‘Director’s duty of loyalty expanded to general shareholders’

Democratic Party plans to pass within the year… against, against

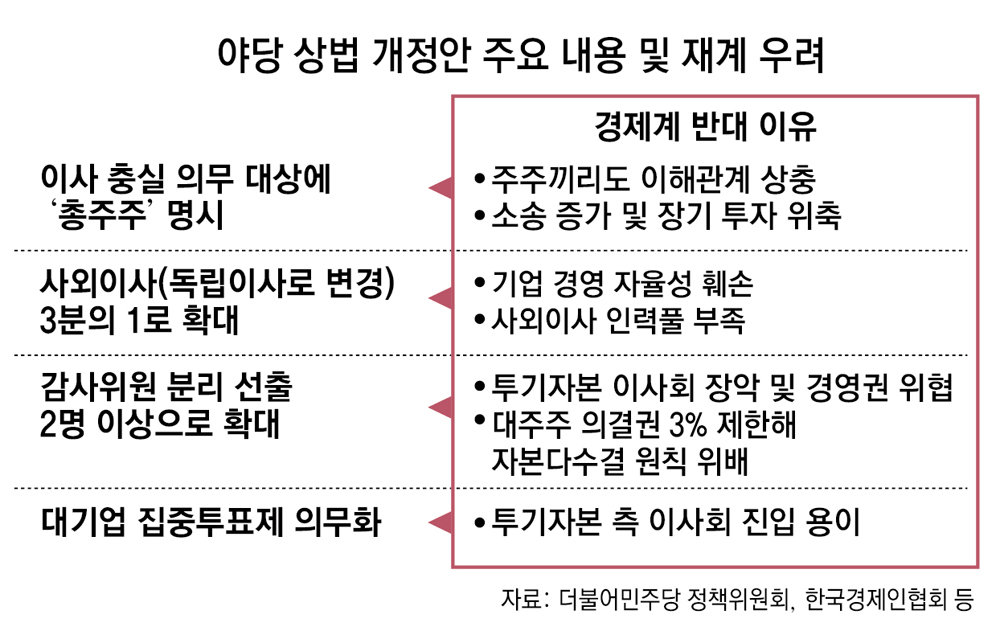

On the 14th, the Democratic Party of Korea adopted as its party platform a bill to amend the Commercial Act that extends the duty of loyalty of directors to shareholders. The purpose is to protect minority shareholders by expanding the duty of loyalty to not only existing companies but also general shareholders. The business community is protesting that if the amendment is passed, there will be an overabundance of lawsuits filed against company directors, and that stipulating a duty of loyalty is itself contradictory as each shareholder has a different purpose for holding stocks. The Democratic Party plans to pass a revision to the Commercial Act within the year despite concerns from the business community and opposition from the ruling party.

The amendment to the Commercial Act, which the Democratic Party adopted as its party line at the general meeting of lawmakers on this day, stipulated the directors’ duty of loyalty to shareholders. In the case of large listed companies with total assets of more than 2 trillion won, a cumulative voting system was introduced in the director selection process, and at least two audit committee members were elected separately from other directors. In addition, the name of outside directors was changed to independent directors and provisions for electronic general shareholder meetings were established. The amendment to the Commercial Act is an issue that Lee Jae-myeong, leader of the Democratic Party, promised to handle during the regular National Assembly when he agreed to the abolition of the financial investment income tax (gold investment tax) on the 4th of this month.

The business community protested, saying that while each country is trying to protect its own companies from the ‘Trump storm’, Korea is actually pushing for a bill that would shake up corporate management rights. According to the Korea Economic Association, if the separate election of audit committee members and the mandatory cumulative voting system are realized as per the amendment to the Commercial Act, 8 (26.7%) of the 30 largest domestic companies (based on assets) could give up the majority of their boards of directors to foreign capital. Among the top 10 companies, 4 were affected.

Eight economic groups, including the Korea Economic Cooperation and the Korea Chamber of Commerce and Industry, issued a statement and argued that “a hasty revision of the Commercial Act will result in an overabundance of lawsuits against directors and will be abused as a means of attacking management rights by overseas speculative capital.”

Business community: “Overseas speculative capital fraud promotion law…” “The board of directors of 4 of the top 10 companies are threatened.”

