| Assaf Elmaleh, Senior Crypto Analyst at Proxibit Investment House |

| Key points in the weekly review of the crypto market:

- Bridgewater, the world’s largest hedge fund, is expected to enter the digital currency market

- The match between the S&P index rises to a peak of 17 months – what do they mean?

- Analysis of social sentiment: Inflation, Elon Musk and social influences

| Will Bridgewater invest in a crypto fund?

According to the crypto news site Coindesk, the $ 140 billion asset management hedge fund Bridgewater will enter the digital currency segment. Ray Dalio, the founder of Bridgewater, is one of the most esteemed investors in the world and is considered a real guru in the field.

Until recently, Dalio expressed strong opposition to digital currencies, calling Bitcoin a “bubble” at every opportunity. But recently the trend seems to have changed, as he called bitcoin “one hell of invention”, and even publicly announced last year that he personally owns bitcoin.

Officials deny that the fund intends to go in that direction, but a company representative claimed last February: “We will not comment on our positions, but we can say that Bridgewater continues to actively investigate crypto, but does not currently plan to invest in crypto,” leaving some ambiguity. .

Another person familiar with the hedge fund’s crypto trading plans said:

“Bridgewater is looking to get involved. They are seriously considering liquidity, suppliers and what not.”

Bridgewater was founded by Ray Delio from his Manhattan apartment in 1975 and is considered one of the most successful foundations in the world. This is one of the most interesting organizations, with an extreme culture in the eyes of many of zero secrets and an in-depth analysis of employee performance – they manage to consistently outwit the market. Last year, Israeli Nir Bar-Dea was appointed acting CEO of Bridgewater.

If such a move is implemented, it is likely that a relatively small amount of Bridgwater’s total assets under management will enter the digital currency world, and even if no direct impact on the market is seen, it is important to remember that such a body’s entry carries some implications.

- In my opinion, the institutional entry into the world of digital currencies will bring with it a greater adjustment to traditional markets. This adjustment will result from institutional behavior and their reactions to the market, not necessarily good news.

- The largest hedge fund in the world will pave the way for more funds in the field of digital currencies – money that will flow to the market and increase its value.

- It is also expected to have an impact on the public – who will understand that if a body that manages, among other things, the pensions of the most solid people in the US (teachers, police officers), takes the digital currency field seriously – it may have to act accordingly.

| The match between Bitcoin and the S&P index is rising to a record high

There is much talk about whether Bitcoin is a “digital gold” to which there will be a capital flight during inflation and uncertainty in Fiat currencies, or as they say, Bitcoin acts as a “technology stock” and moves in line with the classic markets.

The index that answers this question is the index of the match between the price of Bitcoin and the index, which includes the 500 largest companies in America.

Last Friday, the matching index rose to an unseen level since October 2020, to a level of 0.49 – with a correlation of 1 indicating a perfect correlation in fluctuations, while a correlation of minus 1 indicates completely opposite shifts.

To understand the rarity of the event, the match between Bitcoin and the S&P index has been so high only 5 times in the entire history of Bitcoin.

In our review last week, it was concluded that the impact that global events have on the digital currency market will be greater for two reasons:

- The huge institutional entry we experienced in 2021 produces a digital currency market that responds directly to the classic markets, due to the “traditional” behavior of the institutions.

- Global uncertainty produces a more emotional and less rational market. In such a market it is likely that Bitcoin and digital currencies will not be able to ignore what is happening in the world and will react accordingly.

The very rise of the aggressive match between S&P and Bitcoin confirms to us the theory raised in the previous review.

The high match is not good news. Bitcoin investors want to see the digital currency act as an instrument with which to hedge inflation, and not one that works under its direct influence.

If the adjustment continues to rise and stays that way for a long time, it will shatter the wet dream of Bitcoin investors who see it as “digital gold.”

However, currency investors still do not say desperate about it. Indeed, positive signs of Bitcoin behavior were seen under the influence of the Russia-Ukraine war, with investors on both sides of the war using the digital currency more accelerated to escape diving economies due to geopolitical circumstances.

| On-chain analysis: New Bitcoin addresses on the network

A useful statistic for understanding the volume of demand that Bitcoin has is the number of new addresses created in the Bitcoin network – that is, how many new wallets are joining the network?

