2024-05-07 03:03:16

[‘경제 버팀목’ 자영업이 쓰러진다]

Insolvency increased sharply after government support ended in September last year.

Overdue for more than three months, three times the amount during the coronavirus pandemic

“Concerns about negative effects on employment and consumption”

“During the period of the novel coronavirus infection (Corona 19), sales were able to hold up thanks to good delivery, but this year, monthly sales decreased by more than 20% compared to last year. As the loan interest burden grew, I had no choice but to open my hands to my parents.” (Mr. Park, who runs a snack bar in Seongbuk-gu, Seoul)

The number of ‘insolvent self-employed people’ who received loans from the financial sector and failed to repay for more than three months has increased sharply to over 10,000 this year. As the moratorium on repayment of loan principal and interest for the self-employed and small business owners, which has been in effect since COVID-19, ended at the end of September last year, the burden accumulated due to high prices, high interest rates, and the resulting economic downturn began to burst out all at once.

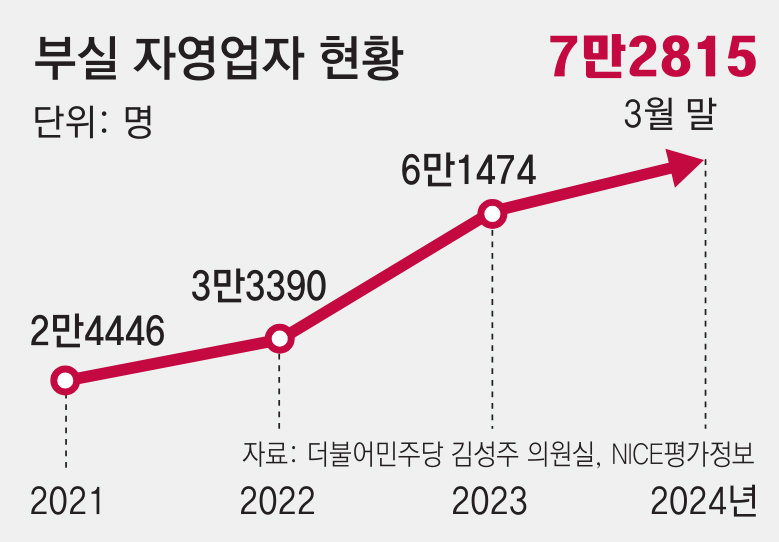

According to data received from NICE Evaluation Information by the office of Kim Seong-ju of the Democratic Party of Korea, a member of the National Assembly’s Political Affairs Committee, on the 6th, the number of self-employed people who had not repaid their loans for more than three months as of the end of March this year was 72,815, an 18.4% increase from the end of last year (61,474). (11,341 people) increased. This is a 28.1% increase compared to the end of September last year (56,860 people) when financial support for the self-employed was cut off, and it is about three times more than the end of 2021 (24,446 people) when COVID-19 was at its peak.

The debt per person of insolvent self-employed people increased by about 26% from 142.99 million won to 180.22 million won at the end of 2021. However, taking into account changes in loan interest rates due to the Bank of Korea’s severe austerity measures, the average amount of interest that one insolvent self-employed person has to pay annually increased by nearly 112%, from about 4.34 million won to about 9.19 million won.

As the burden on self-employed people increases, the loan delinquency rate is also soaring. According to the Financial Supervisory Service, the delinquency rate of domestic banks’ individual business loans at the end of February this year was 0.61%, three times the level of two years ago (0.20%).

Experts point out that a warning light has turned on for the health of the self-employed as the low interest rate phase and the government’s policy financial support effect end simultaneously. Seo Ji-yong, professor of business administration at Sangmyung University, said, “As the self-employed account for a high proportion of the economic structure, if they collapse, there will be a significant negative impact on the overall economy, including employment and private consumption.” He added, “A policy that considers interest rate cuts for faithful repayers and borrowers’ credit scores.” He emphasized, “There is a need for additional measures such as financial provision.”

Self-employed people’s arrears for more than three months increase rapidly by KRW 9 trillion in one year… “I can’t take it any longer, so I’m going out of business.”