Democratic Party adopts party line on commercial law amendment

Democratic Party “Improve corporate governance by revising the commercial law”

Business

Despite opposition from the business community, the Democratic Party of Korea adopted the commercial law amendment as its party platform, saying, “We will improve the backward corporate governance structure.” Instead of agreeing to abolish the financial investment income tax (gold investment tax), they appear to be putting all their efforts into revising the commercial law. Eight economic groups, including the Korea Economic Association and the Korea Chamber of Commerce and Industry, protested in a joint statement, saying, “A hasty revision of the Commercial Act will become a ‘law to promote foreign speculative capital fraud.’”

● Democratic Party “Improve corporate governance by revising the Commercial Act”

The key point of the amendment to the Commercial Act, which the Democratic Party of Korea adopted as its party line at the general meeting of members on the 14th, is that it clearly specifies the duty of loyalty of directors to shareholders. The current commercial law stipulates that ‘directors must faithfully perform their duties for the company in accordance with the laws and provisions of the articles of incorporation,’ and this duty of loyalty has been extended to shareholders.

The amendment also includes provisions mandating the introduction of a cumulative voting system in the process of selecting directors in the case of large listed companies and expanding the scale of separate election of audit committee members. A plan was also included to change the name of outside directors to ‘independent directors’ and to increase the ratio of independent directors to more than one-third of the total number of directors. The current rule is one quarter.

This amendment to the Commercial Act is a condition that CEO Lee Jae-myung proposed when agreeing to the abolition of financial investment income tax on the 4th of this month. Representative Lee said, “We will do our best to advance legislation and stock market advancement policies, including amendments to the Commercial Act, so that the stock market can establish itself as a means of investment for the people.”

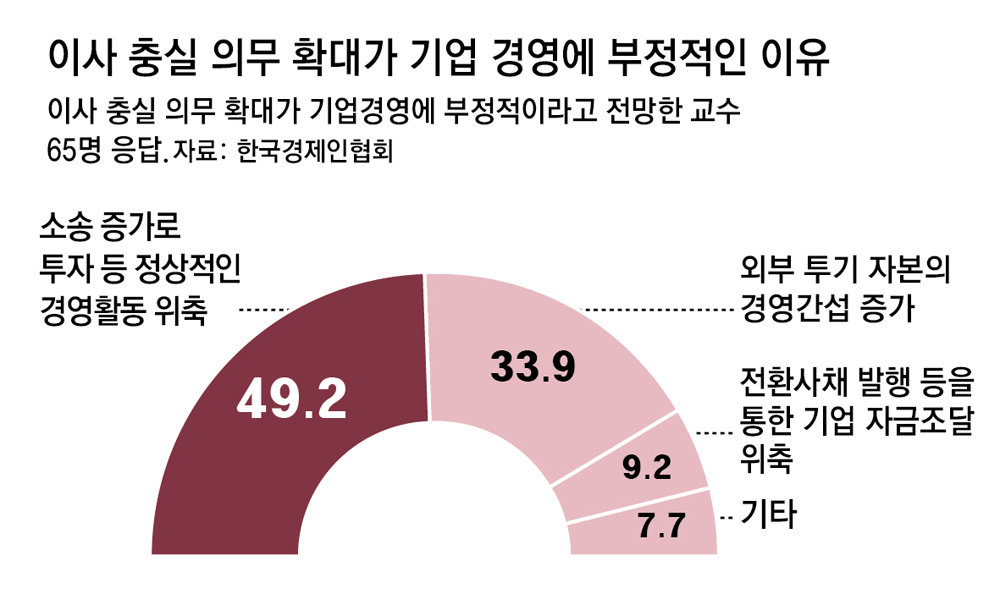

The business community agrees that a change in shareholder-friendly governance is necessary in order to ‘value up’ companies, but they are concerned that the amendment to the commercial law promoted by the Democratic Party could shake up the overall management rights. In particular, the expansion of directors’ duty of loyalty is expected to lead to an overabundance of lawsuits. This is because it is impossible for the board of directors’ decisions to satisfy all shareholders in a situation where shareholders’ interests vary depending on whether they are short-term or long-term investors or domestic and foreign investors. Litigation risk can diminish the board’s management judgment. This is why major countries such as the United States, the United Kingdom, France, Germany, and Japan do not have provisions for directors’ loyalty to shareholders.

●“Threatening the boards of directors of 8 of the top 30 companies”

Some argue that the expansion of separate election of audit committee members

and the mandatory cumulative voting system are provisions that open the way for aggressive activist funds to enter the board of directors. The separate election system for audit committee members selects audit committee members separately from existing directors, and limits the voting rights of major shareholders to 3%.

