| Dr. Gil Befman, Chief Economist of Leumi, and Benyahu Bolotin, Economist in the Economics Division |

| Development of the price of oil

The price of oil rose sharply in the last week: the price of type oil rose from about 97.68 to about $ 123.54 per barrel at the end of the trading day on 3/3/2022 and the price of a type of barrel rose from about 94.09 to about $ 117.18.

This increase occurred against the background of the sanctions imposed on Russia after its invasion of Ukraine which increased the immediate fear of exacerbating the energy crisis in the European market and an increase in the excess demand for oil. This, along with the tightening of the maritime shipping market for oil, due to sanctions imposed on Russian ships used to transport oil and damage to vessels that were in the vicinity of Russia and Ukraine.

| Global supply

U.S. sanctions on Russia have raised concerns in the market about an increase in excess demand, after Asian customers who purchased Russian oil began looking for new sources of oil supply, even though sanctions imposed on Russia did not widely include the energy sector.

The diversion of demand is probably due to the lack of certainty and the fear of imposing further sanctions on Russia that may later include wider parts of the energy sector, along with the fear of supply disruptions after the sanctions imposed also included Russian shipping companies that were subsidiaries of large banks in Russia.

It is also difficult to find shipping companies willing to send vessels to the Russian region due to the fighting prevailing in the region and after a number of ships in the region were damaged by the fighting, making it even more difficult to supply Russian oil to customers. The imposition of sanctions on Russian maritime shipping companies has reduced the supply of ships to transport oil by sea and together with the increased risk in maritime shipping, which has raised the insurance premium for maritime transport, has led to an increase in the prices of maritime shipping.

In order to cope with the excess demand in the market, the US is negotiating with a number of other countries to supply 60 million barrels of oil from the emergency reservoirs.

South Korea is also considering its steps to address the expected disruptions in the country’s oil supply and may also supply oil from its strategic reservoirs in order to meet domestic demand. At the same time, it is considering diversifying its energy sources to reduce the impact of the disruptions expected to be in Russian oil supplies.

In our estimation, the supply of oil from the strategic reservoirs may have an impact only in the short term. However, if the sanctions continue over time and lead to a continuous disruption in the global energy supply, the impact of the oil supply from the reservoirs will be marginal and will not be felt over time. However, it is expected that in the medium to long term the oil output of other oil producers will increase and compensate to some extent for the lack of Russian oil in the market.

Group OPEC+ For further relief in oil production quotas which will rise in April by an additional 400,000 barrels per day. This increase in production quotas is modest and insufficient to meet the strong demands in the market. However, continued cooperation despite the geopolitical tensions and sanctions imposed on Russia, indicates the strength of the group.

Alongside this, the oil output of OPEC+ Rose in February by about 380,000 barrels per day, the strongest growth since July 2021. This, following the recovery of oil exports of, after the disruptions that were in the country due to frictions between the government and locals, along with an increase in oil production of major oil producers in the Middle East.

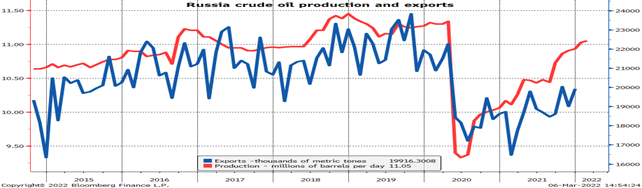

Continued internal friction in Libya, albeit at low intensity, could disrupt Libya’s oil production activity and hamper its oil production. Russia also increased its oil output in February, but according to market estimates the increase in output was less than its allowable increase as part of the easing of production quotas.

membership OPEC+ Africa is still struggling to increase its oil production capacity and is producing less than the amount allowed under production quotas.

Despite the recent rise in oil prices, it has temporarily shut down the operations of two oil fields in the south of the country that together produce about half a million barrels a day. In its estimation, it can increase output in other oil fields and thus at least partially compensate for the expected decline in oil output.

At the same time, oil producers in Canada’s sands are also shutting down some plants’ operations in favor of maintenance work, which could exacerbate excess demand in the short term and support high oil prices.