Let’s take off the ‘Corona Respirator’, Domino’s goes out of business

High inflation, high interest rates, prolonged domestic recession

The loan balance increased by 27 trillion won to 1,109 trillion won at the end of last year.

Point out that “debt burden faces quantitative and qualitative limitations”

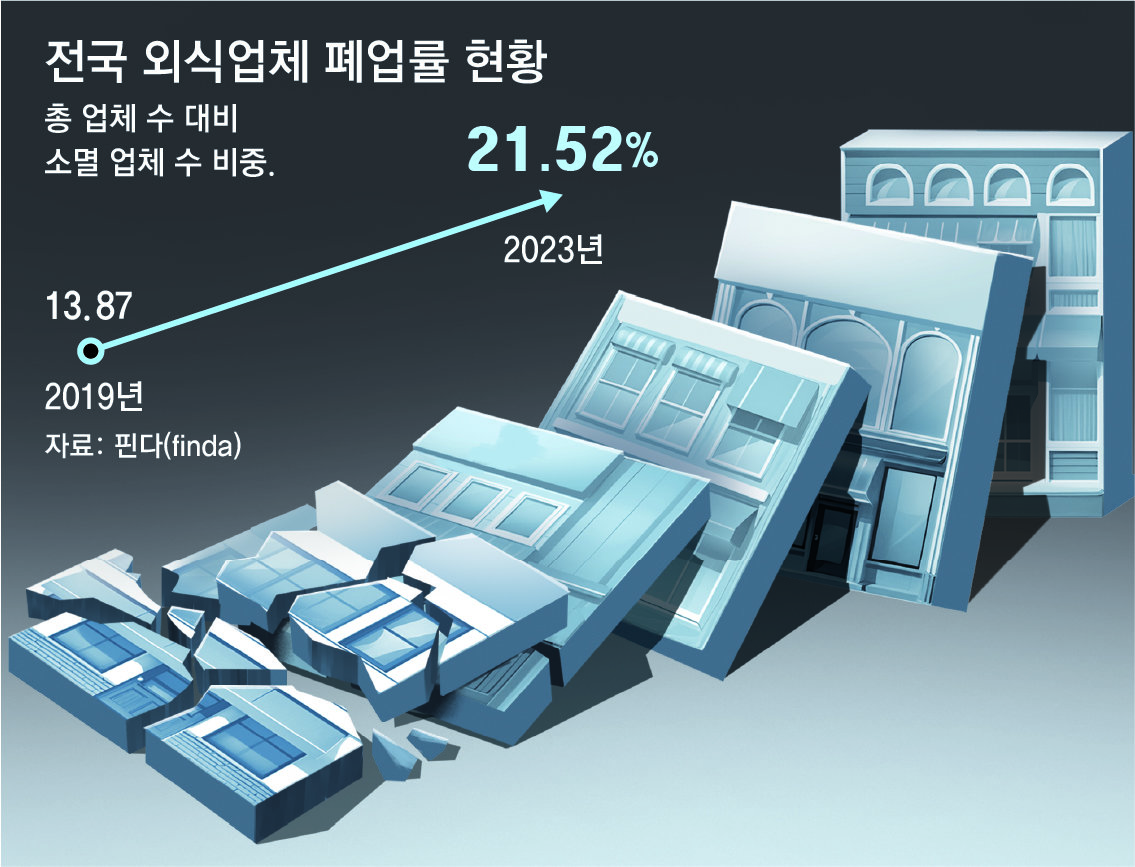

One in five restaurant businesses closed last year

“We reduced the number of employees from three to one and even served the customers ourselves, but with fewer customers, it became difficult to maintain the store. “It looks like it will be difficult to recover sales, so I am preparing for a job at a company.”

Mr. Jin (38), who has run a wine bar in Seongdong-gu, Seoul for six years, complained like this on the 22nd of last month. The store run by Mr. Jin received attention on social media, and at one point, monthly sales reached close to 20 million won. However, as similar stores started popping up nearby in the past few years, sales dropped and shrank to 5 million won from the second half of last year (July to December). Mr. Jin said, “The interest rate on the loan I received to survive the pandemic period has risen from 2.8% to 5.4% per annum in the past year, so I am in a situation where I cannot afford it.”

