This article is a part of your HHCN+ Membership

The home health care industry is intensely focused on navigating a rapidly evolving payment landscape and harnessing the power of technology, according to insights gleaned from a year of exclusive content. A review of 2025’s HHCN+ coverage—articles, interviews, and live events—reveals these two themes dominated discussions among industry leaders.

Our team’s coverage is directly informed by input from HHCN+ members, and this update details how that feedback shapes our editorial direction. Looking ahead to 2026, HHCN+ will continue to prioritize the most pressing topics, emerging trends, and under-reported stories, all guided by the needs of our community.

- Medicare Advantage and reimbursement innovation are top of mind for home health providers.

- Technology is seen as crucial for increasing efficiency and transforming operations.

- Direct member feedback, through annual surveys, drives HHCN+ content prioritization.

- Value-based care models are gaining traction as a path to revenue expansion and improved care quality.

Let’s dive into the specifics. The quarterly HHCN+ TALKS interview series provides members with exclusive access to industry experts. If you haven’t tuned in live, I highly recommend it—and submitting questions for our guests!

Payment Innovation: A Deep Dive

The shift to value-based care is a consistently requested topic. Providers facing tight margins are increasingly exploring episode-based and upside-risk arrangements as a way to expand revenue while simultaneously improving care quality.

This discussion was front and center during the first HHCN+ TALKS episode of the year, featuring WellBe Senior Medical CEO Jeff Kang, who previously served as the chief medical officer of the Centers for Medicare & Medicaid Services (CMS). Kang credited value-based models as the key to re-establishing primary care within patients’ homes.

“The big difference is the introduction of a value-based model,” Kang said. “We are not actually dependent on fee-for-service billing. We are, essentially, both the provider and the payer. We’re economically responsible for the hospital bills, the radiology bills, the specialist bills. That’s a value-based model or a full risk model. We can make it work because we’re prepared to spend the time with the patient and keep them healthy and out of the hospital. We make money by keeping people healthy and out of the hospital. It’s completely flipped. In the fee-for-service world, you make money by just seeing as many patients as you can a day, but that’s not necessarily good for the patient.”

Kang suggested a shared savings model as a first step for home health providers looking to engage in value-based care.

Another key takeaway from the HHCN+ TALKS series, also focused on payment innovation, is the concept of the “reimbursement flywheel.” This model, rooted in upside performance dollars tied to Medicare Advantage, was outlined by Sue Chapman Moss, managing director of payer and provider contracting and strategy at Bayada Home Health Care, during the Q3 TALKS episode.

For Bayada, a shared savings model allows the company to reinvest in its workforce, technology, and clinical innovation, Moss explained.

“The payment model with Medicare Advantage allows us to be able to distribute upside performance dollars back through our organization to continue to invest in the data pipelines, the talent, the people to be able to deliver the results that we’re really proud of,” Moss said. “That’s the impact it’s had on margins. I think what’s really interesting about my tenure here at Bayada is that I can’t imagine what sort of margin pressure we would be facing without having done this body of work.”

Creating this type of flywheel is paramount for providers, who have expressed to us that while they recognize the need for innovation, they often face barriers such as cost and training requirements. Innovation in reimbursement can, in turn, fuel innovation in other critical areas of their businesses.

Shaping HHCN+ Stories: A Behind-the-Scenes Look

Many of our stories originate from casual conversations during interviews or spontaneous discussions at in-person events.

However, the overall scope of our coverage is largely guided by direct input from our HHCN+ members. We conduct an annual survey to identify the topics that matter most to our community. While we always leave room for unexpected stories, this survey helps us prioritize questions, select stories, and shape the agenda for our TALKS episodes and live events.

