Apple’s Chip Supply Squeezed as Nvidia Gains Ground with TSMC

Apple is facing increased costs and potential delays in securing cutting-edge chips from its key manufacturing partner, TSMC, as Nvidia’s surging demand fueled by the artificial intelligence boom reshapes the foundry’s priorities. The shift marks a significant disruption to a long-standing and mutually beneficial relationship between Apple and the South Korean semiconductor giant.

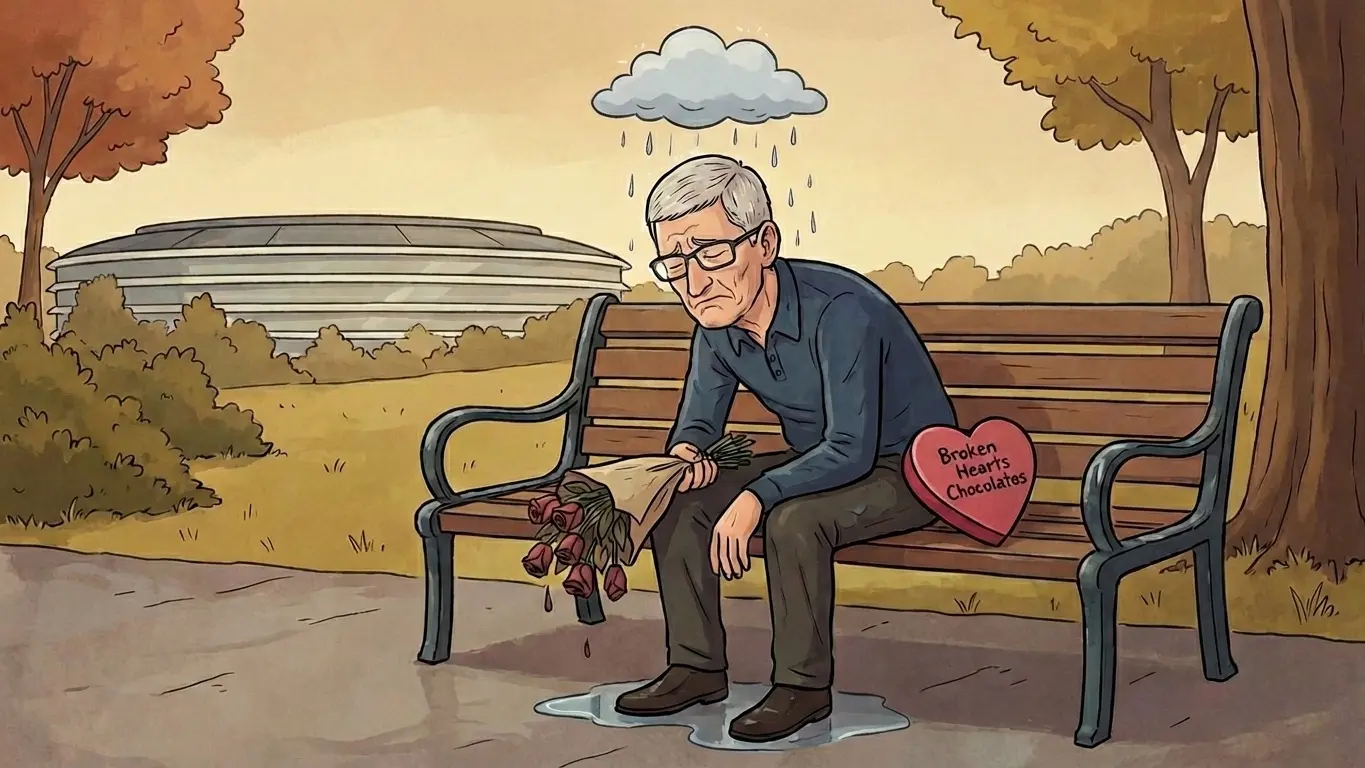

For years, the partnership between Apple and TSMC has been a cornerstone of both companies’ success, propelling them to the forefront of their respective industries. TSMC became the exclusive manufacturer of Apple’s CPUs in the mid-2010s, and together they’ve consistently advanced technology, from the early A-series iPhone processors to the powerful Apple silicon now found in Macs, iPads, and data centers. Apple’s substantial investments in fabrication plants and TSMC’s manufacturing prowess created a synergistic relationship that delivered performance and efficiency advantages.

However, the landscape is rapidly changing. According to a report from analyst Tim Culpan on his blog, Culpium, Nvidia is now challenging Apple’s position as TSMC’s top customer. “Nvidia likely took the top spot in at least one or two quarters of last year,” Culpan stated.

Nvidia, while often referred to as a chipmaker, is actually a “fabless” semiconductor company – meaning it designs chips but relies on foundries like TSMC for manufacturing. The massive demand for Nvidia’s GPUs and AI accelerators, driven by the explosive growth of AI data centers, is giving the company considerable leverage with TSMC. Nvidia is selling chips as quickly as TSMC can produce them, potentially eclipsing Apple’s influence.

“Apple, which once held a dominant position on TSMC’s customer list, now needs to fight for production capacity,” Culpan noted. “With the continuing AI boom, and each GPU from clients like Nvidia and AMD taking up a larger footprint per wafer, the iPhone maker’s chip designs are no longer guaranteed a place among TSMC’s almost two dozen fabs.”

This increased competition is already translating into higher costs for Apple. Culpan claims TSMC imposed “the largest price rise in years” on Apple last fall, though the exact amount remains undisclosed. In the past, Apple’s position as the largest customer afforded it significant negotiating power. With Nvidia now holding that role, Apple’s bargaining position has weakened considerably.

The challenges extend beyond processor costs. The expansion of AI data centers, spearheaded by companies like OpenAI, Google, and Microsoft, is also straining the supply of essential components like RAM and SSDs, further driving up costs. As a result, Apple is facing mounting pressure to increase prices on its products to offset these rising expenses.

This confluence of factors presents a significant hurdle for Apple as it navigates an increasingly competitive and expensive semiconductor market. The company’s future success will depend on its ability to secure access to leading-edge chip technology while managing escalating costs.

Ed Hardy has been writing full-time about tech for 25 years, and using it for much longer than that. His intro to Apple was a Macintosh Classic II (which he still has), but now he uses a 13-inch iPad Pro as his primary computer. He’s written for NotebookReview, TabletPCReview, and Brighthandas well as other sites.