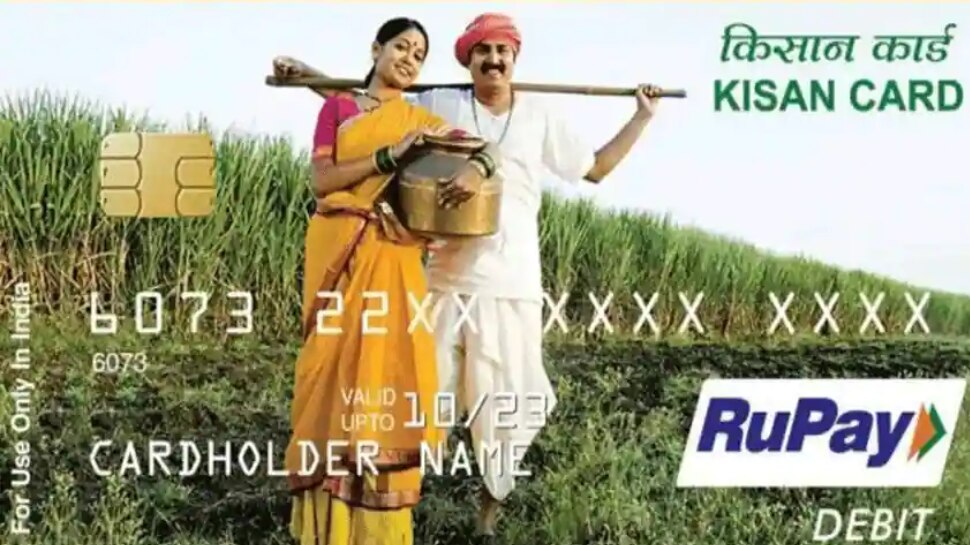

Kisan Credit Card is a credit card loan scheme for farmers. Along with this loan, the farmer also gets an electronic credit card similar to an ATM card. With this, farmers can withdraw and repay money through ATMs at any time. No loan or card available at Krishi Bhavan. This scheme is implemented only through banks.

1

/4

Many of the farmers have various agricultural loans. Interest is calculated on the entire sanctioned amount of these loans. A special feature of Kisan Credit Card is that you can deposit and withdraw money in the loan account at any time during the loan period. If you have taken a loan under KCC scheme from banks, don’t forget to ask for an electronic credit card.

2

/4

Those who own agricultural land can apply for KCC. Land lease holders and farmer groups can apply for a loan by presenting a registered lease agreement and a receipt for the land under cultivation. Application forms can be obtained from the bank or Krishi Bhavan. The application form can be downloaded from the website of the Department of Agriculture.

3

/4

You can get a loan of up to three lakh rupees at a low interest rate. No collateral is required for loans up to Rs 1,60,000. The crop itself is considered as collateral. Anything above that should be secured by a property of sufficient value. Crop insurance is mandatory for borrowers of these loans.

4

/4

The loan amount along with interest is to be paid back in one year or in installments. For short-term crops, the repayment is to be made within 12 months. For long-term crops, the repayment period is 18 months.