Hana Bank-Toss Bank deposit interest rate cut

September home loan interest rate rises highest in two years

Loan interest rates soar due to government regulations

Point out that “the burden on financial consumers is only increasing”

Banks began lowering interest rates on deposits and savings in line with the base interest rate that was lowered by 0.25 percentage points last month. However, loan interest rates continue to remain high, with housing mortgage loan interest rates in September rising by the largest amount in two years. It is pointed out that even during the interest rate cut phase, loan interest rates remain high due to the financial authorities’ management of household loans, which is only increasing the profits of banks and increasing the burden on financial consumers.

● “Even banks that have not lowered interest rates are likely to do so soon.”

Hana Bank announced on this day that it would reduce the basic interest rate for 11 receiving products by 0.05 to 0.25 percentage points starting from the 1st. Accordingly, the interest rate for ‘369 term deposit’ with a one-year maturity will be lowered from 3.00% to 2.80% per year, and the interest rate for ‘Salary Hana Monthly Compound Interest Savings’ will be lowered from 3.35% to 3.30% per year. On this day, Toss Bank also lowered the interest rate on the Toss Bank account, which is a deposit and withdrawal account, by 0.3% points. SC First Bank also decided to lower the interest rate on deposit products by 0.3 to 0.8 percentage points. The reason banks are lowering deposit and savings interest rates is because the base interest rate has been lowered. On the 11th of last month, the Bank of Korea lowered its base interest rate from 3.50% to 3.25%. A ’pivot’ was implemented to change monetary policy after 3 years and 2 months. Accordingly, NH Nonghyup, Woori Bank, BNK Gyeongnam Bank, and Busan Bank reduced the interest rates on incoming products early last month. An executive in charge of credit at a commercial bank said, “As market interest rates have fallen due to the impact of the Bank of Korea’s base rate cut, we are in a situation where interest rates on deposits and savings products have to be adjusted as well,” adding, “KB Kookmin and Shinhan Bank, which have not yet lowered their interest rates, are likely to make similar decisions in the near future.” “This is high,” he said.

● “Only banks have recorded record profits due to government intervention”

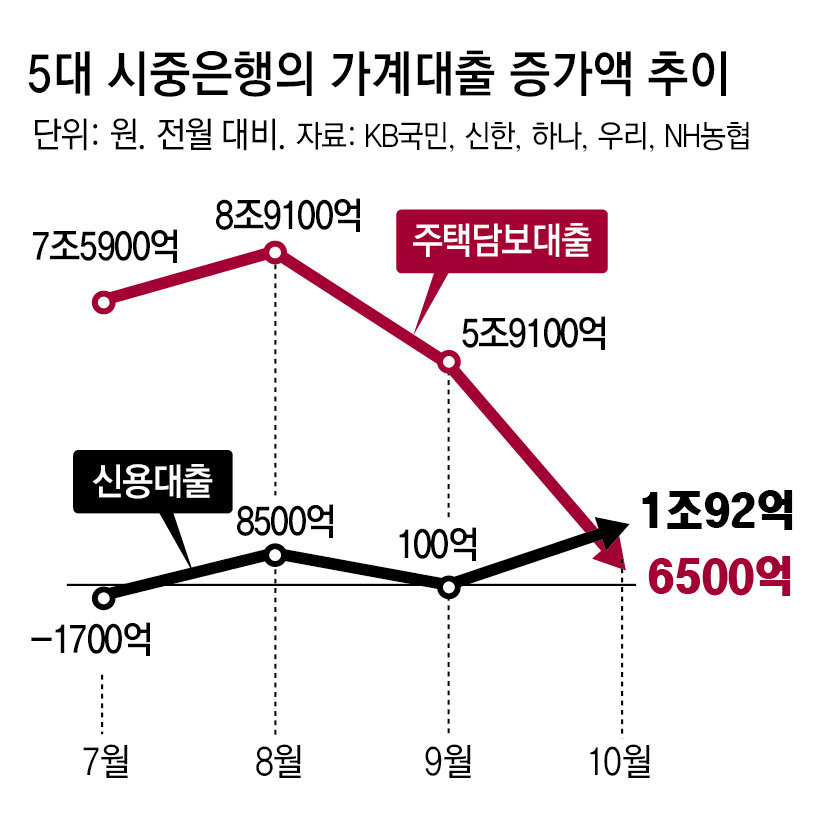

The problem is that the banking sector’s deposit and savings interest rates have begun to fall, but loan interest rates are on the rise. According to the Bank of Korea, the weighted average interest rate on household loans (based on new loan amount) in September this year was 4.23%, up 0.15 percentage points from a month ago. The interest rates for home loans (3.74%) and jeonse loans (4.05%) both increased by 0.23 percentage points from a month ago. In the case of mortgage loans, the increase was the largest since September 2022. Kim Min-soo, head of the Bank of Korea’s financial statistics team, explained, “Although the interest rates on 5-year maturity bank bonds remained flat, lending rates appear to have increased as banks increased their added interest rates.”

