KOSPI rose 2.16% yesterday for a long time

Samsung Electronics once jumped more than 7%

Full-fledged investment of 200 billion value-up funds

U.S. Nasdaq falls for four days in a row

The domestic stock market, which had been reeling from the ’Trump storm’, showed a strong rebound after a long time following news of Samsung Electronics’ share purchase and the financial authorities’ execution of a value-up fund. The ‘Trump trade’ (investment in assets benefiting from Trump) in the global asset market has also entered a calming phase, with the upward trend of virtual assets such as the U.S. stock market and Bitcoin, which had soared through the roof, slowing down.

According to the Korea Exchange on the 18th, KOSPI closed at 2,469.07, up 2.16% from the previous trading day. The domestic stock market plummeted more than 1% every day on the news of U.S. President-elect Donald Trump’s return to power, giving up 2,000 trillion won in market capitalization.

However, Samsung Electronics’ announcement on the 15th of a 10 trillion won stock repurchase plan served as an opportunity for a rebound in the domestic stock market. On this day, the first trading day after announcing the share purchase, Samsung Electronics’ stock price soared 7.1% during the day, but ended trading at 56,700 won (5.98% increase). The stock prices of affiliates with shares in Samsung Electronics, including Samsung Life Insurance (11.48%) and Samsung Fire & Marine Insurance (10.48%), also rose. According to Park Sang-wook, a researcher at Shinyoung Securities, Samsung Electronics’ stock price rose 18% in 2015-2016 when its shares were canceled and 27% in 2017-2018.

The authorities’ announcement that they will try to stimulate the domestic stock market is also assessed to have contributed to stabilizing investment sentiment. At a stock market situation review meeting held on this day, Financial Services Commission Chairman Kim Byeong-hwan said, “The recent decline in the domestic stock market is excessive,” and ordered, “Execute the value-up fund quickly.” Exchanges and other companies plan to begin purchasing domestic stocks through a value-up fund worth 200 billion won starting this week. In the future, an additional secondary fund worth 300 billion won will be created.

In addition, according to the Korea Exchange, the cumulative consolidated operating profit of KOSPI-listed companies as of September this year was KRW 155.6463 trillion, an increase of 64.5% compared to the same period last year, reaching an all-time high. Sales also increased by 4.9% compared to the same period last year, reaching KRW 2,214.6098 trillion.

