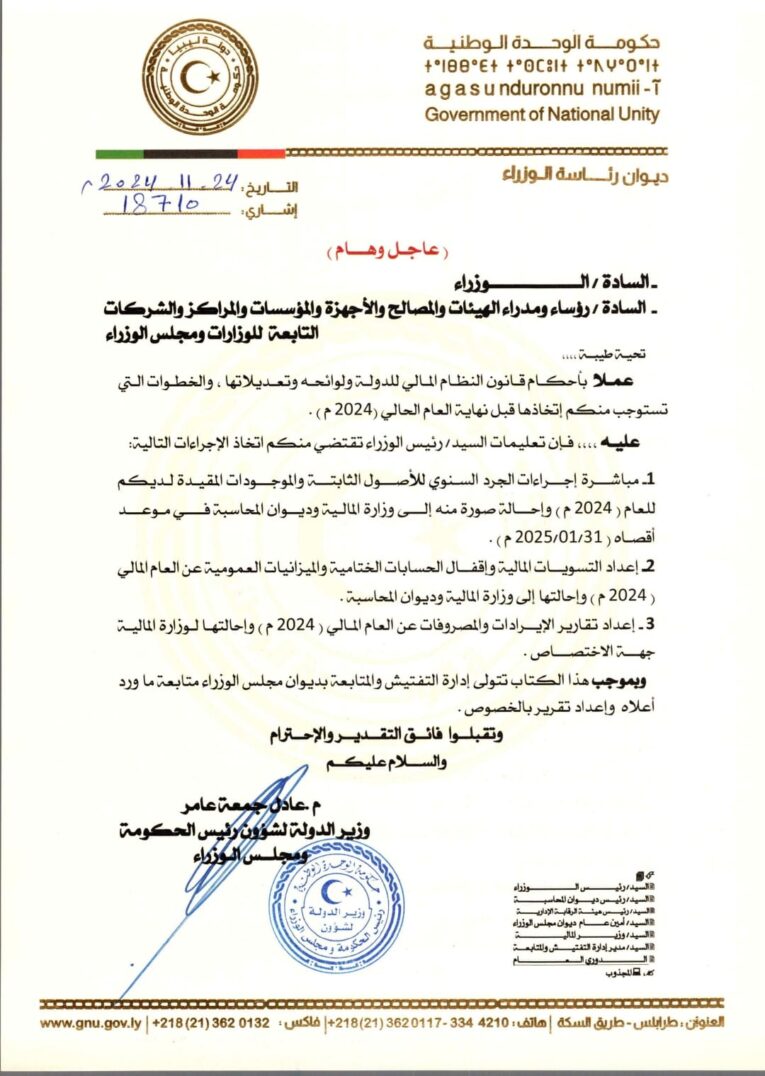

The Prime Minister of the National Unity Government, Abdul Hamid Al-Dabaiba, issued a decision obligating government agencies to undertake the annual inventory, financial settlements, close accounts and budget, and prepare annual financial reports for the year 2024 and submit them before the end of the year.

The decision stated: To “the heads and directors of agencies, departments, agencies, institutions, centers, and companies affiliated with the ministries and the Council of Ministers:

Pursuant to the provisions of the State Financial System Law, its regulations and amendments, and the steps that require you to take before the end of the current year (2024 AD). The Prime Minister’s instructions require you to take the following actions:

1 Initiate the procedures for the annual inventory of your fixed assets and assets registered for the year (2024 AD) and refer a copy of it to the Ministry of Finance and the Audit Bureau on a date. (No later than) 01/31/2025 AD

2 Preparing financial settlements and closing the final accounts and balance sheets for the fiscal year (2024 AD) and referring them to the Ministry of Finance and the Audit Bureau.

3- Preparing revenue and expenditure reports for the fiscal year (2024 AD) and referring them to the Ministry of Finance, the competent authority.

According to this letter, the Inspection and Follow-up Department at the Cabinet Office is responsible for following up on what was stated

above and prepare a report in this regard.

Last updated: November 26, 2024 – 11:55

Suggest a correction

<!–

–>

Interview between Time.news Editor and Financial Expert Dr. Amina Rahim

Editor: Good morning, Dr. Rahim, and thank you for taking the time to speak with us today. The recent decision by Prime Minister Abdul Hamid Al-Dabaiba regarding annual financial procedures has generated quite the buzz. Could you provide an overview of its significance?

Dr. Rahim: Good morning! Absolutely, I’m glad to share my insights. The Prime Minister’s directive is a pivotal step for the National Unity Government in Libya. It obliges government agencies to conduct thorough annual inventories and financial settlements for the fiscal year 2024. This structured approach is essential for transparency and accountability in public finance, especially in a country aiming to stabilize and thrive economically.

Editor: This initiative mandates that various agencies submit comprehensive reports by the end of this year. How challenging do you think this could be for these institutions?

Dr. Rahim: It certainly presents challenges, particularly given Libya’s complex financial landscape. Many agencies may still be grappling with the aftermath of previous instability. Implementing a rigorous financial reporting system requires trained personnel, adequate resources, and commitment. However, the establishment of clear deadlines can motivate agencies to prioritize these vital processes.

Editor: You mentioned the importance of transparency. How do you see this decision impacting public trust in the government?

Dr. Rahim: Transparency in financial matters is crucial for building public trust. By having agencies submit detailed reports to the Ministry of Finance and the Audit Bureau, the government can foster a culture of accountability. If these procedures are followed diligently, it could enhance citizens’ confidence in how public funds are managed, ultimately contributing to a more robust governance structure.

Editor: The directive places significant responsibility on the Inspection and Follow-up Department at the Cabinet Office as well. What role will they play in ensuring compliance?

Dr. Rahim: The Inspection and Follow-up Department will serve as the watchdog, overseeing the adherence to the outlined processes. Their role is critical for ensuring that agencies don’t just meet deadlines but also maintain the quality and accuracy of their financial reports. It’s about creating a feedback loop that encourages improvement and rectifies issues before they escalate.

Editor: What long-term impacts do you foresee if these financial measures are successfully implemented?

Dr. Rahim: If effectively executed, we could see a shift towards more effective budget management, improved financial health of institutions, and ultimately, better service delivery to the public. This could lay the groundwork for future investments, both domestic and foreign, by signaling that Libya is serious about reforming its public sector finance management.

Editor: That sounds promising. In your experience, what are some best practices that Libya should consider adopting moving forward?

Dr. Rahim: Libya could benefit from adopting international standards for public financial management. For instance, embracing the International Public Sector Accounting Standards (IPSAS) would enhance the accuracy and efficacy of financial reporting. Training programs for staff and the implementation of integrated financial management systems would also go a long way toward sustaining these reforms.

Editor: Thank you, Dr. Rahim. Your insights provide a clearer picture of the potential impacts and challenges surrounding this financial directive from the Prime Minister. It’s an exciting time for Libya as it navigates these important policies.

Dr. Rahim: Thank you for having me. It’s important that we continue to engage in discussions like this to encourage reforms that truly benefit the citizens of Libya.