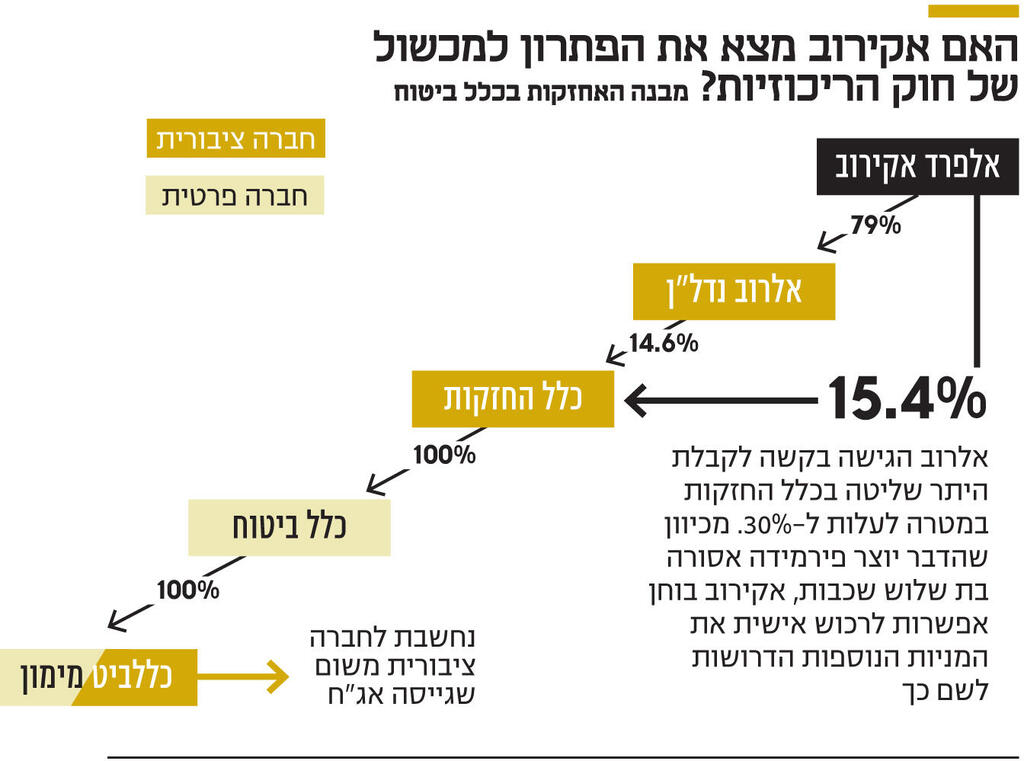

Has Alfred Akirov found the solution to the main problem he faces on the way to controlling Clal Insurance? Calcalist has learned that Akirov is preparing for the possibility of privately acquiring a 15% stake in Clal Holdings, the public parent company of Clal Private Insurance, instead of Alrov Public Real Estate, which it controls (78%). This is the move Akirov prefers to make. In order to solve the problem posed by the Centralization Law to a transaction in which Alrov, which is already the largest shareholder in Clal Holdings (14.6%), acquires more shares, if a control permit is obtained from the Capital Market Authority, it increases its holding to 30% and becomes its controlling shareholder.

Read more in Calcalist:

Last December, Alrov Real Estate applied to the Capital Market Authority for a control permit in Clal Insurance and to hold a 30% stake. The main problem in such a scenario is that it creates an illegal situation. The law, is a traded company or a private company that reports due to various reasons, such as raising it through a bond issue. If Alrov becomes the controlling owner of Clal Holdings, then a prohibited pyramid is created: Alrov Public controls Clal Public Holdings, which in turn owns Clal Private Insurance, which owns Clalbit Financing, whose series of traded bonds.

The pyramid becomes legal

The Capital Market Authority and its head, Moshe Barkat, have already hinted to Akirov that they will not allow Alrov Real Estate to increase its holding by more than 15% – the maximum share approved for it today in accordance with its holding permit. %, Is to purchase the additional shares privately or through privately owned companies.This is because the law of centralization does not prevent an individual from owning a public company through a private company, and does not consider such a situation to be a creation of a stratum.

As long as Alrov Real Estate does not exceed a holding of more than 15%, it itself will not be considered a layer in Clal Insurance’s pyramid. However, a 30% share will already be considered control almost certainly. A share of 29.9% in DSKS. Since this holding does not bring them under control, and this has already stood the test of time, the pyramid of DKSH is not against the law of centralization.

2 View the gallery

Info Akirov has found the solution to the obstacle of the law of centralization

Last Wednesday, an issue of shares of Clal Insurance, against which Akirov issued, was carried out, because it was estimated that the purpose of the issue was to make it difficult for him to become the controlling shareholder in the company. The issue raised a total of NIS 493 million net (NIS 506 million gross), and Akirov purchased shares for NIS 62 million, slightly less than its share, so that Alrov’s share fell from 15% to 14.6%. This is after Clal Insurance rejected Akirov’s offer to purchase the entire shares in the issue and transfer them to a trustee until he receives the control permit.

Alrov itself has not yet reported on the purchase of the shares, which was made by Mizrahi Tefahot Bank for those defined as a classified investor. This individual may indicate that Akirov purchased some, or all, of these shares through a private company and not through Alrov, in preparation for a broader move to purchase shares in the company privately.

Elstein-style detour

If Akirov receives the necessary approvals and embarks on a move to acquire a large stake in Clal Holdings privately, then that move will be criticized for being designed to circumvent the law of centralization. To a large extent, this move is reminiscent of another move bypass, which succeeded: the one made by Eduardo Elstein in 2017, when he was the controlling owner of the IDB Group. In order to overcome the law of centralization, Elstein sold DSKS, a subsidiary of IDB, which then controlled Shufersal, Cellcom, and Properties and Building, to its own dolphin fund in a non-cash transaction, for a bond in the amount of 1.8. A billion that has hardly been repaid. This is how DSK became a private company and the IDB Group overcame the centralization law. The move also drew criticism from then-Justice Minister Ayelet Shaked, who allowed the move to take place. In the law of centralization, it will not stand the test of the court.

Acquiring a share of about 15% of all holdings privately means spending an amount of about NIS 770-800 million – a very large amount even for a rich person like Akirov. Another option that is being developed, and is also quite expensive, is to delete Alrov from trading with an investment of at least NIS 1 billion. The move involves making a public offering and reaching agreements with a source such as Israel Canada, which is controlled by Barak Rosen and Assi Tochmeier, who does not particularly like Akirov and owns 13% of Alrov.

If the Capital Market Authority decides to oppose a move in which Akirov reaches a 30% holding in all holdings through the purchase of the rest of the shares privately, it will encounter legal difficulty. This is partly because Akirov himself can get a maintenance permit, similar to Alrov’s. This is because Barkat does not see the steps taken by Akirov, mentioned in the Danziger report in a critical tone, as deviating from the relationship between shareholders and companies. To Canada Israel, as well as the meeting with the chairman at the time when he allegedly handed over a case he had prepared against Clal Insurance’s investment manager, Yossi Dori.

.