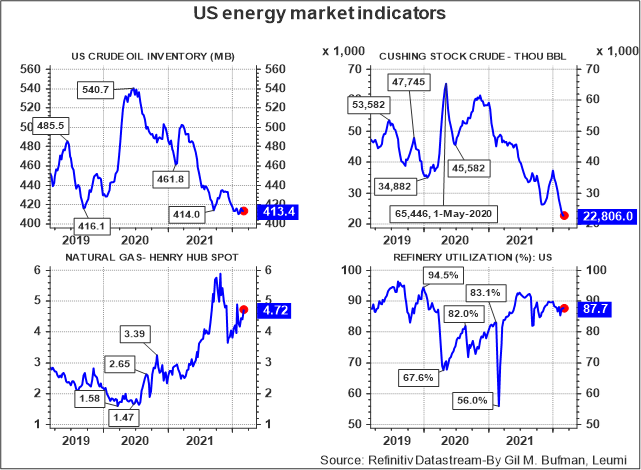

In the United States it decreased in the week ending 25/2/2022 by 2.6 million barrels, and it reached about 413.4 million barrels. At the rate of utilization of the refineries, which reached about 87.7%.

At the same time, oil inventories have fallen by about one million barrels, as a continuation of the declining trend in recent weeks. In doing so, it is once again approaching the level of less than 20 million barrels, which is estimated to be a threshold level environment below which there is an operational risk to the oil reservoir.

As part of the sanctions imposed on Russia in response to its invasion of Ukraine, the US administration is trying to challenge Russia’s status as a global producer of oil and natural gas by restricting technology exports related to the energy sector.

At the same time, the imposition of sanctions on Russia led to the exit of many companies from the Russian market, including energy companies that were invested in projects in Russia. In doing so, Russia’s business sector’s investment in the energy sector is expected to decline, which will hamper its ability to increase its energy generation capacity.

| Global demand

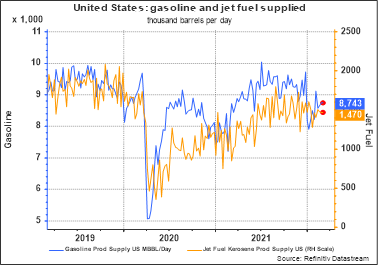

Demand for car fuel in the U.S. rose slightly in the week ending Feb. 25 and remained around the level of 8.7 million barrels a day.

The recent rise in the price of oil may further burden the price of fuel, which may weigh on the continued growth of demand in the short term and may even lead to a temporary decline in demand. However, the expected decline in the price of fuel in the medium term will further support the strengthening of demand back to the range they were in the last half of 2021.

On the other hand, the demand for jet fuel decreased slightly and remained around the level of 1.5 million barrels per day. This level is in the range of demand that was in the second half of 2021, and is supported by the decline in morbidity that partially offsets the rising price burden on demand. Later in the year, demand for jet fuel is expected to grow to a higher level, especially during the tourist season in the spring and summer months when demand for flights is growing.

Geopolitical tensions in Eastern Europe are shifting demand from the Russian market towards other markets and increasing demand for oil in Middle Eastern countries, with an emphasis on what is expected to lead to an increase in Saudi Arabia’s oil premium for its customers in Asia.

At the same time, although Chinese oil importers have halted oil purchases from Russia for the time being until the geopolitical situation and the possibility of payment for oil after the imposition of sanctions on a significant part of the Russian banking system, China is expected to return to Russian oil purchases. , And thus it will benefit from a decrease in the price of Russian oil in the future. This is similar to the behavior of China after sanctions were imposed on Iran and Venezuela.

| The natural gas economy

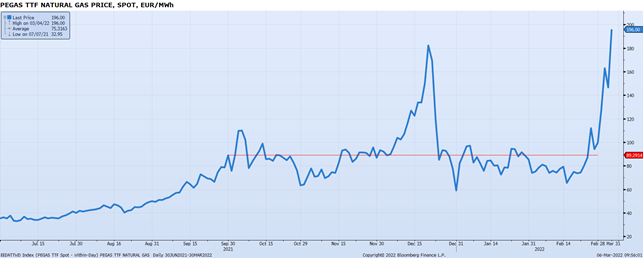

US Price (Henry Hub) Continued to rise last week to $ 4.72 perMMBTU. This is against the background of the escalation of geopolitical tensions in Eastern Europe that intensify the uncertainty in the energy market and disruptions in the supply of natural gas from Russia to Europe, which increases the excess demand for natural gas in the world in general and in Europe in particular.

The level of natural gas inventories in the United States has remained about 10.5% lower than the level in the same period last year and the average level in this period in the last five years, which supports natural gas prices. Existing market demand At the same time, the winter season is coming to an end and demand for natural gas is expected at least due to the decline in demand for domestic and business heating.

