| Dr. Gil Befman, Chief Economist, and Yaniv Bar, Economist at Bank Leumi

At its meeting on Monday, the Monetary Committee of the Bank of Israel decided to raise it by 0.25 percentage points to 0.35%, the highest level since mid-2014 (see chart).

This interest rate is similar to the current range (0.25-0.5%), although it should be noted that the Bank of Israel emphasized that the future path of raising the Bank of Israel’s interest rate is not only affected by the US interest rate path.

The move was not surprising, as senior Bank of Israel officials “prepared the ground” recently for a raise at an April meeting. However, the interest rate hike was larger than the average of forecasts, which stood at an expected interest rate of 0.29% (in the range of 0.25-0.50%). The choice of this size of raise, at a non-standard level, seems to reflect different opinions among the Monetary Committee, as to the rate of increase desired.

The factors that have been the background for raising interest rates include economic activity in the Israeli economy that continues to function properly; The governor highlighted the unusually high growth rate in the fourth quarter of 2021 alongside indicators of activity in the first quarter of 2022; With a solid labor market, returning to the environment it was on the eve of the crisis – in a way that stands out positively compared to most developed countries. That is, the very low level of the real interest rate (which is the Bank of Israel interest rate after deducting short-term inflation expectations) on the eve of the decision, did not correspond to the rapid expansion in activity.

The Bank of Israel also noted the (actual) increase in Israel in recent months beyond the upper limit of the price stability target (3%), but still significantly lower than inflation in most of the world, as well as the rise in inflation expectations. The upward trend in house prices continues to accelerate and these have risen by 13% in the last twelve months. The Bank of Israel noted the economic effects of the war in Ukraine and the rise in morbidity in China, which are deepening the disruptions in global production chains, increasing inflationary pressures and leading to a certain slowdown in the pace of global economic activity.

Looking ahead, according to me, the interest rate will stand at 1.5% in a year. This is a significant upward update compared to the Central Bank’s forecast from January 2022 (interest rate of 0.10-0.25% at the end of 2022), which, if realized, will have relatively significant broad implications for the local economy, including: rising house loan repayments, with an emphasis on Mortgages, in a way that may create challenges for policymakers in this regard.

The rate of interest rate hikes by the Bank of Israel is expected to be gradual, as noted by the Research Division:

“The rise in actual and expected inflation, so that the low real interest rate reflects strong monetary expansion relative to the past, together with the continued marked improvement in activity and the labor market, and accelerating the rate of expected global interest rate increases Gradual increase in interest rates. ” As stated above, the Bank of Israel emphasizes the resilience of local economic activity, which includes a tight labor market and an increase in the inflation environment, adding that “the rate of interest rate increase will be determined in accordance with activity data and inflation, in order to continue supporting policy objectives.”

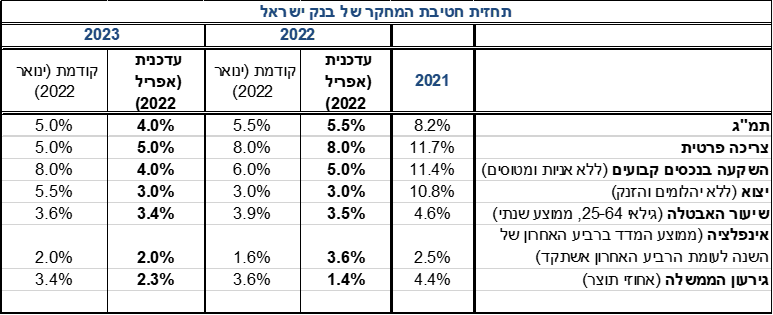

| Bank of Israel Research Division’s Forecast for 2022-23: Macro of the Economy Looks Relatively Positive

Simultaneously with the publication of the interest rate decision, the Research Division of the Bank of Israel published an updated macroeconomic forecast for the state of the Israeli economy (see Table).

According to the latest forecast, GDP is expected to grow by 5.5% in 2022, unchanged from the previous forecast of January, and similar to Leumi’s forecast. In 2023, GDP is expected to grow at a rate of 4%, which is a downward update of one percentage point compared to the January update, and reflects a return to the pre-crisis trend. The growth forecast for private consumption in 2022-23 remained unchanged, but a reduction was recorded in the growth forecasts for investments and exports, among other things, against the background of the expected slowdown in the growth rate of developed economies compared to earlier estimates.

However, the Research Division of the Bank of Israel estimates that a significant impact of the Russia-Ukraine conflict on Israeli exports is not expected, given the low (direct) volume of trade with these countries. At the same time, the improvement in the labor market is expected to continue, with the unemployment rate expected to continue to decline and the employment rate to continue to rise slightly during 2023, returning to its pre-crisis level.

