The company at the head of which he stands is making its way to the best year in its history, as far as the main operational parameters are concerned, and according to Hankin – many things the group does are not yet fully reflected in Azrieli’s reports.

“If you ask me what the main story is in this quarter, then it is in the NOI of identical assets. This is a small line that tells a big story,” Hankin said. This refers to the net operating profitability of the yielding assets that were fully operational throughout the two periods. This figure increased by 11% in the second quarter compared to its counterpart. “Occupancy in Azrieli’s properties is the same, and it is close to 100% (the average in Israel is 98% – YR). And we are talking about long-term agreements with strong customers.

1 Viewing the gallery

Still, there is an 11% increase. This is happening thanks to crazy demands. We have no merchandise to offer to customers. If we look at the Azrieli center in Tel Aviv – which is indeed groundbreaking, but there are already newer buildings around it – then there we have 16 clients who want to grow long-term. We have an old client who rents thousands of square meters in offices above the mall.

To date he has paid NIS 93 per square meter, and now he is renewing a contract for NIS 127 per square meter, and he will rent thousands of square meters in the nearby Spiral Tower. And we have many such customers. This generates a strong increase even when the occupancy is full. This is due to Azrieli’s value proposition to its customers, and the fact that we do not repeat ourselves. Our prices are market prices.”

Azrieli, whose real estate is worth NIS 42 billion, currently operates in six sectors: 19 malls in Israel (31% of the portfolio in fair value terms), 17 office properties in Israel (37%), eight income-generating properties in the US (5%), four Sheltered housing in Israel (6%), 16 data centers (14%) and one hotel (1%) in Jerusalem.

The reports of Azrieli, which is controlled by chairman Dana Azrieli and her family (about 70%), show that the NOI (net operating profitability) amounted to NIS 473 million in the second quarter, a 16% increase compared to the same period last year. This line was mainly contributed by the group’s two largest areas of activity – shopping malls (NIS 205 million) and offices (NIS 191 million). The malls continue to contribute more to this line, even though this is the second largest activity area in terms of fair value in the portfolio.

The field of data centers showed a significant increase of 4 times and contributed NIS 32 million to this line, thanks, among other things, to the moves made by the company in the field, primarily the purchase of the Norwegian company that operates in it, Green Mountains, for NIS 2.8 billion in the summer of 2021, as well as the growing activity of the Canadian Compass in which it owns 24% after investing about 200 million dollars. Azrieli has an option to grow up to a 33% holding. The NOI from identical properties, that is, those that operated throughout both periods in full, rose at a slightly more moderate, but high, rate of 11% and amounted to NIS 450 million.

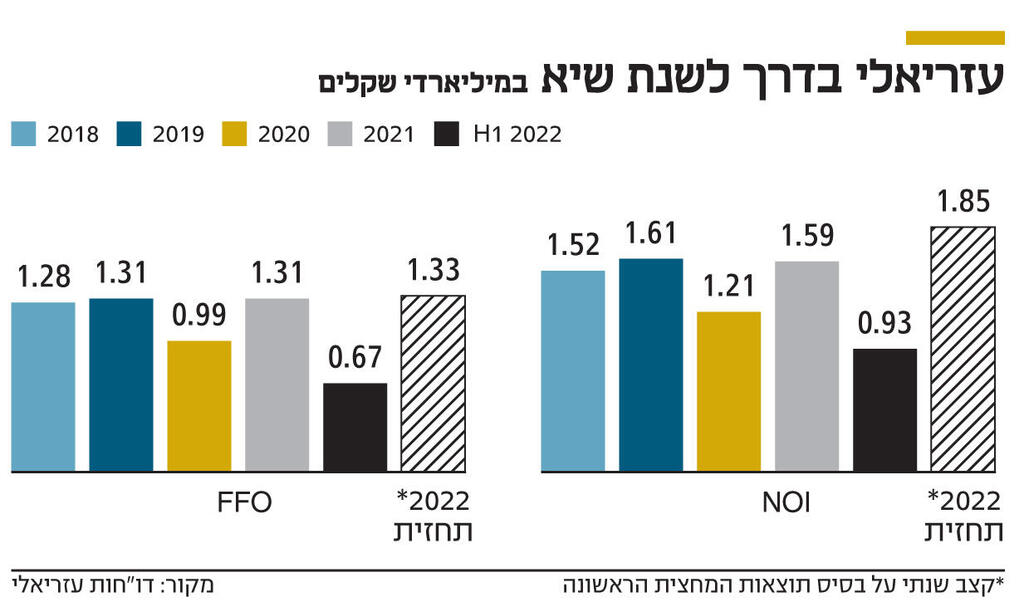

The NOI in the first half was NIS 929 million, a 31% increase compared to the corresponding period, and it reflects an annual rate of NIS 1.85 billion, which will make 2022 the strongest year in Azrieli’s history in this section. For comparison, the strongest year in this section was 2019, when the NOI amounted to NIS 1.6 billion.

