Regarding the Nikkei Stock Average (the asset name in Gaitame.com trading account “CFD Next”: Japan N225), I have summarized the market trends so far and key points for the future for a quick review.

‘Latest Nikkei Average Market Analysis’

Nikkei Average Stock Price Movements Summary

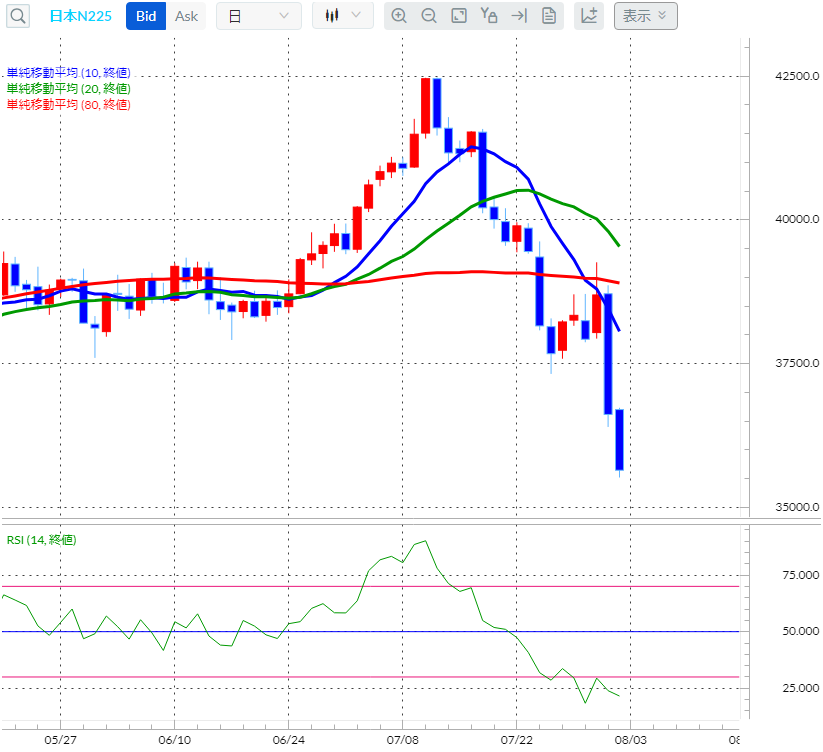

1. Sharp decline of Nikkei 225:

– Dropped about 3000 yen from the previous day

– Technical analysis shows a strong downtrend

2. Chart Analysis:

– All moving averages are downward

– RSI has fallen below the 30 line

– On the weekly chart, it has dropped below the 52-week moving average

– After forming a double top, it has broken below the neckline

3. Future Targets:

– Psychological level at 35,000 yen

– Further declines may consider the 30,000 yen range

4. Causes of the sharp decline:

– Progression of yen appreciation (Yen strengthened by about 13 yen from 162 yen against the dollar)

– Change in Bank of Japan’s monetary policy (implementation of interest rate hikes)

5. Relationship between yen valuation and stock prices:

– Yen depreciation positively affects Japanese companies’ performance

– As the yen appreciates, the benefits of yen depreciation diminish

6. Advantages of CFD trading:

– You can enter from a sell position, aiming for profits even in a declining market

7. Future points of interest:

– Movements in the dollar-yen exchange rate

– Support lines for the Nikkei Average

Overall, it was explained that the sharp decline in the Nikkei Average is due to the progression of yen appreciation and changes in the Bank of Japan’s monetary policy, the possibility of continued declines, and how utilizing CFD trading can allow for profit-making even in a falling market.

Latest Nikkei Average CFD Chart (Gaitame.com “CFD Next”)

Daily Chart

Japan N225 Stock Index / Commodity CFD Chart│First FX on Gaitame.com

Economic Indicator Calendar

Economic Indicator Calendar|First FX on Gaitame.com

Live Commentary for FX Beginners from 12 PM

Researchers from Gaitame.com Research Institute’s survey department provide daily live broadcasts around 12 PM on weekdays for FX beginners. They offer clear explanations of the previous day’s review and today’s market points. You can watch it on YouTube at the “Gaitame.com Official FX Beginner Channel.”

Click here for the FX Live Commentary Channel starting at 12 PM

Factors for the Rise and Fall of the Nikkei Average

Factors for Rise

Strong Japanese Economy: Growth in the domestic economy increases corporate profits and pushes up stock prices.

Improvement in Corporate Performance: Major companies included in the Nikkei Average show improved performance.

Yen Depreciation Trend: Increased profitability for export companies supports stock prices.

Monetary Easing Policy: The Bank of Japan’s monetary easing policies supply liquidity to the market and boost stock prices.

Net Buying by Foreign Investors: Increased foreign investment leads to rising stock prices.

Strong Global Economy: Growth in the global economy supports the performance of Japanese companies, leading to rising stock prices.

Factors for Decline

Slowdown in Japanese Economy: Slowing growth in the domestic economy negatively affects corporate profits and lowers stock prices.

Deterioration in Corporate Performance: Key companies included in the Nikkei Average show declining performance.

Yen Appreciation Trend: Decreased profitability for export companies negatively affects stock prices.

Monetary Tightening Policy: Normalization of monetary policy or interest rate hikes reduce market liquidity and pressure stock prices.

Net Selling by Foreign Investors: Increased selling by overseas investors leads to declining stock prices.

Global Economic Instability: Increased uncertainty in the global economy results in stronger risk-averse behavior and falling stock prices.

Attractiveness of Gaitame.com “CFD Next”

Gaitame.com’s CFD service “CFD Next” allows you to invest in various global stock indices, gold, crude oil, and U.S. stocks with a single account.

No Trading Fees

With no trading fees, you can start trading with a small margin.

The Nikkei Average CFD allows for a maximum leverage of 10 times, enabling efficient trading with a low margin.

Note that margin call fees will be charged separately. For details, click here

Ability to Sell First

You can enter not only from the “buy” position but also from the “sell” side, allowing you to profit even if the market declines and prices drop.

Trading in “Japanese Yen”

You can trade various global products in “Japanese Yen,” just like in FX.

About CFD (CFD Next)|First CFD on Gaitame.com

Researcher, Survey Department, Gaitame.com Research Institute

Shuhei Uehara (うえはら・しゅうへい)

Certified Technical Analyst (CFTe) from the International Federation of Technical Analysts

Entering the financial industry in 2015, involved in customer support and other roles. Also active as a lecturer in financial seminars. Joined Gaitame.com Research Institute in February 2022. Utilizing past experiences and knowledge to actively provide information to individual FX investors. Regular commentator on economic programs such as “Stock Voice” and Nippon Broadcasting’s “Jiro Shinbo Zoom So far, I say!” and numerous other appearances. Currently writing a series on dollar-yen and euro-yen forecasts in the financial magazine “Diamond ZAi.”

●Disclaimer

While we take great care in providing information on this site, we do not guarantee the content. This service is intended to provide information useful for investment decisions and not for the purpose of investment solicitation. Please make the final decisions on investment policies and timing based on your own judgment. Also, Gaitame.com Co., Ltd. is not responsible for any damages arising from the use of this service.