The latest alarming events associated with the Swiss banking giant began when the US Securities and Exchange Commission approached it with a series of questions regarding cash flow reporting. Credit Suisse, in an unusual move, postponed the publication of its annual reports from last Thursday. He called the questions expected, the delay in publishing the financial results and the extraordinary findings “a technical matter”.

“We delayed the reports to deal with the questions raised by the Securities and Exchange Commission,” according to CEO Ulrich Kerner, who said these things yesterday in an interview with the Bloomberg agency. No one is satisfied with the developments in the share price, but we are doing everything we can, we have a large-scale plan, and our shareholders are aware of this.” Kerner also noted that, against the background of the collapse of SVB, an influx of funds into Credit Suisse was detected in recent days.

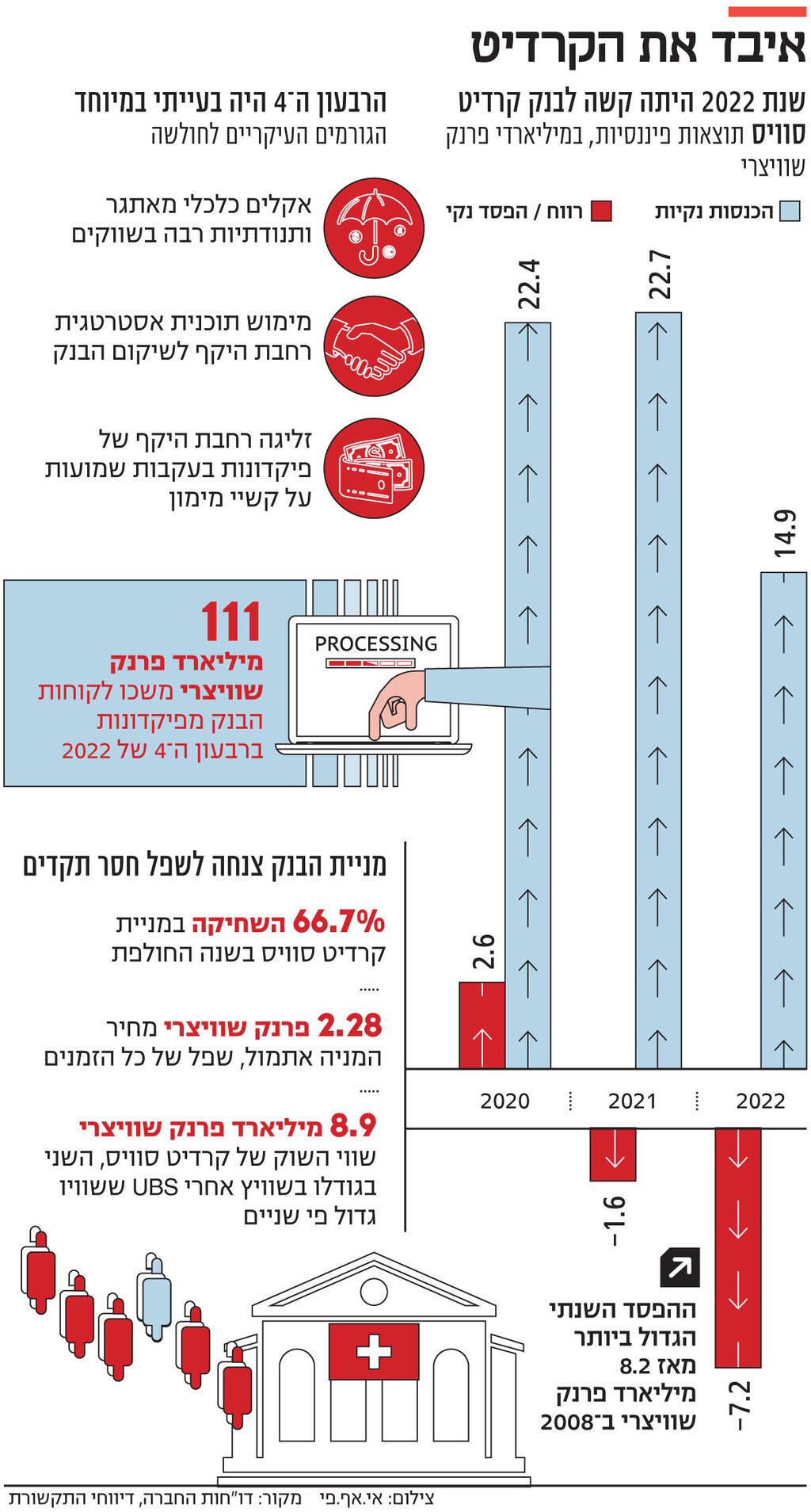

At the same time, the reports painted a gloomy picture. In 2022, Credit Suisse’s revenues fell by 34%, deposits worth 111 billion Swiss francs fled, and a huge loss of 7.2 billion francs was recorded. Following the poor performance, the bank’s chairman Axel Lehman, as The other senior managers will also not receive a bonus for 2022, when for Lehman it is a loss of a benefit worth 1.7 million francs. This is his first full year in office, and the worst in the bank’s history since the financial crisis of 2008, when it posted a loss of 8.2 billion Swiss francs.