Although the purpose is to select audit committee members who can rebel against major shareholders, the business community believes that there is a high possibility that it will be abused by activist funds that have a strong ability to act and are advantageous in gathering overseas investors. Moreover, it is a provision that only exists in Korea, as it goes against the ‘majority voting principle’ (exercise of voting rights equal to the number of shares held), which is the basic principle of a stock company.

In fact, as a result of the Korea Economic Association’s analysis assuming that the separate election of audit committee members and the mandatory cumulative voting system become a reality, four of the top 10 domestic companies (based on assets) have a majority of their board of directors held by foreign capital such as foreign asset managers and private equity funds. It was found that it can be given to . If expanded to the top 100 companies, the number increases to 16. Among the top 100 companies, 84 companies were able to appoint at least one director with foreign capital.

How might the cumulative voting system impact minority shareholders in large companies?

Interview Between Time.news Editor and Corporate Governance Expert

Editor: Welcome to Time.news, where we bring you the latest developments in business and governance. Today, we have with us Dr. Min-seok Lee, a corporate governance expert, to discuss the recent amendment proposed by the Democratic Party of Korea regarding the Commercial Act. Dr. Lee, thank you for joining us.

Dr. Lee: Thank you for having me. It’s great to be here.

Editor: Let’s dive right in. The Democratic Party of Korea is pushing to expand the duty of loyalty of directors to include all shareholders, not just the company itself. What do you believe are the implications of this shift?

Dr. Lee: This amendment reflects a significant move towards enhancing shareholder rights, particularly for minority shareholders who have often been left in the shadows. By extending the duty of loyalty to all shareholders, it aims to create a more equitable playing field. However, this also raises concerns about the potential for increased litigation against directors if their decisions do not align with the varied interests of all shareholders.

Editor: That’s an interesting point. The business community seems quite concerned about this potential for litigation. They argue that this could lead to an overwhelming number of lawsuits against directors. Do you think these fears are justified?

Dr. Lee: Yes, I believe they are valid concerns. The very nature of business decisions often means that not all shareholders will be satisfied with the outcomes. Each shareholder may have different goals—some may prioritize quick profits, while others may focus on long-term sustainability. This divergence can create a legal minefield where directors may face lawsuits for not meeting one or several shareholders’ expectations, which could ultimately impede their ability to make sound management decisions.

Editor: The proposed amendment also includes a cumulative voting system for certain large companies and mandates separate elections for audit committee members. How do these changes fit into the overall goal of improving corporate governance?

Dr. Lee: These measures aim to bolster accountability and transparency within the boardroom. A cumulative voting system can empower minority shareholders by amplifying their votes, ensuring their voices are heard in the selection of directors. Additionally, having independent auditors can help maintain the integrity of financial reporting and bolster investor confidence. However, the effectiveness of these changes will depend heavily on their implementation and the cultural shift within the companies.

Editor: Speaking of implementation, the Democratic Party plans to proceed with these reforms despite significant pushback from the business sector, which argues that these changes may destabilize corporate management rights. What do you think about this pushback?

Dr. Lee: It’s important that reforms are balanced. While there is a pressing need to improve corporate governance, especially in protecting minority shareholders, we must tread carefully. If the reforms destabilize the management rights to the extent that it affects business operations and decision-making, we might witness adverse reactions from corporations, including potential relocations of capital or a decrease in foreign investment. A collaborative dialogue between policymakers and the business community is crucial to find common ground.

Editor: The Democratic Party argues that this legislation will ultimately advance stock market interests and create a more robust investment environment. Do you see a direct correlation between corporate governance reform and investor confidence?

Dr. Lee: Absolutely. Strong corporate governance frameworks are increasingly being recognized by investors as essential indicators of company health and reliability. By creating a system that is fairer and more transparent, you can attract both domestic and foreign investments. However, it’s essential that these reforms genuinely address the concerns of investors rather than simply being a checkbox exercise.

Editor: In light of all this, what do you think will be the long-term effects of the proposed amendments if they are passed?

Dr. Lee: If implemented thoughtfully, the amendments could strengthen corporate governance in Korea, enhance minority shareholder protections, and foster a more competitive business environment. However, if they lead to excessive litigation and instability in the management of companies, we could see a decrease in managerial autonomy, ultimately could hinder innovation and growth. It’s a delicate balancing act that requires careful consideration of all stakeholders involved.

Editor: Thank you, Dr. Lee, for your insight on this crucial topic. The implications of these proposed changes are indeed far-reaching and deserve careful consideration as the democratic process unfolds. It will be interesting to see how this develops.

Dr. Lee: Thank you for the opportunity to discuss these vital issues. I look forward to seeing how the situation evolves in the coming months.