Policy Committee meeting on the 11th, Bank of Korea Governor Lee Chang-yong said, “Consumption is lower than the potential growth rate and domestic demand is not improving quickly,” and “There are many classes suffering from household debt.” He pointed out that construction investment was also sluggish due to the debt problem and emphasized the inevitability of stimulating the economy through interest rate cuts.

It is interpreted that the rapid increase in housing prices in the metropolitan area, which had caused hesitation in pivoting, has calmed down and the growth in loans has calmed down somewhat, which has served as the background for the interest rate cut. According to the Financial Supervisory Service on the 11th, the increase in household loans in the financial sector in September was 5.2 trillion won, a significant decrease compared to August (9.7 trillion won).

There are expectations in the market that this interest rate cut will provide breathing room for revitalizing domestic demand, as private consumption and corporate investment have decreased due to prolonged high interest rates. Kim Miru, a researcher at the Economic Outlook Office of the Korea Development Institute (KDI), said, “If the base interest rate is lowered by 0.25 percentage points, private consumption is expected to increase by up to 0.18% after 9 months, and facility investment is expected to increase by about 0.7%.” “If interest rates are cut, the effect of domestic demand recovery will be greater,” he said.

There is also an analysis that an interest rate cut could be a relief in the drought for domestic real estate project financing (PF) businesses that have been halted due to lack of funds. The domestic real estate PF loan amount exceeds 200 trillion won, and the interest burden alone amounts to tens of trillion won per year. Due to the interest rate cut, the interest burden has decreased and the possibility of new fund inflow has increased.

● “Effectiveness unclear” analysis… Concerns about side effects such as rising housing prices

However, some experts say that although the interest rate reduction cycle has begun, it is difficult to see as great an effect as expected. Kim Young-ik, a professor of economics at Sogang University, pointed out, “The three-year treasury bond interest rate, which serves as a benchmark for market interest rates, has already been below the base rate since December of last year,” and added, “Expectations for a base interest rate cut have already been reflected in mortgage loan interest rates.” . Jeong Young-do, head of the corporate investment division at Hanyang Securities, also said, “Meaningful changes (related to PF) will only occur if an additional interest rate cut is implemented.”

Some are concerned that the Bank of Korea’s decision to cut interest rates could actually encourage real estate prices, which had calmed down. Ko Jun-seok, head professor at Yonsei University’s Sangnam Institute of Management, said, “If the base interest rate falls further, commercial banks will have no choice but to lower their lending interest rates. If the interest burden is greatly reduced, housing purchases will flock again, and housing prices in Seoul may rise significantly.”

Meanwhile, Governor Lee recently refuted the practical theory of interest rate cuts raised both inside and outside the Bank of Korea, saying, “Please evaluate after one year.” “(August), household loans increased by nearly 10 trillion won even though the base interest rate was not lowered. He also asked, “Do you really think it’s practical skills?”

Regarding the rumors of discord that arose as the government’s recent pressure to lower interest rates intensified, he said, “We have a very good relationship with the government,” and added, “It is important to cooperate well and contribute to the national economy.”