| Assaf Elmaleh, Senior Crypto Analyst at Proxibit Investment House |

Key points in the weekly review:

- The payments giant MoneyGram will operate in the field of stable currencies

- Crypto and racing: Red Bull Racing launches NFT collection

- Conclusions from the new Block Inc survey

- Adjustment to declining capital markets, a sign of separation?

- On-chain analysis

| Manigram will operate in the field of StableQuins

The payment service giant Manigram (NASDAQ 🙂 has announced a partnership with the blockchain with the aim of creating international payment transfer services based on the stable digital currency USDC. The new service will allow Stellar wallet users to send Circle currency to people around the world, who can redeem them for dollars or local currency through the MoneyGram network.

In an interview with Bloomberg, Alex Holmes, CEO of Manigram, said:

“We have set a goal to be the bridge between the crypto world and the Fiat world.”

Holmes added that MoneyGram is in contact with companies that provide digital wallets in El Salvador alongside government-backed wallets. From his words it can be understood that the company intends to create payment transfer capabilities with the use of blockchain technology.

Stellar is one of the most recognized blockchain projects in the world. The project was established in 2014 with a clear goal: to use blockchain technology to create a basic technology for transferring funds across borders with as low fees as possible and without waiting time.

Among the “old money” companies, there is a growing understanding that the power of the blockchain must be harnessed in order to offer better service and streamline international money transfers.

The best example of inefficiency in the current financial system comes from Campbell Harvey’s book “DeFi and the Future of the Financial World.” Harvey examined the costs of international payment services: Western Union’s first transfer was in 1873. The transfer was $ 300, the total commission was $ 9.34, around 3%. Today, after 149 years, a 3% commission is still acceptable for routine transactions of international money transfers and credit card transactions. In fact, if we’re currently trying to send a $ 300 transfer through Western Union (NYSE :), we’ll probably pay a commission higher than $ 9.34.

Today an international money transfer, whether through the banking system or financial service providers, takes a minimum of one business day, usually much longer than that. The blockchain technology allows the transaction to be confirmed within a few seconds. We see and will continue to see global payment companies create collaborations and even develop independent capabilities in the field of blockchain in general and stable currencies in particular.

| Crypto and racing: Red Bull’s Formula 1 team launches NFT collection

The Formula 1 Red Bull Racing team is launching an NFT collection ahead of the 2022 Grand Prix in Monaco. Red Bull Racing is the leading team in the Formula 1 race, the most prestigious motor race in the world.

This is not the first NFT launch in motorsport. Competitive groups have launched similar collections in the past. Moreover, motor sports have a close connection with the world of digital assets. The most prominent sponsors of Formula 1 are mainly crypto exchanges and blockchain projects. Notable partnerships include the US crypto exchange FTX, which has signed an agreement with the Mercedes group, the Red Bull Racing group, which has signed with the crypto exchange Bybit, the iconic McLaren group with the blockchain company Tezos, and the Aston Martin group with the crypto.com exchange. In fact, today it is difficult to find a Formula 1 team that has not yet received sponsorship from any crypto / blockchain company.

With the launch of NFT, Red Bull hopes to strengthen the fans’ connection with the team, and especially to easily generate additional revenue for the team.

In a press release, the company said:

“NFT will connect fans to the group and its memorable moments through a series of excerpts in a limited edition digital souvenir. Each excerpt marks an exclusive aspect of the past, present and future of Red Bull Racing.”

As for the value of these NFT works, it is likely that many fans around the world will want to acquire the copyright of a work documenting the first race of their favorite driver in their favorite group, thus bouncing the value of the works.

However, their future value depends on a broader question: Will the NFT field occupy an integral part of the art world and stay with us for a long time? Or will the recent cooling in the market herald a decline in the field?

| Conclusions from Block’s new survey

The digital payment companies Block (NYSE 🙂 and research firm Wakefield Research surveyed more than 9,500 people in 14 countries across the Americas, Europe and the APAC (Asia-Pacific) region in an attempt to better understand people’s behaviors regarding bitcoin and digital currencies in different places, genders and ages.

The survey shows that lower-income earners, regardless of where they live, see Bitcoin as a means of payment and value transfer. This is compared to high-income earners, about 50% of whom see Bitcoin as a “potential to make money.”

In general, higher-wage earners find many investment reasons to buy – yield, protection from inflation and diversification of their investment portfolio. Low-wage earners, on the other hand, recognize more value in using Bitcoin – buying products with the currency and sending money to others.

