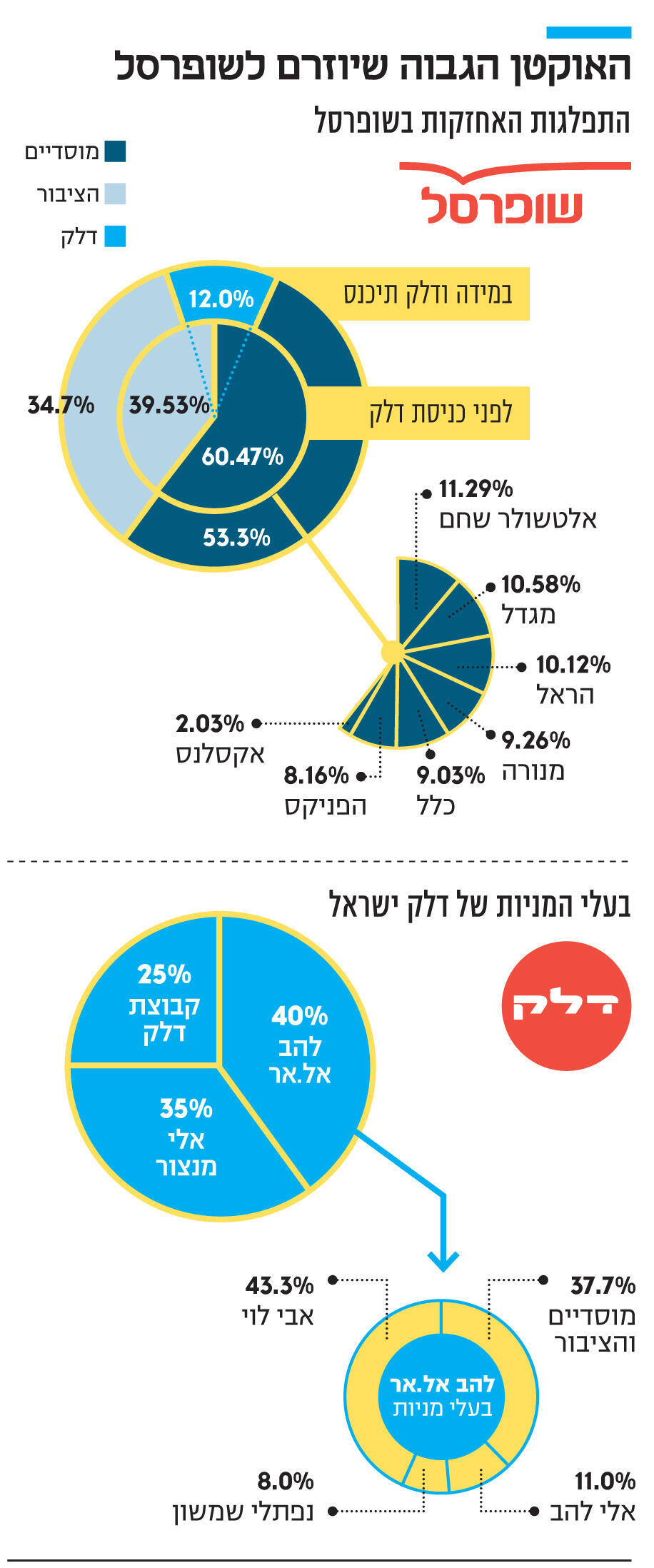

Despite the decline in sales, threats from new competitors in the industry and the negative buzz generated by the company’s internal organizational crisis, Shufersal continues to arouse interest among investors. The Shufersal Board of Directors is expected to convene and discuss Delek Israel’s proposal – controlled by Avi Levy of Lahav LR (40%), Uri Mansour (35%) and the Delek Group controlled by Yitzhak Tshuva – for a share exchange transaction. As part of this, Delek Israel shareholders will carry out a merger transaction by exchanging shares with Shufersal.

