In July 2021, a 4-room apartment measuring 100 square meters in the Africa Israel Residential project in the new Galil Yam neighborhood in Herzliya was sold for NIS 3.3 million, which is about NIS 33,000 per square meter. Exactly a year earlier, the same project sold a 4-room apartment with an area of 98 square meters for NIS 1.988 million, reflecting about NIS 20,000 per square meter.

Read more in Calcalist:

The rise in housing prices recorded in 2021 explains only a small part of the difference. The gap is mainly because buyers in 2020 won the price per occupant and enjoyed a generous discount on state subsidies. The price of the apartment was set in December 2016, and even then it was lower than the market price. According to the rules per occupant price and also the new “discounted apartment” program, developers can not raise the price of apartments, except for linkage to the construction input index. These rules, combined with the extraordinary price increase recorded last year, gave the lucky winners of the lottery in the Galilee Yam a generous grant and a good opportunity to become real estate investors.

This week, registration for the lottery for about 10,000 apartments was closed at a discount, the price of which was set in a format similar to the price-per-tenant method. According to data from the Ministry of Construction, 120,000 single-family homes have registered for lotteries, most of them competing for apartments in Beer Yaakov, Or Yehuda and Rishon Lezion.

4 View the gallery

Galil Yam neighborhood, price per occupant of Herzliya

(Photo: Amit Shaal)

The Galil Yam project in Herzliya was one of the first to be marketed using the price per occupant method. The development of prices in it is an extreme example of the price gap between eligible apartments and regular buyers.

The neighborhood was established on agricultural land that was used by Kibbutz Galil Yam. The change of designation has cost nearly 15 years of much controversy. At the end of the road, a plan was approved that allows the construction of about 4,000 apartments, the kibbutz received rights to build about 700 apartments.

At the beginning of 2016, the idea was to market about 20% of the apartments in a price-per-tenant format, but then-Finance Minister Moshe Kahlon changed the rules. Following a new policy he outlined 80% of the apartments were designated for the eligible.

The prices of the apartments were set in a tender that closed in December 2016, in which plots for sale for the construction of a total of 1,470 apartments were put up for sale.

4 View the gallery

Shabiru Galil Yam Herzliya project

(Photo: Assaf Friedman)

The method was that the state predetermined the price of the land while embodying a 30% discount.

To illustrate: According to an appraisal prepared by real estate appraiser Yaron Spector for the purpose of the plan, the value of land for an 115-square-meter apartment was about NIS 1 million in August 2016. The state sold the plots at a value of NIS 700,000 per apartment. About NIS 400 million.

Knowing in advance the price of land, developers were asked to compete for the lowest price at which they are willing to sell an apartment. The state allowed them to sell about 20% of the apartments at the market price. This rule allows them to compensate themselves for the discounts given to those entitled to a price per occupant.

The tender was won by Africa Israel Residential, Praszkowski, Azorim, a partnership of Ista Properties and Sela Binui and Rami Shabiru.

The price per square meter, including VAT set by the winners, was about NIS 19,000-17,000. This is while according to the madlan website at the time, apartments were sold in the area for about NIS 24,000 per square meter.

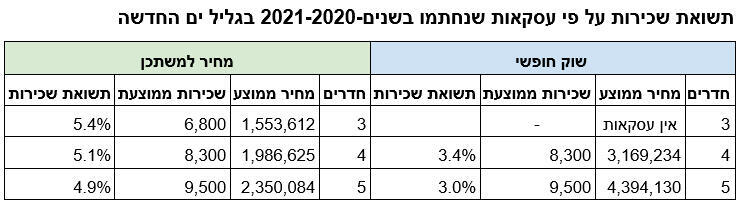

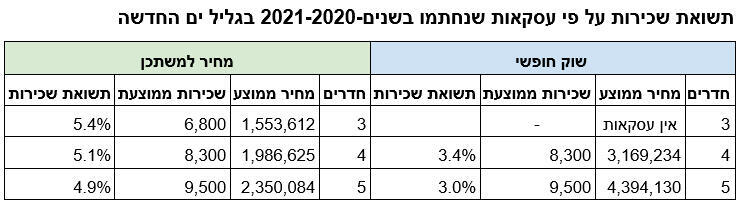

Madlan data show that in the years 2021-2020 in the Africa Residence project, 3-room apartments were sold to those entitled to a price per occupant at an average price of NIS 1.5 million, 4 rooms at NIS 1.9 million, and 5 rooms at NIS 2.3 million.

4 View the gallery

Tal Kopel, CEO of Madlan

(Photo: Orit Pnini )

Because eligible people get their apartment by lottery and not always in the city where they choose to live, many of them rent the apartment and rent an apartment in their favorite city.

Tal Kopel, CEO of madlan: “Those who bought an apartment at a discount enjoy the same rent as those who bought in the free market. The result is that the annual rental yields, ie the ratio between the price of the apartment and the cumulative annual amount of the rent, are higher for apartment buyers at a discount by a significant difference, which allows them additional flexibility and savings in mortgage routes. “

According to Madlan, a 3-room apartment is rented in the area for NIS 6,800 per month, a 4-room apartment is rented for NIS 8,300 per month, and a 5-room apartment for NIS 9,500 per month. These rental payments give eligible people who have chosen to rent their apartment a return of about 5% and sometimes even more.

On the other hand, their neighbors who did not win the lottery bought a 4-room apartment at an average price of NIS 3.1 million, and a 4-room apartment at an average price of NIS 4.3 million, so they will enjoy a yield of 3.4-3%, lower than their neighbors but relatively good compared to Tel Aviv.

In June 2021, a 5-room apartment measuring 138 square meters on the 9th floor was sold for NIS 5.2 million, which is NIS 37,000 per square meter. If the landlords rent it out, their annual return will drop significantly to about 2.19%.

4 View the gallery