Exacerbation of natural gas shortages in Europe following Russia’s invasion of Ukraine and disruption of energy supplies from Russia, led to a large rise in gas prices in Europe (TTF) In the last week more than 100% and its price reached about 203 euros perMWh (About $ 65 per MMBTU). The shortage of natural gas in Europe stems from its critical dependence on Russian energy, with an emphasis on Russian natural gas.

Disruptions in energy supply stem both from Russia’s possible response to sanctions imposed on it by Europe and the United States and as a result of disruptions in the passage of gas through Ukraine where the fighting is taking place. As part of the sanctions, Germany has suspended the Russian gas pipeline approval Nord Stream 2. Without these bureaucratic permits, Russia will not be able to operate the gas pipeline designed to carry gas underwater directly from Russia to Germany.

However, as the winter season draws to a close, demand for natural gas in Europe is expected to decline due to the expected decline in demand for natural gas for domestic and business heating. In addition, increasing the supply of liquefied natural gas (LNG) From the US, Asian countries and other countries will support in the medium term the decline in natural gas prices.

| Expect the medium term

The price of oil is expected to be affected by the following factors: Continued geopolitical tensions over the fighting between Russia and Ukraine; The degree of progress towards a nuclear agreement between the superpowers and Iran; Relief policy in production quotas of. If a nuclear agreement is signed with Iran, it will increase the oil supply in the market quickly, from the existing oil reserves in its possession.

Group OPEC+ Will increase oil production in March-April, in line with the decision made at its last meeting. Actual output, however, is expected to increase less than the increase in production quotas (400,000 barrels per day), as some group members have exhausted most of their excess production capacity, for now.

The largest oil producers in the group OPEC They are expected to be the main beneficiaries of the increase in production quotas, as they have not yet exhausted their production capacity, and on the other hand it seems that the African companies in the group will find it difficult to increase oil production capacity which is already lower than their quota.

It seems that the rise in morbidity in the current wave has not significantly hurt energy demand, and the continued recovery in economic activity supports the policy of OPEC+ To facilitate production quotas.

The high price level together with the sanctions imposed on Russia, which reduce its demand for oil, increase the economic viability of the major oil producers in the country.OPEC Deviate from production quotas and increase oil production. This is because until the imposition of sanctions, Russia was the force among the member states of the group OPEC+ Who are not members of the group OPEC And it posed a threat of being dragged into a price war, as occurred in March-April 2020.

However, if sanctions on Russia remain long-term, it appears to have a lasting effect on oil demand even though sanctions will only partially include Russia’s energy generation sector.

In such a scenario, Russia would not be bound by the production quotas of OPEC+, And group members will be able to make decisions without regard to Russia and without Russia’s involvement in the extended group it joined about six years ago. This scenario concerns the medium term and if it materializes, it is likely that my members OPEC Will continue with the current policy of gradually increasing the oil supply, with Russia’s quotas distributed among other members of the group.

The main beneficiaries of such a decision are likely to be Saudi Arabia and the United Arab Emirates, and possibly Iraq as well, which are large oil producers and have not yet exhausted their oil production capacity.

As long as Russia is free from restrictions OPEC, And if the sanctions do not extensively include its energy sector, Russia will be free to increase its output further, subject to the energy transport capabilities and the degree of willingness of the countries of the world to purchase oil from it. Such a move may reflect an attempt by the Russian government to greatly increase the state’s revenues from natural resources, as a key part of dealing with the economic crisis it is now entering.

The Russian invasion of Ukraine supports a continued rise in oil prices in the immediate term, but assuming heavy fighting is limited in time, this rise is expected to be temporary and oil producers are expected to further increase their oil production, which will support lower oil prices. More.

Oil futures indicate a certain decline in price, in the second half of 2022 and a further decline during 2023. This is probably due to the expectations that oil supply will increase during 2022, and there may even be some surplus supply towards the end of the year.

PDF document: Leumi’s full weekly energy review

The writer is the chief economist of Bank Leumi. The data, information, opinions and forecasts in the review are provided as a service to readers, and do not necessarily reflect the official position of the Bank. They should not be construed as a recommendation or substitute for the reader’s independent discretion, or an offer or invitation to receive offers, or advice to purchase and / or make any investments and / or actions or transactions. Errors may occur in the information and changes may occur. The Bank and / or its subsidiaries and / or companies related to it and / or the controlling shareholders and / or stakeholders in which of them may from time to time have an interest in the information presented in the review, including financial assets presented in it.