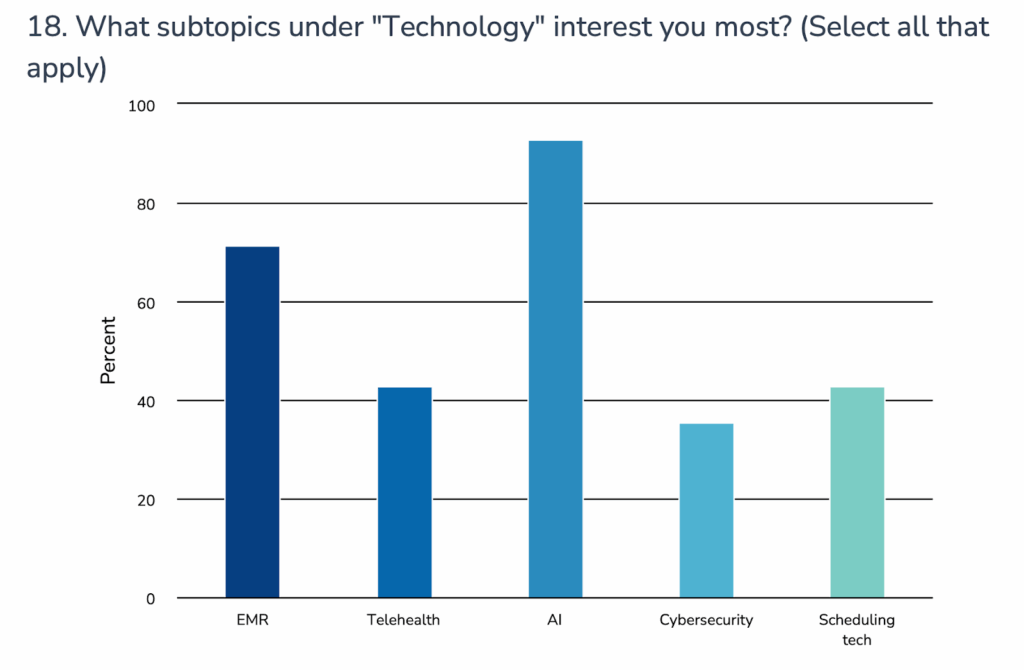

For example, survey respondents indicated a strong interest in learning more about artificial intelligence (AI) and electronic medical records (EMRs) when it comes to technology. In 2025, we covered a range of AI-related topics, including how AI tools can help alleviate the burden of the Outcome and Assessment Information Set (OASIS) and the policies providers have implemented to safely leverage AI without triggering compliance risks. These insights also prompted stories on selecting the right EMR and integrating and maintaining one.

Here are some key insights from our coverage of AI and EMR technology:

AI and tech adoption are shaping strategic readiness for broader regulatory and payment shifts: Providers are not only using AI to reduce documentation time but view AI as a strategic tool to navigate value-based care and increased reporting expectations. AI-related insights can be used to analyze trends and outcomes that help agencies prepare for payment model shifts, including risk-based contracts and quality reporting demands.

Technology choices (AI and EMR) are forcing providers to rethink workflows and upgrade infrastructure: Selecting and integrating an EMR isn’t just about technology — it reveals deeper organizational needs, such as change management, cross-functional collaboration and data governance. Home health leaders report that EMR implementation often surfaces gaps in internal processes and highlights opportunities for workflow redesign, training and greater data interoperability.

AI is highlighting data quality and interoperability limitations: Using AI to assist with documentation aids efficiency, but brings into focus any problems with underlying data in EMRs and other systems. To get meaningful outputs from AI, agencies must have clean, standardized data flows and better integration across platforms and clinical and operational functions. This is influencing EMR configuration, data governance and interoperability practices.

Furthermore, 80% of respondents to the HHCN+ survey expressed interest in learning more about value-based care models within Medicare and Medicaid policy, surpassing all other topics except Medicare Advantage. One respondent specifically requested “more focus on transition to value rather than [fee-for-service]. The more information on this the better.” Another asked us to “push for the true definition and measurement of [value-based care] that the industry can rally around and build a functional model. Single point of truth needed for success.”

These comments highlight the industry’s ongoing struggle to define and implement true value-based care, particularly in non-Medicare settings.

“That is the next hill that we have to climb, is if we as an industry can help define what value-based can be in personal care and show them a path of what that will be,” Kunu Kaushal, CEO of Senior Solutions, said at HHCN’s FUTURE conference this year.

The definition of value-based care in home health is somewhat clearer, but still complex. Check out my podcast episode with Mike Johnson, chief researcher of home care innovation at Bayada, for his thoughts on the matter.

Looking back at this survey and the coverage it inspired, I’m excited about the stories HHCN will cover in 2026. We’ll continue to explore payment, technology, and operations, while also uncovering niche topics and innovative home-based care initiatives.