Real Estate Appraiser and Lawyer Erez Cohen (Photo by Mario Levy, Flash 90 / Hadas Porush)

The periodic real estate survey of the Chief Economist at the Ministry of Finance, Shira Greenberg, has been published in recent days – and she wants to provide an up-to-date picture of the housing market in Israel. Earlier and 8% less than last January.

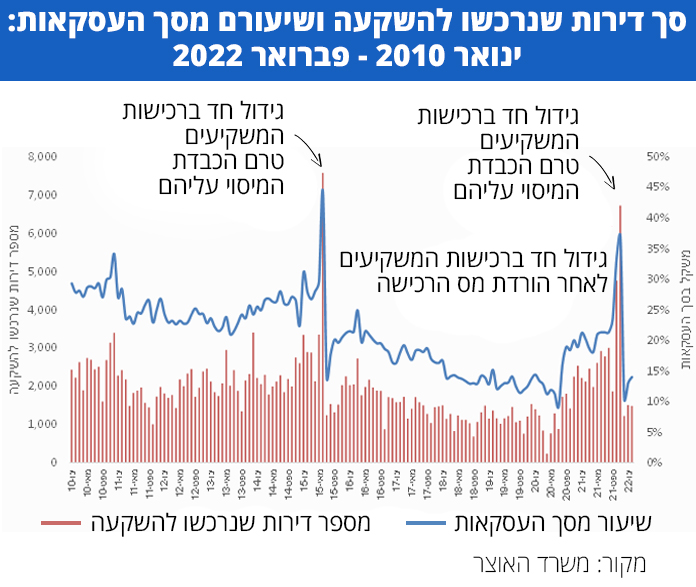

The reason behind the relative moderation, according to the review, lies in the fact that “since the purchase tax was raised on investors, the rapid growth rate of total transactions in the free market has been halted.” The process that began in December last year, with the tax increase from 5% to 8%, is also reflected in February 2022: when the purchases made by the investors stood at a low level of 1,500 apartments – a 30% drop compared to the same month a year ago.

The survey also shows that in the last quarter of 2021, 40,600 apartments were purchased on the free market – an increase of 41% compared to the corresponding quarter a year earlier, a matter that constitutes a “historical record level”. The purchases in the free market were led by the investors, with the purchase of 12,700 apartments. Following this, the review indicates that investor sales in February 2022 continued to be high, with 2,400 apartments, an increase of 13% compared to February 2021 and 9% compared to the previous month. Investors’ holdings of assets shrank last February by about 1,000 apartments, similar to the previous two months after the purchase tax increase.

Chief Economist at the Ministry of Finance, Shira Greenberg (Flash 90)

While investors have cooled, the purchase of apartments by young couples in the free market stands out, which in February 2022 amounted to 4,400 apartments – an increase of 22% compared to February 2021 and 3% compared to last January. The highest demand, by the way, was recorded in the Rehovot area.

The CBS data is also included in the Ministry of Finance’s review. A comparison of transactions made between January-February 2022 and the same period a year earlier shows that housing prices climbed by 15.2% – the highest increase in a decade. In addition, throughout January-February 2022, prices rose Housing is 1.8% relative to the period between December 2021 and January 2022. To this must be added the CBS data that herald increases in the index of residential construction inputs: 1% in March and 2.3% from the beginning of 2022.

“The data that appear in the reviews of the Ministry of Finance and the CBS are far from surprising, there is no real line here,” states real estate appraiser and lawyer Erez Cohen, owner of ZK Research and Surveys, and who headed the Real Estate Appraisal Bureau in Israel. “We have seen a rise in the purchase tax relative to a cooling of investors in recent times, but from here to talking about a downward trend in demand or falling prices, the distance is great – we are really not there.”

“The state has marked the investors as the ones who will fuel the housing market in the country and not rightly so,” Cohen emphasizes. “Even when investors downshift, we see that there is no massive decline in the volume of activity – what’s more, past experience shows that when investors were excluded from the market and the amount of transactions they made out of total was modest, housing prices did not fall. “In the current state of affairs, to say that the increase in the purchase tax has created a dramatic effect on the ground is a statement that does not align with reality.”

“Beyond that, who exactly is included under the definition of ‘investor’?” Cohen wonders, “Is someone who owns more than one apartment and designates the property he purchased for the younger generation included in this category? And this is just one issue that needs clarification. The criteria must be sharper and clearer. “So that we can really separate those who are buying an apartment for investment from those who are buying an apartment for other purposes.”

Combined activity

With the increase in the purchase tax, it has so far been difficult to produce a real change in the market, another step that is expected to bring about a return, according to Cohen, lies in raising the interest rate, as the Governor of the Bank of Israel, Prof. Amir Yaron, recently announced.

“This was a necessary action against the background of the sharp jump in prices, although it may have been done too late in light of the banks reaching the maximum level of credit they can provide to the industry,” Cohen analyzes. “We will see the consequences of raising interest rates both among home buyers – for whom the move micromanages the mortgage and reduces repayment capacity, and therefore is also expected to reduce demand – and among developers, as credit is expected to rise, which will join other micro factors such as rising raw material prices and costs The transport. ”

A residential project under construction. “The factors in the real estate market will require patience and patience” (Photo Flash 90 / Yossi Aloni)

Cohen also refers to the increase in the purchase of apartments in the free market by young couples, as presented in the chief economist survey in the Ministry of Finance, and says: “People need a place to live, probably given the natural increase and population growth. “Among other things, it is in the hands of young couples. It should also be remembered that a dominant segment of these young people are high-wage earners. While the government is constantly talking about the expectation of further increases in prices, why is it any wonder that young people also fall off the fence?”

Looking ahead, Cohen explains that the way to curb the rise in prices lies first and foremost in increasing the supply of housing, with raising the purchase tax and raising the interest rate only part of a whole arsenal of steps to be taken. “An integrated multi-arm operation is required,” he clarifies. “Target Price Plan”, Framework Agreements for Urban Renewal that will encourage local authorities to issue permits, conversion of employment areas and residential offices and harnessing RMI for rapid land release – this is just a partial list of a series of moves that can reduce the gap between supply and demand “.

“It is also important to take into account that the impact of these actions can only be examined and analyzed in the medium to long term,” Cohen concludes. “All the factors operating in the real estate market in Israel will require patience and forbearance. “Those who expect a turnaround and we are finished and a drastic change from now to now, it is recommended that it be considered a new route.”