Graph source: Glassnode

In the graph shown here, it can be seen that the history of the increase in the number of new wallets joining the Bitcoin network (blue arrow) also indicates an increase in the price of Bitcoin – because the large number of wallets increases the demand for the property. And vice versa: a decrease in the number of wallets joining the bitcoin network (pink arrow) will come with a decrease in the price of bitcoin.

The current trend indicates a moderate increase in the number of new wallets. The conclusion that can be drawn from this event is that the increase in the number of wallets joining bodes well. This increase indicates the “smart money” that is preparing its entry into the market in anticipation of increases.

We are still talking about a relatively pessimistic market, but a bright spot for a transition to a more positive market seems to be on the edge.

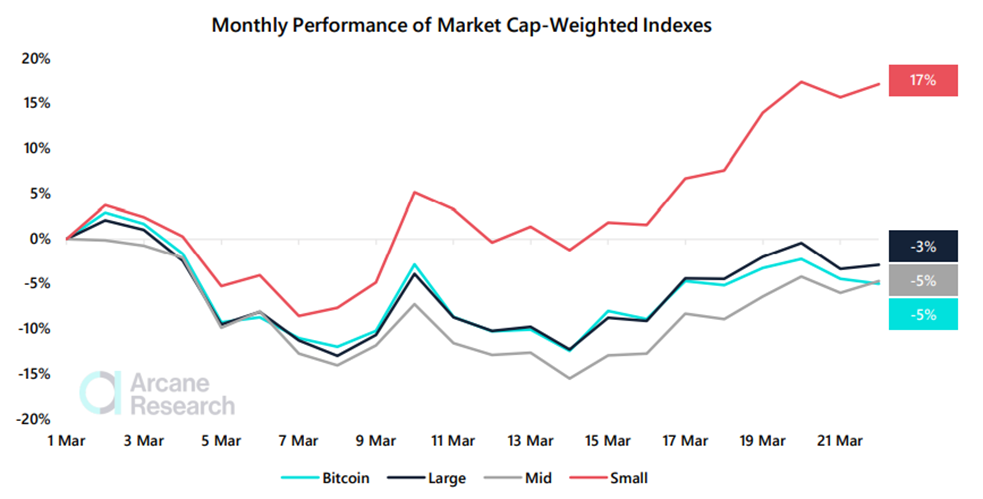

| Small cryptocurrencies have been winning in performance over the past month

Examining the yields from the beginning of March, it can be seen that it is precisely the small cryptocurrencies that have shown the highest yield. As of March 21, small currencies are the only ones that have shown a positive return, compared to Bitcoin which gave a return of minus 5%.

Some of the currencies with the relatively small value showed an amazing return: with more than 32% up and with 30% return last week only.

Graph: Arcane Research

The rise in the value of the smaller currencies shows the revival of the market after weeks of very low risk appetite on the part of investors and traders. Market participants are exploring alternatives to Bitcoin and flocking to other smaller currencies, but in their view, with the potential for higher returns.

Although the appetite of crypto currency traders for risk is growing, caution is still being felt in the markets, according to the Fear Index, which stands at 31 out of 100.

| Conclusions and actions for the near future

The behavior of the crypto market over the past week is giving positive signals, from the number of new wallets in the Bitcoin network to the market revival in small currencies, but the framework is still a pessimistic market – so caution is required. The concern is slowly being removed, and thus traders and investors will carry out more trading operations – so there is an expectation of an increase in volatility, mainly with the help of leverages and futures contracts.

A volatile market is a more risky market, where inexperienced traders and investors are eaten too easily – so, pay attention in the coming days. Recommended rather passive conduct: without multiple trading orders, which will cost us a lot. Good luck to everyone.

The author is a senior crypto financial analyst at Proxibit. The website does not contain investment advice and / or marketing and / or tax advice and does not contain any substitute for such services that take into account the data and the special needs of each person. The website does not contain any recommendation regarding the viability of investing in virtual currencies and / or any financial products or instruments, nor does it contain any order and / or offer to perform operations in the products mentioned. This does not constitute an obligation to bear any return. Investing in virtual currencies is risky and can result in a loss of the full investment. The field of virtual currencies involves regulatory, taxation and application uncertainty by various entities with which interactions are required for the purpose of performing operations.