By country, there is a direct relationship between the amount of inflation in a country and the reference to Bitcoin as protection against it. In countries where inflation is unusually high, such as Argentina (annual inflation rate of 55%), about 47% of respondents said they bought Bitcoin for protection against inflation. In the US, by contrast, only about 18% of respondents claimed that buying Bitcoin serves as a tool for dealing with inflation.

In terms of the amount of knowledge, the conclusion is interesting: of those who identified themselves as having basic to advanced knowledge in crypto, 41% say they will purchase Bitcoin “highly likely” in the next 12 months, compared to only 7.9% of those with “limited to no knowledge”. In fact, the main reason for not buying Bitcoin is not a fear of coolness, regulation or volatility, but simply a sense of ignorance.

A second reason for not buying Bitcoin is a fear of theft. This is despite the fact that the Bitcoin network has never been hacked, and all the thefts in the crypto world have happened for reasons of incorrect currency retention, negligence of various exchanges and DeFi protocols and failure to maintain the private key. To view the survey report: https://block.xyz/2022/btc-report.pdf

| Adjustment to the declining capital markets – a sign of the separation or lag of Bitcoin?

Last week the US stock market experienced a recovery, while the price remained fairly constant. Are these early signs of a disconnect from capital markets, or is Bitcoin simply lagging behind?

Last week, the stock index rose 6.5% and rose 7%. Meanwhile, Bitcoin has finished declining for the ninth consecutive week. Since then the price of bitcoin has recovered by 7%, while indices in America have been pretty flat and even down by almost 1%.

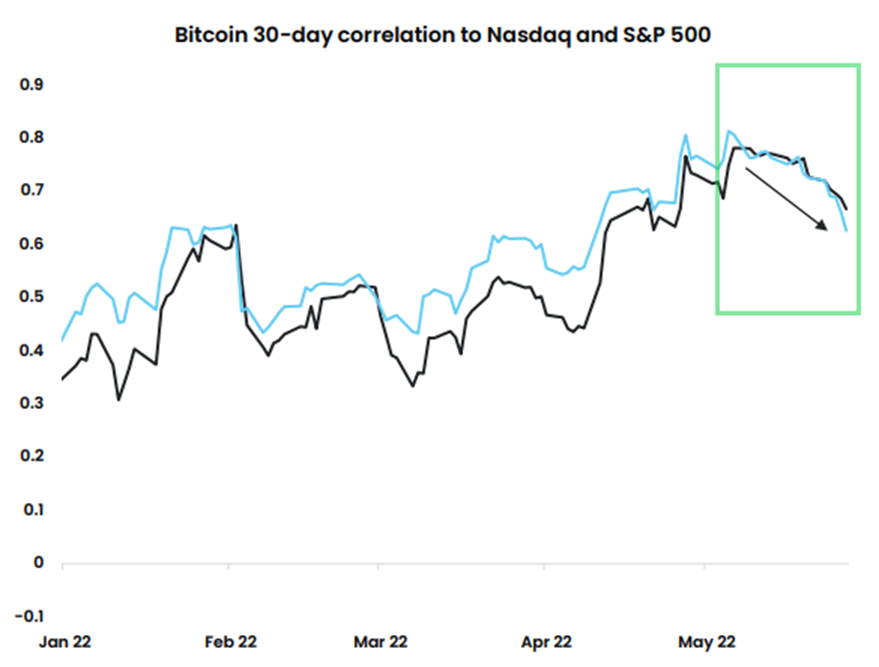

The last two weeks indicate a break in the upward trend between the traditional capital markets and the price of bitcoin and the digital currency market. The match is not fundamentally natural, and currently stands at more than 0.6, when tested over the past 30 days (see graph).

Blue – Bitcoin Match to Nasdaq / Black Index – Bitcoin Match to S&P 500 Index

Graph Source: Arcane Research

In the coming weeks, more macro-events await, which in the past led to corresponding gains between Bitcoin and US stocks, such as May’s inflation data in the US, when the numbers will be released on June 10, and the next FOMC interest rate discussion to be presented on June 15. I do not see a reasonable chance that Bitcoin will be completely freed from its close connection to the US stock market, but it is possible that these ties will loosen – and that is welcome.

Bitcoin was once considered the most resilient sector in the real world, unaffected by successes and capitalist failures in general. However, in the first five months of 2022, we saw a fairly stable match between the price movements of Bitcoin and the S&P 500 index.

