This week a very unusual move took place in the US in terms of the American car market. Ford announced a discount on a certain model, the electric Ford Mustang Mach E. The scope of the discount ranges from “tiny” to “respectable”.

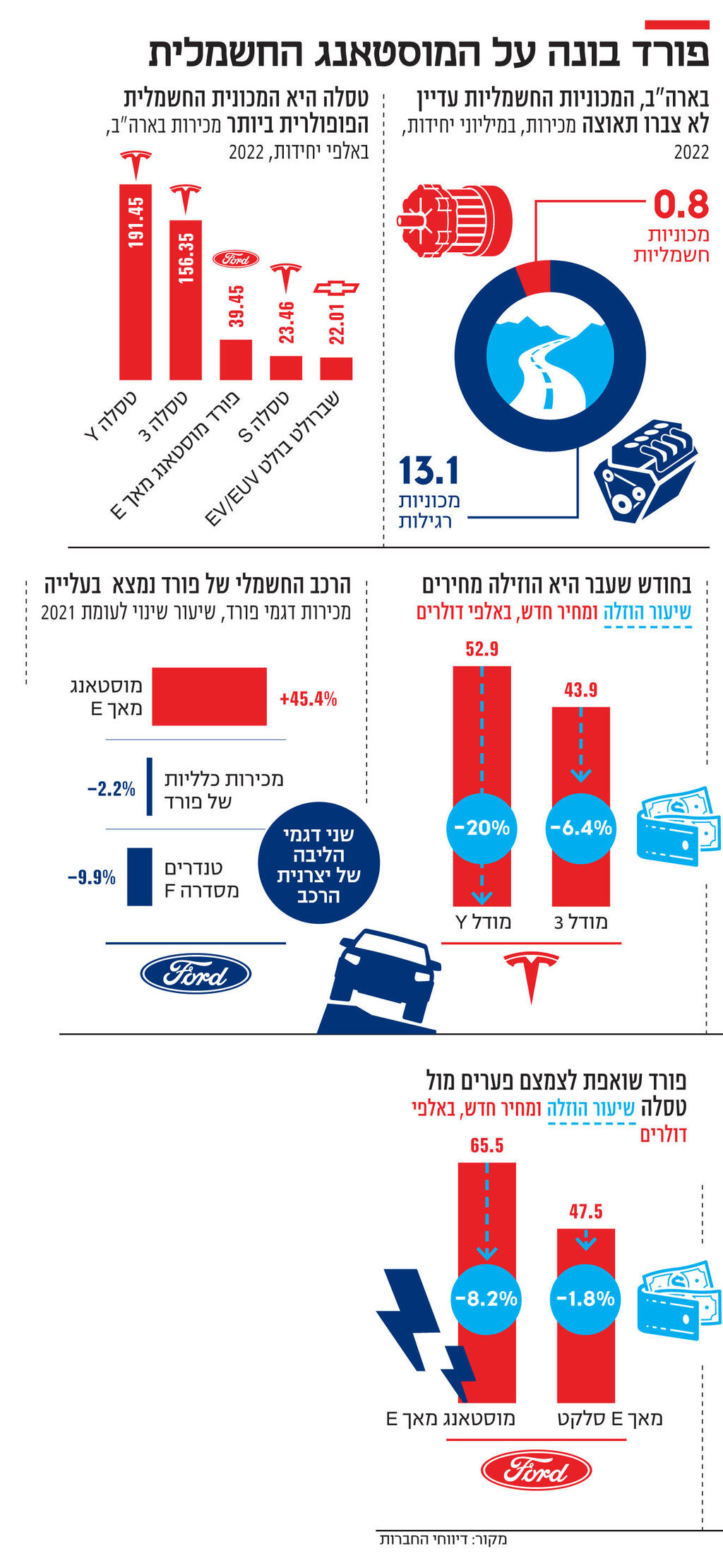

Thus, the rear-wheel drive Mach E Select was reduced from $48,395 to $47,495, a discount of only $900, less than 2%. In contrast, the Mustang Mach E GT Extended Range, whose official price is $71,395, has been discounted by a substantial $5,900. A particularly important fact: Ford has not discounted its electric van, the F 150 Lightning, even by one cent, even though both the Ford Lightning and the Mach E have long waiting lists.

1 Viewing the gallery

So why did Ford discount the Mach E? The explanation given by Marin Jaja, VP of customer relations in Ford’s electric division leaves no room for doubt and is in perfect coordination with the policy of the American manufacturer, which handles every problem with a heavy hammer. “We have no intention of giving up assets for anyone. We are producing more electric vehicles to reduce waiting times, offer competitive prices and create an unrivaled customer experience,” he announced.

