| Liran Lublin, Director of Research Department, IBI Investment House

A moment after the two years and before the publication of the first quarter reports, the picture regarding Bazan’s operating environment (TASE 🙂 in the quarter becomes clearer.

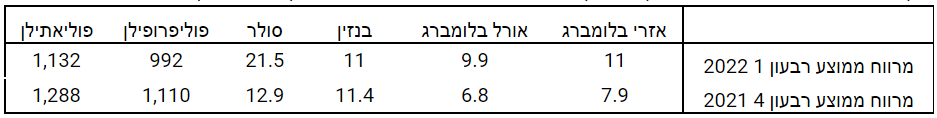

The trend of expansion of refining margins in the quarter was maintained, with the Azeri margin of Bloomberg closing the first quarter with an average of $ 11 per barrel. On the other hand, the sharp rise in the price of oil requires Bazen to invest heavily in raw materials, and although the rise in the price of the barrel is rolled over to customers through the margin, the absolute cost will lead to an increase in the company’s working capital needs.

The efficiency rate of the refining facilities is expected to improve to levels of over 90% in the first quarter, when distillery margins also recorded an increase – the diesel margin was $ 21.5 per barrel and the gasoline margin was an average level of $ 11 per barrel.

Given the margin environment described (in the Azeri Bloomberg graph in green and the Ural Bloomberg in white), we estimate that in the first quarter of 2022, Zen’s refining segment is expected to generate EBITDA of $ 150-160 million.

In the polymer segment, polyethylene and polypropylene margins continued to shrink to levels of $ 992 and $ 1,132 per tonne, resulting in a quarterly EBITDA rate of approximately $ 40 million in the first quarter.

However, it will be recalled that during the quarter, CAO facilities were shut down for treatment for a period of about 45 days and Zen sold produce from the inventory produced during the fourth quarter of last year in preparation for shutdown.

About half of the damage as a result of the shutdown ($ 41 million) was already recognized in last year’s results and we estimate that the damage in the first quarter will be about $ 35 million, which will bring the EBITDA of the polymer sector to $ 5-10 million.

Another point worth noting in the context of Bazan’s expected cash flow is that before the crisis the company identified and took advantage of market opportunities and entered into future transactions to fix refining margins for the years 2023-2022.

In light of the unusual jump in refining margins near the date of approval of the report for the previous quarter, the company deposited approximately $ 130 million in deposits guaranteeing the transactions and hence in view of oil prices and refining margins, the group’s net financial debt is expected. Is an opportunity.

It is possible to produce a rough forecast for the results of the first quarter coming out of the margin environment on which there are already indications:

According to our estimates, Zen is expected to present a neutralized EBITDA for the first quarter of 2022 in the range of $ 160-180 million.

The author is the director of a research department at IBI Investment House and has no personal interest in the review. This review is not a substitute for investment marketing that takes into account the data and special needs of each person.