As for fiscal policy, the Bank of Israel’s forecast indicates a significant decrease in the budget deficit, and in 2022 the deficit is expected to amount to only 1.4% of GDP, both lower than the deficit ceiling and compared to its January forecast, in light of significantly higher tax receipts. In addition, the debt-to-GDP ratio in 2022 and 2023 is expected to be approximately 67% and 65%, respectively. Due to the optimistic revenue forecast for 2023, no tax increase is expected. Under these circumstances, the net capital raising needs of the Israeli government will decrease.

The Bank of Israel’s Research Division estimates that the inflation rate is expected to reach 3.6% in 2022 (similar to the national forecast), a significant upward update of the forecast, and in 2023 it is expected to be 2%. The inflation rate for the next four quarters will be 3.1%. This forecast assumes that no significant wage pressures will be created that will affect inflation, despite the labor market approaching a state of full employment, and that the housing clause is expected to grow at a pace commensurate with the long term. The Bank of Israel also estimates that energy and commodity prices are expected to stabilize further, which have risen significantly due to problems in global supply chains as well as against the background of the war in Ukraine.

Overall, the Bank of Israel’s forecast shows relative optimism in its view of the macro picture of the local economy in the coming years. However, the Bank of Israel noted the risks to the forecast, chief among them: developments around the fighting in Ukraine, continued volatility in commodity prices, the recurrence of morbidity in Corona, increased security events and political uncertainty in Israel.

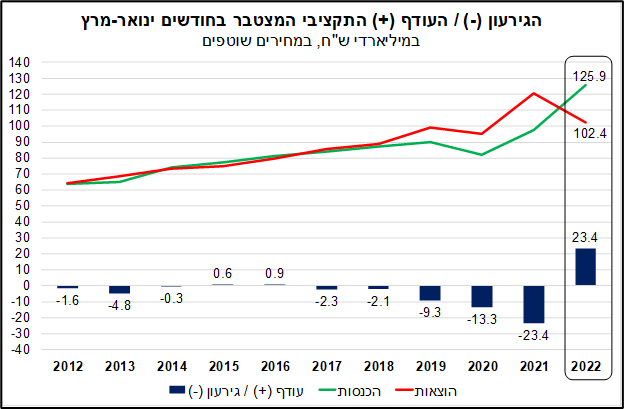

| The continued accelerated increase in revenue contributed to the reduction of the government deficit in the 12 months ended March, to 1.4% of GDP

In March this year, government activity amounted to a small surplus (this is the third consecutive month) of NIS 0.7 billion, compared with a deficit of NIS 12.1 billion in March 2021.

In light of this, (January-March) was a record volume of about NIS 23.4 billion, in a way that is significantly more pronounced than in previous years (see chart).

The budget deficit in Israel

A positive picture is also obtained in terms of the annual deficit. In the last 12 months ended March 2022, the deficit has fallen to its lowest level since 2008, and stood at about 1.4% of GDP, compared with a deficit of about 2.2% of GDP in February. This is the same deficit rate as projected according to the Research Division of the Bank of Israel for 2022 (see extension in the previous paragraph). In light of the above, it seems that in a key scenario, 2022 is expected to amount to a deficit lower than the official deficit target of 3.9% of GDP (and also to that estimated by the Ministry of Finance for 2022, about 3.2% of GDP), with high probability.

The main reason for the decrease in the annual deficit, and the large budget surplus since the beginning of the year, is the sharp increase in state revenues. In the first quarter of the year, revenues totaled a record amount of NIS 126 billion, reflecting an increase of 20.4% (in real terms and at uniform tax rates) compared to the corresponding period last year. It should be noted that direct tax revenues grew at a faster rate compared to indirect taxes (an increase of 26.6% compared to 12.1%, respectively). An unusual increase was recorded in the collection of corporation tax, while revenues from real estate taxation and capital gains also continued to grow. At the same time, thanks to the reduction in spending on the aid program, government spending was low relative to the same period in 2021.

In conclusion, the budget data continue to indicate a continuous improvement and a positive picture regarding the fiscal situation of the economy at present, which was one of the factors for a positive stabilization in recent times, a development which may lead to a rating increase from A1 to Aa3 later. This development allows the government a great deal of flexibility in dealing with the recent rise in the cost of living, significantly more than a temporary reduction in the excise tax on fuel. In addition, it should be noted that the current trend reduces the need to issue bonds to a significant extent for the purpose of financing the deficit.

The writers are economists from Bank Leumi. The data, information, opinions and forecasts in the review are provided as a service to readers, and do not necessarily reflect the official position of the Bank. They should not be construed as a recommendation or substitute for the reader’s independent discretion, or an offer or invitation to receive offers, or advice for the purchase and / or execution of any investments and / or actions or transactions. Errors may occur in the information and changes may occur. The Bank and / or its subsidiaries and / or companies related to it and / or the controlling shareholders and / or stakeholders in which of them may from time to time have an interest in the information presented in the review, including financial assets presented in it.