When the IMF publishes such a gloomy forecast and inflation is rampant in the United States, we have no choice but to wait for the tsunami to hit the shores of Israel.

“This is going to be a difficult 2022,” she continued, “and it may even be 2023 even more difficult, with an increased risk of recession” and announced that the fund will publish updated downward forecasts of course of world growth and inflation later this month. This will be the third downward update in a row: at the end of 2021 the fund believed that the global economy would grow by about 5% this year, at the beginning of 2022 we updated to 4.4%, in April to 3.6% and in two weeks we will see the new number.

1 View the gallery

It is clear that the senior figure in the IMF, and with it other senior figures in the world’s strongest and leading economies, are facing a serious crisis and difficult times. The Fund has therefore issued two unconventional recommendations, which do not fit in with the IMF’s traditional view. The first was to affect the foreign exchange market, including intervening in trade in very extreme cases (“In a crisis situation, when the shocks are exaggerated, they can not be absorbed by a regime of flexible exchange rates only,” it was written.) The second recommendation, which is already Related to government policy (known as fiscal budgetary policy), is to provide direct assistance to the bank accounts of weak households. . “Here, direct transfers from the government to households’ bank accounts have proven to be effective, and are probably preferable to distorted subsidies or the imposition of price controls on certain products that usually fail to reduce the cost of living on an ongoing basis.”

However, another challenge will be to curb the deficit and debt, because increasing them are pro-inflationary measures. “These new measures must be budget neutral (not increase deficit) and funded by new revenues or reduced spending elsewhere, without increasing debt.” The fund warns of a “new era, in which there is a record debt but also higher interest rates – therefore, this issue is becoming doubly important.”

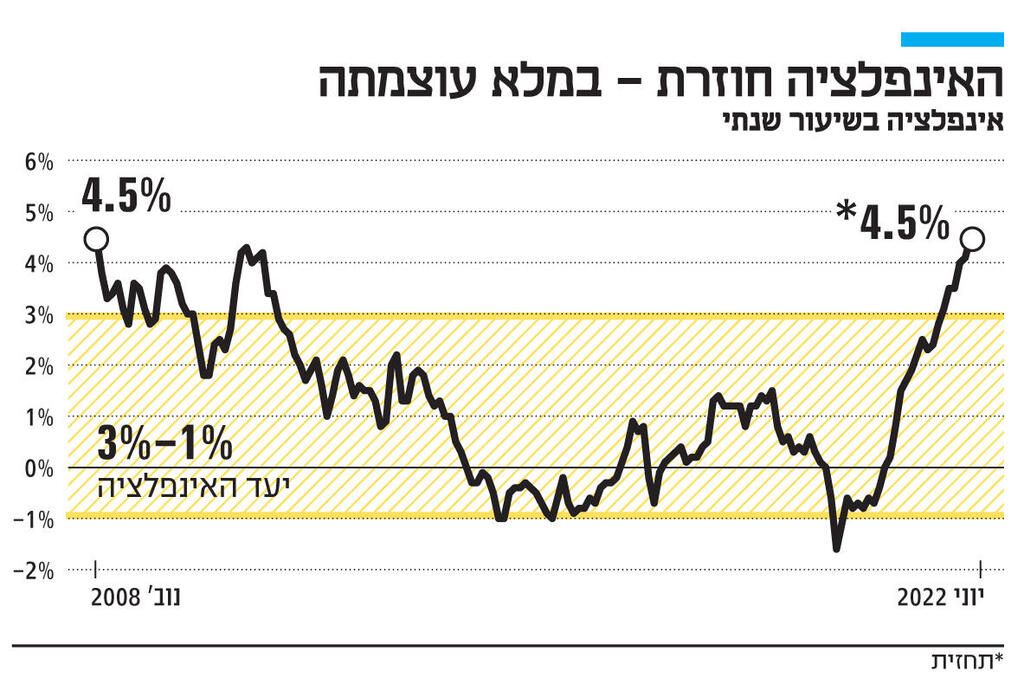

2. It is worth remembering at this point that Israel’s situation is a little better. Just a little: here our inflation is about half the average rate in OECD countries. But never resilience. First of all, annual inflation is expected to break a record of more than 13 years this week. Tomorrow the CBS is expected to publish the consumer price index for June, and according to forecasts annual inflation is expected to reach its level in November 2008: 4.5%, which is 1.5 percentage points above the upper limit of the price stability target (3% -1%). According to forecasts, the annual rate is expected To rise in the index close to about 4.5% in the last year, compared with 4.1% in the previous index.

Market forecasters have already begun to update their upward forecast for the end of the year in light of the Electricity Authority’s decision to increase electricity prices by about 10% at this stage, in light of the war in Ukraine, which is raising coal prices to very high levels. Electricity is the main input in the water economy, industry, and also in trade and services (malls, restaurants, hotels). It can quickly trickle in every direction. In addition, in the following indices, the housing section will begin to be heavier, as in July-August many leases are renewed and the replacement of tenants calls for sharp increases in rents. The housing item is more than a quarter of the index.

Inflation is also not really going to stop after the Bank of Israel, like most central banks in the world, started raising interest rates. According to the IMF, about three-quarters of the world’s central banks (75 in number) have already raised interest rates in the past year alone – 3.8 times on average. The average rise in interest rates ranges from 1.7 percentage points in developed economies to about 3 percentage points in emerging and emerging markets. But that’s not enough.

Yesterday we saw inflation once again hit the world’s largest economy, the US, as it soared to an annual rate of 9.1% (1.3% monthly). Powell and his friends in recent months. Inflation is not just due to the surge in energy and food prices – as core inflation – excluding energy and food – in the US reached 6% in June, far from the target.

The fact that inflation has deceived forecasters and bypassed forecasts could lead to rising inflation expectations in the US – which is a problem in itself. There is a lesson to be learned here in the world and not just in the US. Recent events in China (continued closures), Russia and Ukraine (continued war), as well as rising world housing prices – all weaken the recently held claim that “the peak of inflation is behind us.”

Meanwhile, the Israeli economy was lucky and the latest indices were quite in line with forecasts – and even a little below them, but the coming months are unpredictable, when the patience of workers ‘committees has expired and they will start demanding immediate compensation for their workers’ real purchasing power and demand nominal wage increases. These processes are not linear, and it is not always clear when decision makers lose control of the situation. What is clear is that we are once again facing a turnaround in the business cycle in the world economy and that includes Israel. This requires extreme care and caution. The fact that there is an interim government and starting another election campaign – unnecessary and which could distort policy – does not really help. The fact that it is not possible to reform or make disciplinary changes in fiscal policy (for example, expenditure or taxation) is also to our detriment.