As the decline in deposit and savings interest rates coincide with the rise in loan interest rates, the household deposit-to-loan interest rate difference of the five major commercial banks, including KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup, as of September was 0.73% points on average in July (0.43% point) and August. (0.57% points) and expanded for two consecutive months. The deposit/loan interest rate difference is the difference between the lending interest rate and the deposit/savings interest rate. As the figure increases, the bank’s profits also increase. The reason major financial holding companies achieved record-breaking profits through the third quarter of this year (July to September) was because interest income was close to the maximum.

The reason why the banking sector maintains high lending interest rates is largely because the end of the year is approaching. Banks submit ‘loan growth targets’ to the financial authorities at the beginning of each year, and most banks exceeded their annual targets in the third quarter of this year. As the financial authorities have announced that they will impose penalties on banks that exceed the target, they are reducing household debt balances by keeping loan interest rates high and encouraging repayment of existing loans.

Experts point out that the financial authorities’ regulation of total loan volume is having side effects. Seo Ji-yong, a professor of business administration at Sangmyung University, said, “As the banking sector is trying to reduce the total amount of loans, the lending interest rate is not set even with the base interest rate cut. As a result, the interest burden on the people remains the same, but the banking sector is on the verge of record-breaking profits.” said.

Reporter Kang Woo-seok [email protected]

- I’m sad

- 0dog

- I’m angry

- 0dog

Hot news now

Interview between Time.news Editor and Finance Expert Seo Ji-yong: The Impact of Interest Rate Changes on Consumers

Time.news Editor: Thank you for joining us today, Professor Seo Ji-yong. The recent interest rate changes by banks, especially the cuts to deposit rates while loan rates are soaring, have left many consumers confused and concerned. Can you help us unpack what’s happening in the financial sector right now?

Seo Ji-yong: Thank you for having me. It’s indeed a perplexing situation. As the Bank of Korea lowered its base interest rate from 3.50% to 3.25%, we saw banks like Hana Bank and Toss Bank respond by cutting their deposit rates. However, simultaneously, we’re witnessing a significant increase in loan interest rates, particularly for home loans, which are rising at the fastest rate we’ve seen in two years.

Time.news Editor: That’s a troubling trend for consumers. Why do you think we are seeing such a disparity between the rates for deposits and loans?

Seo Ji-yong: Several factors contribute to this. First, while the base rate has decreased, banks are still managing their loan portfolios aggressively due to regulatory pressures. Specifically, they need to keep their total loan volumes in check, especially as the end of the year approaches and they are held accountable for their loan growth targets. Therefore, to encourage repayment and control the volume of outstanding loans, they’re maintaining high interest rates on loans.

Time.news Editor: And what does this mean for consumers, particularly those looking for home loans?

Seo Ji-yong: Unfortunately, it places an added financial burden on them. With household loan interest rates climbing to an average of 4.23%, consumers are facing higher monthly payments while the interest on their savings continues to drop. This scenario is compounded by the fact that while rates on deposits are decreasing, the burden of servicing loans is only increasing. The widening gap—0.73% between deposit and loan interest rates—clearly shows that banks are benefiting in terms of profits at the expense of consumers.

Time.news Editor: Many have mentioned that these policies seem to favor banks significantly. Are the regulations being imposed on the banks serving the interests of the consumers?

Seo Ji-yong: That’s a critical concern. The financial authorities claim the goal is to manage household debt. However, the unintended consequence is that it creates significant profits for the banks while consumers struggle with higher borrowing costs. The disparity in how banks adjust interest rates demonstrates that the regulatory framework needs reassessment to ensure that it does not disproportionately burden consumers while allowing banks to profit.

Time.news Editor: Some banks, like KB Kookmin and Shinhan, have yet to adjust their deposit rates. Should we expect these changes soon?

Seo Ji-yong: Yes, most banks that have not yet adjusted their rates are likely to follow suit soon. The market generally aligns with the trends set by the central bank and their competitors. As consumers continue to see a decrease in returns on their deposits, the pressure on banks to match these trends is mounting.

Time.news Editor: what steps can consumers take to protect themselves in this environment of rising loan rates and decreasing deposit interest?

Seo Ji-yong: Consumers need to be proactive. First, they should compare different loan products carefully and negotiate rates when possible. Additionally, diversifying savings into more favorable terms or considering investment options that offer higher returns than standard deposits might be wise. It’s also crucial to stay informed about policy changes and consider voice in regulatory discussions, as awareness can shape future financial landscapes.

Time.news Editor: Thank you, Professor Seo, for your insight into these pressing financial issues. Your expertise offers clarity in a complicated situation, and we appreciate you sharing your knowledge with our readers today.

Seo Ji-yong: Thank you for having me. It’s critical for consumers to stay informed and engaged as the financial landscape evolves.