Following the reports, the bank’s stock fell to an all-time low and traded today for 2.2 francs, after having fallen by 66.7% in the past year. According to the bank’s publications, a record amount of funds – about 100 billion francs – flowed out of it in the first two weeks of October. The wealth division alone It suffered huge redemptions in 2022 that cut the volume of managed assets by 30%, while in the investment banking division profits fell by 54%.

1 Viewing the gallery

Credit Suisse is one of the 13 European lenders on the list of global banks important to the system. The duplicate withdrawals and the bank’s announcement in October that one or more of its divisions violated the liquidity requirements due to the large withdrawals, led industry officials to estimate that the veteran financial institution is suffering from a funding crisis. At the time, Kerner said in a memo to employees: “I trust that you are not confusing our daily stock performance with the bank’s strong capital base and liquidity.” Not long after, the bank published data on the outflow of funds, noting that “in the first two weeks of October 2022, following negative coverage in the press and social media based on false rumors, Credit Suisse experienced a significant level of outflow of managed assets.”

Credit Suisse may call this negative coverage, but it may simply be a dizzying coverage of a chain of scandals. These include, among other things, a $234 million payment to settle a tax fraud case in France, a $475 million fine for a corruption scandal that involved Mozambique’s tuna fishing industry and plunged the country into a debt crisis, as well as a commitment by the bank to write off $200 million in debt which is considered “tainted with corruption”.

Other scandals included a $2 million fine for money laundering related to the cocaine trade and the Bulgarian mafia (the bank denies any connection) and public criticism following a journalistic investigation that it served clients involved in torture, human trafficking, money laundering, corruption, drugs and other serious crimes for decades .

In addition, the bank suffered a loss of $5.5 billion following the collapse of the Archgos family office — the largest single loss on Wall Street linked to the collapse of one business. Added to this was a payment of $680 million in a civil lawsuit for his part in the subprime crisis, the deletion of $450 million from an investment in the asset management company York Capital, the disclosure that the bank carried out illegal surveillance of its employees, and the closing of four investment funds at a loss of $140 million with the collapse of the fintech company Greenseal . Credit Suisse provided the primary funding for his dubious invoicing business.

It’s no wonder that the company reported staggering legal expenses of about $1.4 billion in 2022 – the third year in a row in which it recorded legal expenses higher than $1.2 billion. For comparison, in 2019 this expenditure amounted to 427 million dollars.

“The new Credit Suisse will definitely be profitable from 2024 onwards,” announced Kerner in an interview with Bloomberg back in December. Kerner was appointed to the position last July and is the third CEO of the bank in the last five years. “We don’t want to overpromise and under-deliver, we want to do it the other way around,” he emphasized. These words were said at the same time as Lehman’s announcement in an interview with the “Financial Times” that a trend of leakage The cash “partially reversed.” In an interview with Bloomberg a day later, he stated that the flow had “stopped,” and the next day the stock jumped 9%.

This chain of events also cast a shadow on Credit Suisse. Last February, the Reuters agency revealed that the Swiss Financial Market Supervisory Authority (Finma) began to investigate whether, when Lehman announced the cessation of the outflow, he knew that customers were still withdrawing funds. The suspicions that led to the opening of the investigation followed the bank’s announcement that 85% of the withdrawal The fourth happened in October and November, which led to the conclusion that about 15% happened in December.

Even before the publication of the so-called “false rumors” regarding a financial crisis, the bank published an extensive plan to strengthen its capital base and operations. This included two issues, one private to increase the holding of the Saudi National Bank (SNB), and another issue to the existing shareholders. At the same time, an upgraded strategic plan was also presented, the third in number in recent years. This included focusing on the risk management division for wealthy clients, reducing investment banking activity and cutting costs by 15%, partly by laying off 9,000 of the bank’s 50,000 employees. All this in the pursuit of recording a profit in 2024 after two loss-making years.

The moves did little to calm spirits, and at least one prominent investor gave up. David Herro, who previously owned 10% of the bank’s shares, announced this month that he liquidated all his holdings, partly due to the massive cash outflow that, according to him, cast a shadow over the future of the financial institution.