Inflation and fears of war in Europe were not kind to any of the markets. Why is crypto related to stocks? Apparently, due to the massive growth in market value in 2020 and 2021, retail investors in stock markets have flocked to digital currencies at unprecedented rates. This has caused a much greater overlap in the course of trading, with the growth of the crypto market. The power of this claim should only increase over time.

| On chain surgery: the ratio of lunges to shorts, excessive fear?

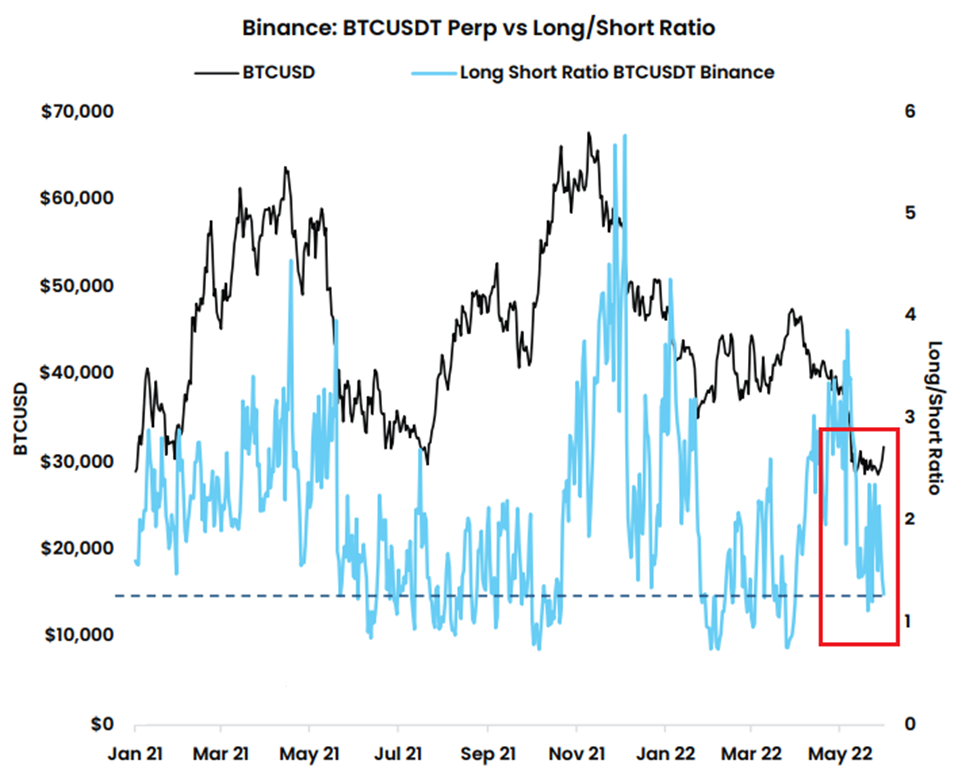

After a long period of increases in the ratio between the amount of longs and shorts in the market, we notice a massive decrease in this ratio.

As observed on the Binance Stock Exchange, traders tend to be overly apprehensive, lowering the ratio of longs to shorts on Bitcoin to the level it was at the beginning of the year.

A long account is considered to have a net long position on the currency larger than the short position net, and vice versa. Currently, the consensus among traders seems to be negative, with a long / short ratio at a historically low level – slightly above 1.

Before the crash of the cryptocurrency, we saw an increase in the long / short ratio, when it climbed above 3, but this tends to be a sign of overconfidence on the part of traders.

Even today, when we talk about such a low ratio, it comes from excessive fear in the market – one that tends to be reversed. Therefore, interpreting this information as more prone to optimism than pessimism. Another conclusion from this issue is the fact that leverages that are not high in the market neutralize the danger of a sharp decline as a result of liquidity.

The author is a senior crypto financial analyst at Proxibit. The website does not contain investment advice and / or marketing and / or tax advice and does not contain any substitute for such services that take into account the data and the special needs of each person. The website does not contain any recommendation regarding the viability of investing in virtual currencies and / or any financial products or instruments, nor does it contain any order and / or offer to perform operations in the products mentioned. This does not constitute an obligation to bear any return. Investing in virtual currencies is risky and can result in a loss of full investment. The field of virtual currencies involves regulatory, taxation and application uncertainty by various entities with which interactions are required for the purpose of performing operations.