The loan delinquency rate of self-employed people, the ‘support of the Korean economy’, has more than tripled in two years, and the amount of delinquent loans has also surged by nearly 10 trillion won in one year. They barely survived the unprecedented crisis caused by the novel coronavirus infection (Corona 19) by receiving additional loans. However, as high prices, high interest rates, and a prolonged slump in domestic demand following the pandemic, the loans that self-employed people had increased at the time returned as a boomerang. The self-employed people we met at the site all said, “It’s much harder now than it was during COVID-19.”

● Self-employed people’s arrears increase by 50%

According to data received from NICE Evaluation Information by the office of Rep. Yang Kyung-sook of the Democratic Party of Korea, a member of the Planning and Finance Committee of the National Assembly, on the 6th, the loan balance of self-employed people (household loans + corporate loans) as of the end of December last year totaled KRW 1,109.6658 trillion, up 2.5% compared to the same period last year. 27.4 trillion won) increased. Of these, the amount overdue for more than three months amounted to KRW 27.3833 trillion, a sharp increase of 49.7% (KRW 9.0892 trillion) compared to the same period last year.

The problem is that more than half of the self-employed are ‘multiple borrowers’ who have received loans from three or more financial institutions. As of the end of last year, there were 1,731,283 self-employed people with multiple debts, or 51.5% of all individual business borrowers. This means that more than half of self-employed people are no longer able to receive institutional loans. Their loan balance amounted to 691.6232 trillion won, accounting for 62.3% of the total.

There is a growing number of self-employed people who borrow policy funds and are unable to repay them. According to data received from the Small Business Promotion Corporation by the office of Rep. Oh Ki-hyung of the Democratic Party of Korea, a member of the National Assembly’s Political Affairs Committee, the amount of policy funds insolvent for small business owners who were overdue for more than three months or went through public debt restructuring such as rehabilitation or bankruptcy amounted to 275.4 billion won in the first quarter of this year (January to March) alone. reached. In just three months, more than a third of last year’s (KRW 824 billion) worth of bad debt occurred. The amount repaid by the Credit Guarantee Foundation for bank loans that self-employed people could not repay (subrogation amount) also increased to 1.7126 trillion won as of the end of last year, 3.4 times higher than the previous year (507.6 billion won).

● Business closure rate higher than during COVID-19

Self-employed people who are pushed to the limit are increasingly choosing to close their businesses because they cannot handle the deficit. Mr. A, who ran a women’s general store in Paju, Gyeonggi Province until February of this year, said, “I survived well during COVID-19 by receiving disaster relief funds, but after the pandemic, I had to close the store because I had a loss of about 7 million won every month.” He explained, “I paid back the overdue loan with the key money I received.”

According to ‘Open Up’, a commercial analysis platform operated by fintech company Finda, the number of restaurant businesses that closed last year totaled 176,258, a surge of about 82.6% compared to 2020 (96,530). The closure rate of restaurant businesses was also 21.52%, which was 8.11 percentage points higher than in 2020 (13.41%). Hwang Chang-hee, Finda Open Up Service Planner, explained, “The data confirms that the current time is an even more difficult time for restaurant business owners who have endured COVID-19.”

Experts point out that the loan burden of self-employed people has reached its limit in both quantitative and qualitative aspects. Lee Jeong-hee, a professor of economics at Chung-Ang University, said, “The situation in which delinquencies are increasing and business closures are becoming more frequent, especially among the self-employed,” and expressed concern, “As the total amount of loans has increased due to COVID-19, the burden of interest costs (for the self-employed) has greatly increased.” . Lim Hyeong-seok, senior research fellow at the Korea Institute of Finance, said, “As the burden of debt repayment increases, especially among vulnerable borrowers, the demand for debt restructuring is also increasing,” adding, “There is a need to consider introducing systems such as immediate exemption from small debts to help them make a rapid economic recovery.” “He said.

Reporter Kang Woo-seok [email protected]

Reporter Jeong Soon-gu [email protected]

Reporter Shin A-hyung [email protected]

Reporter Kim Soo-yeon [email protected]

2024-05-07 03:03:16