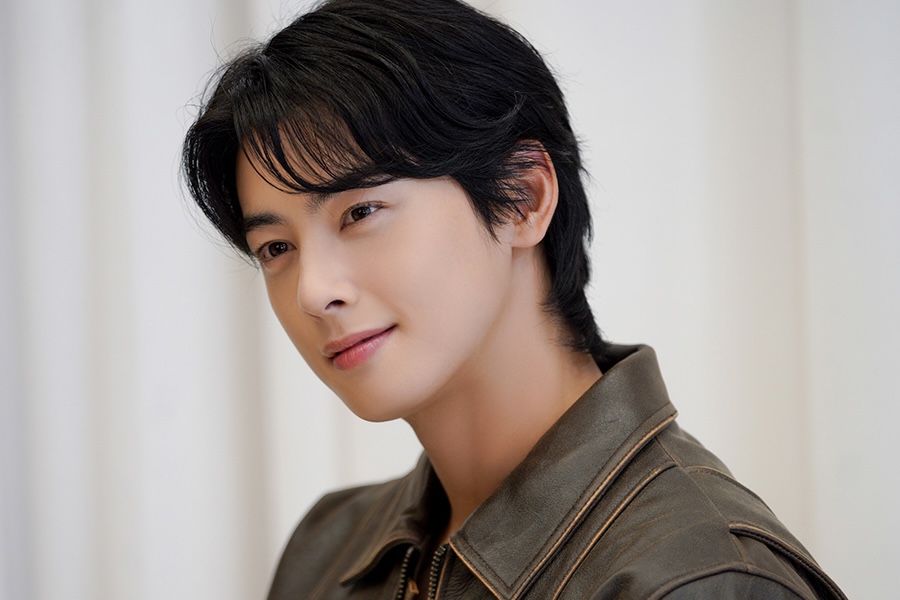

Cha Eun Woo Faces Tax Evasion Investigation, Agency Responds

Table of Contents

A probe into the financial dealings of South Korean singer and actor Cha Eun Woo has surfaced, with allegations of tax evasion totaling over $13.6 million. His agency, Fantagio, has released a statement acknowledging the investigation and pledging full cooperation with authorities.

On January 22, reports emerged detailing an investigation initiated last year by the Seoul Regional Tax Office’s Investigation Bureau 4. The National Tax service (NTS) reportedly assessed an additional tax liability exceeding 20 billion won (approximately $13,600,000) in income tax and related levies against the ASTRO member.

Allegations of Income Structuring

The core of the investigation centers on the structure of Cha Eun Woo’s income. According to the reports, despite being represented by Fantagio, the singer allegedly established a separate company – identified as “corporation A” and founded by his mother – and entered into a service agreement with it. This arrangement is suspected to have been used to split his income between Fantagio, Corporation A, and himself, perhaps as a means to reduce his overall tax burden.

The NTS reportedly believes Corporation A functioned as a “paper company,” providing no substantive services and serving solely as a vehicle for tax avoidance. This led to the conclusion that Cha Eun Woo had failed to remit more than 20 billion won in income tax.

Fantagio’s Response and Commitment to Cooperation

Fantagio addressed the allegations in an official statement, emphasizing the central question of whether Corporation A qualifies as a taxable entity. “The key issue in this matter is whether the corporation established by Cha Eun Woo’s mother falls under the category of an entity subject to substantive taxation,” a company release stated. “Nothing has been finally confirmed or officially notified at this time, and we plan to actively clarify the matter in accordance with lawful procedures.”

The agency further assured the public of its commitment to resolving the issue swiftly and transparently. “In order for the process to be concluded as swiftly as possible, the artist and his tax representative will cooperate diligently,” the statement continued. “We assure you that cha Eun Woo will continue, as a citizen of this country, to faithfully fulfill tax filings and his legal obligations.”

Current Status and military Service

Cha Eun Woo is currently fulfilling his mandatory military service as part of the Army Military Band, having enlisted in July of last year.His expected date of discharge is January 27, 2027.

Watch Cha Eun Woo in “Rented in Finland” below:

The investigation remains ongoing, and further details are expected as the NTS completes its review and Fantagio provides additional information.

Why: The investigation centers on allegations that Cha Eun Woo used a company founded by his mother to structure his income in a way that reduced his tax burden. The National Tax Service (NTS) assessed an additional tax liability of over $13.6 million.

Who: The key individuals involved are Cha Eun Woo, his agency Fantagio, his mother (founder of “Corporation A”), and the National Tax Service (NTS).

What: The NTS is investigating Cha Eun Woo for alleged tax evasion related to income structuring through a company suspected of being a “paper company.”

How did it end?: As of January 23, 20