But, why exactly is Ford in a hurry to respond to Tesla’s move and not other car manufacturers, such as Hyundai or General Motors. The answer lies in the structure of the companies, and surprisingly, in similarities between Ford and Tesla. The explanation begins with the sales tables of the American car market that analyze electric vehicle and general vehicle deliveries. First, it should be clarified that contrary to many publications, the US is light years away from being a country that adopts an electric vehicle. The supply of electric models there is not extensive, and in fact, the supply of popular electric core models offered to customers in Israel is larger than in the US.

According to official data from Motor Intelligence, about 800,000 electric cars were sold in the US last year out of 13.9 million cars in total. So what is troubling Ford? The answer is the American sales ranking: the best-selling electric car in the US in 2022 was a Tesla Model Y followed by the Tesla 3. In third place on the list of the best-selling electric models in the US is the Ford Mustang Mach E. In fourth place, another Tesla, this time the Model S, followed by the Chevy Bolt.

But Ford is not General Motors. She has different priorities that require handling the Tesla problem. For Ford, the Mustang Mach E is much more than just another car. This is a car on which Ford threw all its heart in anticipation of an electric future. The Mach E bears the name of a legendary Ford car, and it has also been quite successful relying on the features that Ford has incorporated into it, features that should propel Ford into the next decade – which will definitely be electric.

It must be emphasized again that Ford’s real trump card is not the electric Mustang but the Lightning, its electric van. Until Tesla introduces the Cybertruck, its electric van, Ford has no reason to discount the van, only the model that competes with the Tesla 3 and the Tesla Model Y.

So why is Ford discounting, but the likelihood that General Motors or Hyundai will discount their electric cars is not high? The reason lies precisely in non-electrical products. General Motors, Hyundai, Kia, Volkswagen, all the automakers that directly compete with the discounted Teslas, don’t drop their gold on a single core model, electric or non-electric.

Already in the previous decade, Ford significantly reduced the range of models and actually became a company of two core products: F-series pickup trucks and the electric Mustang. In recent years, the Bronco has also joined, but it is a niche SUV. The Explorer, Ford’s off-road vehicle, is getting old—and the sales figures for the other core model, the F-series pickup, are not promising. According to Ford’s own data, the manufacturer sold 653,957 F-series vans last year, a decrease of 9.9%, but sales of the Mustang Mach E, which stood at 39,458 units last year, represented a 45.4% jump compared to 2021. Ford’s total sales last year, by the way, was 1,864,464 units, a decrease of 2.2% compared to 2021.

Ford’s message is clear. She has a trump card in her hand, but one whose volume of sales in the manufacturer’s core market is not large at all, neither in global terms nor out of the company’s total sales. Therefore, Ford can play with its price without fear of harming consumers or profits. But the Mustang Mach E has another important role. This is the car that should carry Ford on its shoulders into the electric age, which will occur in the US a few years after Europe, but will eventually occur.

Today, annual Mach E sales do not even reach half of Ford’s total monthly sales in the Detroit area alone, but this is a situation that is expected to change in the future. Ford knows very well that the Mach E is the car that is better to sell even at a loss, but it is important to keep selling in order to instill the values of the brand in Americans.

At the same time, this loss is only temporary. Ford knows this very well, which is why it uses the terminology of “asset grabbing”, as Jaja stated. Tesla did drop prices sharply, but its ability to keep prices low is limited. That is, it is a matter of a few months until the price of its models increases again. This is because of overheads, a jump in the prices of raw materials, increasing transportation costs, and because of another significant innovation that is around the corner: a new version of the Tesla 3 that will be presented this summer.

For its part, Ford is ready to enter the discount battle, aiming for the Mach E to become “America’s streetcar”, just as the original Ford Mustang bore the nickname “America’s sports car” – and no high-end manufacturer will take the title from it through a few discount sales. And as for all the others – Kia, Hyundai, Volkswagen, their streetcars do not carry such a historical obligation on their shoulders. They are not arrowheads in the war to conquer the American market against Tesla, because they have quite a few other core models.

Therefore, from the point of view of Ford’s competitors, Tesla’s price reduction is seen as another momentary craze, the fruit of Elon Musk’s fevered brain that will pass as soon as it comes. For Ford, it is a battle for consciousness in a small but hot arena, which is definitely able to determine the future of the manufacturer.