Contractors’ rating (Flash photo 90 / Gil Yaari, freepik)

In principle, one of the conventions in the economic world talks about the possibility of sticking to the industry through exposure to the shares of companies that operate in it, so if we assume we want to be exposed to the real estate world, one of the options is through buying shares of contractors.

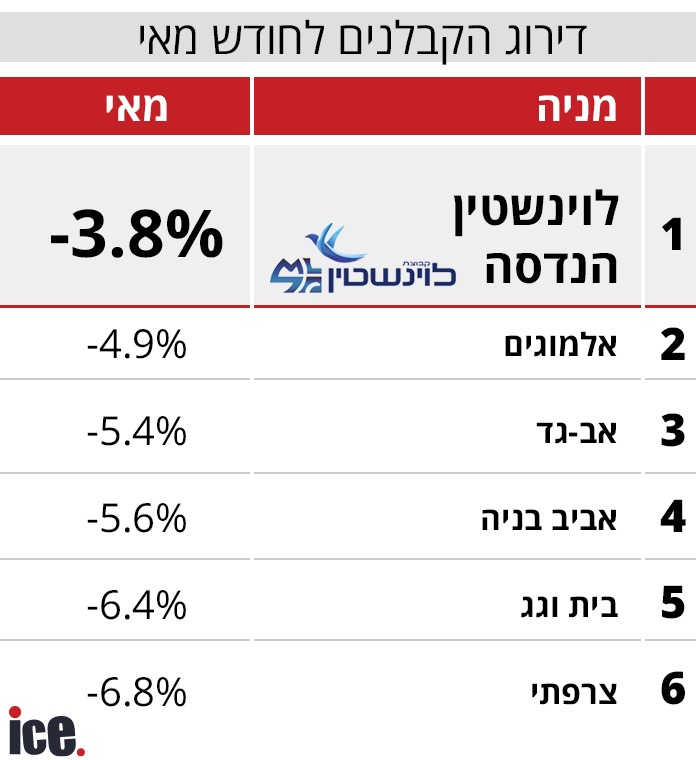

This convention, too, usually works, since in May it did not work. But there is an explanation for this (or some explanations) but in principle all the shares of the contracting companies went down in May and today contractors whose shares have gone down less and there have been as many as possible. This is the full rating.

More in-

We will try to explain for a moment the process that real estate stocks go through. This process includes in the first stage stubborn attempts to curb the rise in prices. This should happen through government plans to increase land supply, increase the tax burden on investors and limit financing options for both contractors and customers .

Let’s add to this dish, rising interest rates that make mortgages even more burdensome, rising inflation that burdens households in current expenses and therefore impairs their ability to commit large amounts to mortgages (assuming they have not yet taken out).

All of these are supposed to cause, at least in the short term, a decrease in the sales of the contractors, maybe even a slight decrease in prices but mostly it causes an increase in construction costs (increase in financing expenses and increase in raw material prices) and so on.

In principle, the instinct is to make it clear that the increase in contractors’ expenses will be passed on to the consumer, ie to the buyers of the apartments. But that is not the reality. Usually some of the expenses will be passed on to the customer and his share will be absorbed by the manufacturer, ie by the contractor and this will play the profits.

One way or another, we will add to this dish also a bad general atmosphere in the capital market and here we get even sharp price declines in the contractors’ shares.

We will mention in the margins the world of revaluations. Almost all contractors in Israel will value their assets and increase their book value. Now on the rising interest rate route they need to do the opposite, i.e. reduce the value in the books. And that’s bad for their stock, too.

So here’s the full rating of contractors’ shares for May.

Comments on the article(0):

Your response has been received and will be published subject to system policies.

Thanks.

For a new response

Your response was not sent due to a communication problem, please try again.

Return to comment