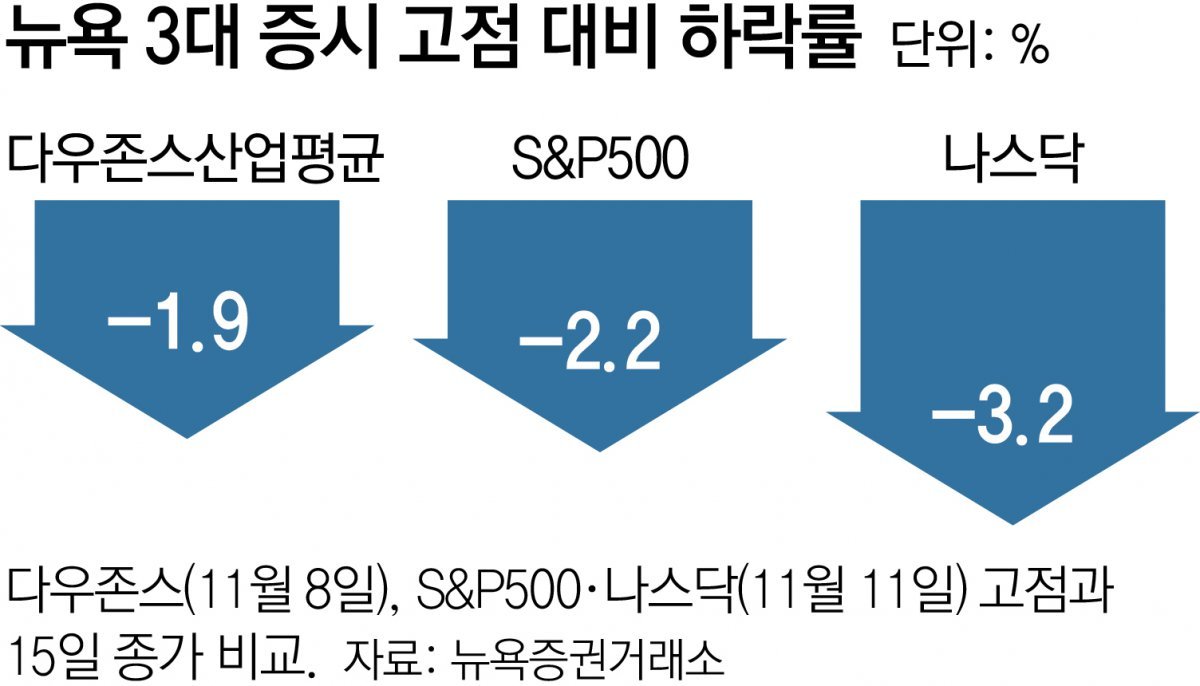

The ‘Trump Trade’ fever in the global market is also slowing down. The U.S. stock market, which had been hitting record highs every day, closed lower on the 15th (local time). The NASDAQ index reached its highest point (19,298.76) on the 11th and then fell for four consecutive days. On the 15th, trading ended at 18,680.12, down 3.2% from the high, giving back most of the gains gained due to the Trump effect. Bitcoin also exceeded $93,000 on the 13th, hitting an all-time high, and then fell to the $91,000 range.

Experts analyzed that the global asset market, which had been soaring in anticipation of the same massive liquidity supply policy effect as during Trump’s first term (2017-2021), has entered a calming phase. During Trump’s first term, the Nasdaq (58.7%), S&P 500 (41.0%), and Dow Jones Industrial Average (36.4%) soared in the aftermath of large-scale tax cuts and deregulation policies. This means that stock prices have risen excessively due to expectations that the same effect will occur in Trump’s second term.

There is also skepticism that even if the liquidity supply policy is implemented in Trump’s second term, the effect will not be significant. This is because stock prices have already reached an all-time high and inflation and interest rates remain high. Hwang Se-woon, a researcher at the Korea Capital Market Institute, said, “The U.S. stock market will break away from the excessive Trump rally and undergo a technical adjustment. Conversely, there is a possibility that low-price buying will flow into the domestic stock market for the time being.”

Reporter Lee Dong-hoon [email protected]

Reporter Kwak Do-young [email protected]

- I’m sad

- 0dog

- I’m angry

- 0dog

- I recommend it

- dog

Hot news now

Interview between Time.news Editor and Hwang Se-woon, Researcher at the Korea Capital Market Institute

Time.news Editor (TNE): Welcome, Hwang Se-woon! Thank you for joining us today to discuss the recent developments in the Korean stock market and their implications.

Hwang Se-woon (HS): Thank you for having me. It’s an exciting time in the markets, and I’m happy to share insights.

TNE: We’ve seen a notable rebound in the KOSPI, up 2.16% recently, largely fueled by Samsung Electronics’ significant stock repurchase plan. Why do you think this has generated such a strong reaction in the market?

HS: Samsung Electronics has always been a bellwether for the KOSPI. Their plans to buy back 10 trillion won worth of shares signal confidence in their long-term prospects. It provides a psychological boost to investors and indicates a commitment to stabilizing stock prices. This kind of move can alleviate fears in a bearish market.

TNE: Absolutely. It appears that the recent instability was compounded by the ‘Trump storm.’ Can you explain the concept of ‘Trump Trade’ and how it affected global markets?

HS: The term ‘Trump Trade’ refers to investments in assets expected to benefit from policies associated with Donald Trump’s first term, such as tax cuts and deregulation. After his election victory, there was euphoria in the markets, leading many to believe that a similar growth trajectory would occur in his second term. However, the reality is that the market is now undergoing a technical adjustment after a significant rally.

TNE: That makes sense. You mentioned that this adjustment reflects a calming phase for the global asset market. How do you anticipate the U.S. stock market will evolve in the coming months, especially considering the current high inflation and interest rates?

HS: There is indeed skepticism regarding how effective potential liquidity measures will be. Given that U.S. stock prices are at all-time highs, any new policies will likely have diminishing returns. We are likely to see a technical adjustment as investors re-evaluate the sustainability of these valuations amid persistent inflation and high interest rates, which could significantly curb economic growth.

TNE: So, with this context, do you think there is an opportunity for domestic investors in South Korea’s market?

HS: Yes, I believe there is potential for low-price buying in the domestic market. While the U.S. market is adjusting, Korean stocks, particularly those like Samsung, could be seen as cyclical plays. The investment from the value-up fund totaling 200 billion won might also stimulate interest. there is a window of opportunity for investors looking for solid positions as the market stabilizes.

TNE: It sounds like the upcoming weeks will be critical in determining the trajectory for both the KOSPI and global markets. Any final thoughts on what investors should keep an eye on?

HS: Absolutely! Investors should focus on key indicators such as U.S. economic data, inflation readings, and any comments from the Federal Reserve regarding interest rates, which could provide further clues about future market movements. Domestically, the reaction to the execution of the value-up fund and overall corporate earnings will be significant for KOSPI stocks.

TNE: Thank you for such deep insights, Hwang Se-woon. It’s always enlightening to hear from experts like you who can dissect these complex market dynamics.

HS: Thank you for having me! I appreciate the opportunity to discuss these important topics.