The FFO (flow-operating profit), which is the accepted index for measuring profitability among yielding real estate companies because it neutralizes items such as revaluations, decreased by about 11%, mainly due to a sharp decrease in receipts from tenants’ deposits in Azrieli’s sheltered housing, and it amounted to – NIS 331 million. However, the FFO of the income-generating real estate activity, excluding the sheltered housing, rose slightly, by NIS 1 million, to NIS 309 million. The FFO in the first half of the year amounted to NIS 668 million, an increase of 11.5% compared to the corresponding period, and it reflects an annual rate of NIS 1.33 billion.

Even in this case, if Azrieli reaches this figure, 2022 will be the strongest year in its history in the two most important operational parameters. For comparison, the company ended 2021 with an FFO of NIS 1.31 billion, slightly more than what it recorded in 2019. Azrieli’s net profit in the second quarter more than doubled from NIS 383 million to NIS 803 million, also thanks to a 2-fold jump in real estate valuations which amounted to NIS 600 million.

Azrieli’s results in the first half of the year show through a simple calculation that the company is on its way to its best year yet. But according to Hankin, many growth engines that are gaining momentum are still not manifested. “Our reports do not show what is happening with the growth engines in a complete way, like what is happening in the field of data centers.

The global forecast is for growth of 34% per year in the cloud market. This thing quickly translates into demand for real estate space. That is, for data centers. This is the result of the focus of giant companies such as Microsoft and Amazon on the cloud. Amazon grows every quarter by about 40% in this area. They grow at the rate of a country’s GDP. It is no coincidence that the person who replaced Jeff Bezos at the head of Amazon is the person who founded the cloud division, and not someone who comes from an e-commerce background. These days we are signing contracts with large customers in the field of data centers, and the contribution of this in the reports will only be seen in about a year and a half, because the establishment of these centers takes between 10 months and two years.”

Hankin adds with the required sensitivity that the tragedy unfolding in Europe in the face of the Russia-Ukraine war is also giving a boost to its data center business in Europe. “Data centers need electricity. There are data centers around the world that consume more electricity than all of Tel Aviv. And this issue is problematic, because the war exposed the instability on the issue, when Germany, the largest economy on the continent, relies mainly on Russian natural gas. Norway has fossil fuel reserves that will last more than 450 years, and it still produces most of its electricity from renewable energies. It gives a lot of confidence. And so when giants like Microsoft look at where to consume services or set up data centers, they look at places like Norway.”

Hankin also adds that even the activity of initiating the profitable real estate in Israel is not yet fully seen. Azrieli currently has 12 properties under initiation in the scope of 700 thousand square meters which will join existing areas in the scope of 1.4 million square meters. These are expected to increase the NOI of the company for the year represents a 36% increase compared to 2021 to a level of NIS 2.1 billion a year, and the FFO by 18% to a level of NIS 1.55 billion. “There is a significant backlog that will reach maturity by 2027. We are about to expand by 95,000 square meters of commerce, the Har Zion Hotel will start operating in 2026 and become a Masterpiece, and there is the Solaredge campus that will start operating in 2025 and alone contribute NIS 70 million a year to NOI.”

Hankin emphasizes that for the purpose of all these projects, Azrieli has the necessary financial strength. “We raised NIS 6.7 billion in bonds in the last 12 months, at extremely low interest rates, with a rating of AA plus and with very strong demand.” Indeed, Azrieli’s leverage ratio (net financial debt to balance sheet) stands at only 31% at the end of the second quarter of this year , and the equity to balance sheet ratio is 49%.

With regard to the stubborn and high inflation that leads the Bank of Israel to raise interest rates, similar to other central banks in the world, and the possibility that it will negatively affect Azrieli, Hankin shows confidence. Not only because Azrieli’s leases are linked to the index, which provides the company with built-in protection, but also because “our business in shopping malls is aimed at all the Israeli people. If inflation continues to rise, then they may reduce purchases of luxury goods, but not of basic consumer goods. The situation in Israel is good. The job market is strong and the economy is growing, but we are not arrogant. We have our finger on the pulse.”

To illustrate, Hankin says that in 2021, during the tide of the markets in general and of the technology companies in particular, both in the public market and in the private market, the company performed strict due diligence for every company that asked to rent office space from it. “Even at the height of the hype, we did not rent office space to any technology company. We only rented space to the largest companies, and to those we checked and knew had financial strength and a real business model.”