mortgage (photo by vecteezy)

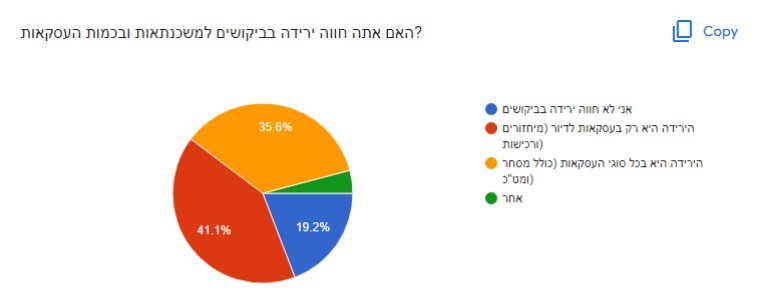

In a conference held with the participation of the bank’s owners Zalman Shuval and chairman Zeev Nahari, approximately 400 mortgage consultants from around the country participated, in preparation for the bank’s value conference together with the Association of Mortgage Consultants a general survey of attitudes. Over 40% of the external mortgage consultants feel a decrease in demand and over 55% of them People turn to the Bank of Jerusalem when they handle transactions defined as complex, according to a survey conducted by the Bank of Jerusalem among external mortgage consultants last week.

The survey also shows that 38% of the advisors responded that the new banking reform required the advisors to become more professional in their field. In the survey it appears that over 44% of the consultants also reflect the feelings of the public who expect that housing prices will continue to rise. This is compared to 23% of the mortgage advisors who answered that housing prices actually went down.

More in-

Yair Kaplan, CEO of the Bank of Jerusalem: “An economic reality in which interest rates are high in the economy directly affects the mortgage sector, which becomes more challenging for the customer. In the more complex mortgage market, where Bank of Jerusalem is an expert, demand is still high. The bank recognizes the need for consultants also in response to more complex transactions from the ‘classic’ market segment of housing loans. That’s why we respond to consultants and clients with complex mortgages in terms of the client’s financial strength and in terms of the collateral offered for encumbrance. Therefore, it is not surprising that most mortgage consultants turn to the bank in response to these customers. This market still reflects good demand since the demand for purchasing an apartment that is not for investment remains high, therefore the trend of the decrease in demand is less noticeable for us.”

Today in a market environment of high interest rates, homeowners with consumer credit/high credit card balances have a distinct advantage in recycling the credit for a longer period for more convenient monthly repayments. If there is a first-class loan to another bank, you can take out a second-class mortgage loan on the same property both to cover obligations and for other purposes.

The ability to respond to the various sectors of the population is part of the professionalism of the Bank of Jerusalem, which is expressed in the tailoring of complex transactions. In the bank, for example, employees from different Hasidic groups are employed who know which Kollel belong to which Hasidic, and which Kollel incomes are more or less reasonable. In addition, the bank has six branches focused on activity in the Arab and Druze sectors. Most of the employees of these branches come from these sectors, therefore there is a deep familiarity with the complex assets in the Arab and Druze sector and for them we have developed unique products.

The bank sees the external mortgage consultants as partners in the journey, when the Bank of Israel reform sharpens the added value of the consultants in the process of taking out the mortgage. According to Shalom Amoyel, the bank’s underwriting manager: “The consultant is actually a professional figure who mediates the mortgage between the banker and the bank and the customer, and therefore the value of the consultant for us bankers is very high both in conveying the complexity of approving specific mortgage applications, and in mediating the information that the customer requires in order to execute the mortgage. In this era, when the bank needs a short time to get a complete picture of the client and the transaction, the professionalism of the mortgage consultant is more strongly expressed, who needs to make the request and the required information available to the bank in a clear and complete manner.”

Comments to the article(0):

Your response has been received and will be published subject to the system policy.

Thanks.

for a new comment

Your response was not sent due to a communication problem, please try again.

Return to comment