BarcelonaIt was 2011 and the main Spanish bankers were well aware of the state of their bank balance sheets. “There was not a single bank that was not at risk of bankruptcy,” said a prominent Catalan financier a few years later. Indeed, the digestion of years of real estate banqueting was being heavy, and banks and savings banks were paying the price.

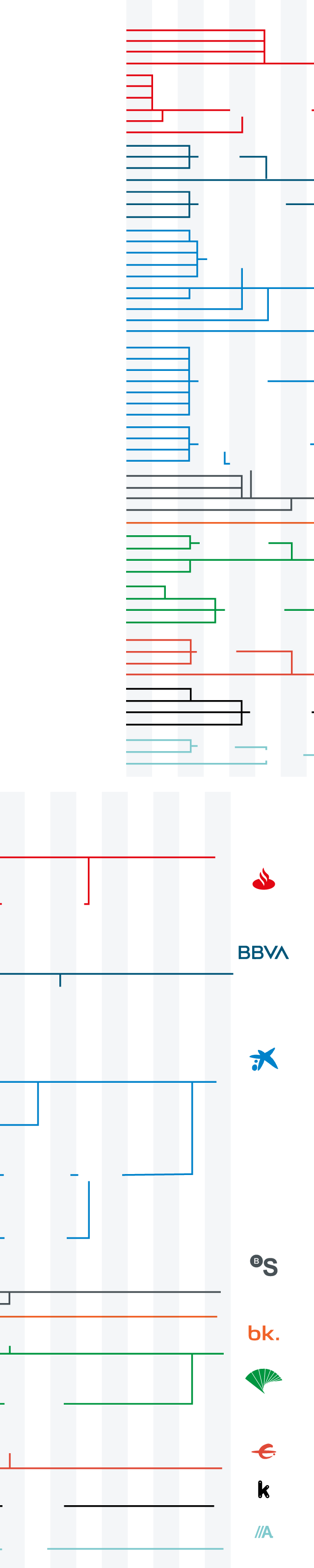

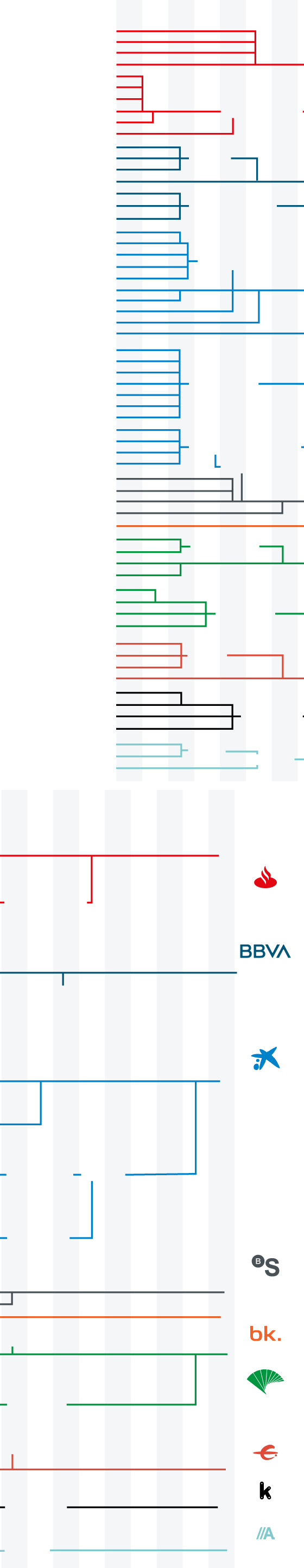

In the last decade, no sector has suffered like banking. It is estimated that since 2008 almost 120,000 jobs have been lost in the sector, compared to a maximum of 276,000 jobs. Another fact defines the problem well: before the Great Recession in Spain there were 62 entities of remarkable size; today there are 9. And in 2012, when the rescue was just signed, there were 24. The rescue prevented major bankruptcies and the dreaded domino effect. But many entities never recovered. These are some of the missing ones.

Catalunya Caixa

This union of old savings banks (Catalonia, Tarragona and Manresa) passed into the hands of BBVA in 2014. Over time, not only was the brand lost, but also more sensitive aspects such as its social work. BBVA acquired it at auction and ended up paying around 600 million euros. The total cost of rehabilitating CatalunyaCaixa was more than 12.5 billion, a figure that can no longer be recovered.

Bankia

The biggest merger in the history of Spanish banking took place just a year ago: CaixaBank remained the former coalition of savings banks, in a macro-operation that resulted in almost 6,500 redundancies. Bankia and its main bank, Caja Madrid, had starred in some of the most notorious scandals in the Spanish financial sector. Despite this, the State has not yet released its stake (it is now 16% of CaixaBank) and, therefore, it is not yet possible to calculate how much it will have cost. Of the nearly 22.5 billion it cost, 3,300 have been recovered and the stake in CaixaBank is now worth 4.4 billion.

CAM

At the end of 2011, Sabadell was left with the ruinous CAM for one euro. He took stock of it with an asset protection system to shield himself from surprises. The Alicante bank is at the top of the ranking of contributions of public capital received, with more than 26 billion euros, and exceeds 22,500 from Bankia.

popular Bank

When the Bank of Spain had been claiming for years that the Spanish financial system was solid, in 2017 the Popular Party fell. Customer distrust swept him away; it was resolved by the ECB and Santander was left with it, which paid one euro and assumed a debt well. This bank was an exception: it never made use of public money, not even in the ruinous purchase of Banco Pastor.

The latest merger in the sector has affected Unicaja and Liberbank, last year, which left the sector with nine medium and large entities.