Read more in Calcalist:

But it is doubtful whether the institutional bodies that own Shufersal will support Delek’s proposal. Although it has elements that can contribute to the company’s activities, it mainly concerns Liki and Damani, chairman of the Shufersal board, who has been in the eye of the storm since it led to the resignation of the company’s CEO Itzik Aberkhan.

Avi Levy, who is eyeing Shufersal real estate, identified Wadmani as the weak link that can be made through a promise to preserve his position as chairman, harness him to promote a fuel proposal and convince board members of a company without a controlling interest, to vote for a deal to produce one.

As part of the application submitted to Shufersal, Delek Israel shareholders offer to transfer their entire holdings in Delek Israel shares to Shufersal, in exchange for an allotment of 10% of the company’s shares. After this transaction is completed, Delek Israel shareholders will pay Shufersal an additional NIS 100 million in cash in exchange for the allotment of additional shares at a rate based on the value determined for Shufersal as part of the valuations. However, Levy is not really interested in being satisfied with holding at this rate and the deal also includes giving options to Delek Israel shareholders to purchase additional Shufersal shares according to the combined value of the two companies up to 20% of Shufersal, within one year from the date of completion of the transaction.

3 View the gallery

In fact, Delek Israel wants to purchase shares in Shufersal in shares, in a way that will make it within a year the largest holding company among the shareholders and in fact the actual controlling shareholder. At this point, it will be easier for Levy to take the reins and stick his teeth into Shufersal’s real estate. On the consequences of separating the real estate from the retail, one could learn from the fate of Mega, which within years moved from leading the market alongside Shufersal, to an insolvent company that was sold in shares to its competitors.

Delek’s proposal to Shufersal provides a rare opportunity to see how far the government’s statements are from its actual conduct. Just two months ago, Finance Minister Avigdor Lieberman presented his plan to reduce centralization by 5 steps, the most significant of which concerned the tightening of conditions for approvals of mergers by the Competition Authority headed by Michal Cohen. Shufersal, whose power and surplus power over the past 15 years, partly due to the Competition Authority’s approval to acquire competitors such as Clubmarket, New Pharm and Amiga, is already hurting industry competition, and a leader, as the 2021 financial reports show Upwards. The Authority has an opportunity to prove that it is behind its statements regarding the need to reduce concentration in the food market, as the deal presented is expected to increase Shufersal’s power in purchasing food from suppliers by hundreds of millions of shekels, as a result of merging with Delek Mint Joe stores. The merger will also kick-start the huge deployment of Shufersal, which together with the Pharm Be chain owns about 400 points of sale, when it receives 240 gas stations, which operate 210 convenience stores under the Mint brand, the Joe coffee shop chain, and shares in Burger King and Zappa.

3 View the gallery

Right: Lahav chairman L.R. Avi Levy, competition supervisor Michal Cohen, Shufersal chairman Yaki and Damani. The Delek-Shufersal deal is a test of the government’s statement on reducing mergers

(Photo: Zvika Tischler Abigail Pepperno – Beer Uriel Cohen)

The approval of the deal will neutralize Delek as a competitor to Shufersal, which already operates in the convenience store format with the Express brand, and will help it continue to block the competition that is expected to arise with Paz entering the food market, after acquiring Super Yoda and Freshmarket chains last year.

It can be estimated that Shufersal will explain to Cohen that the convenience stores of Delek do not meet the minimum size defined in the Food Law and do not sell vegetables, fruits and detergents and therefore do not constitute parallel points of sale, but enter a territory where the chain is inactive. But the PA is already supposed to understand that increasing the body from NIS 14 billion to NIS 20 billion and expanding its activities from food to pharma, finance with ICC and Facebook, electricity, stock and now also to fuel, will increase centralization in the economy and the one who pays the prices is the Israeli consumer. Another issue that is on the agenda and is expected to bother the competition authority is the agreement signed by Shufersal last January to acquire control (60%) of Mini Line, an importer and retailer of electricity, at a value of NIS 936 million and additional negotiations to acquire the Dan Deal Group.

Even if Shufersal and Delek pass the hurdle of the competition authority, the deal poses an equally complex challenge to Shufersal. A significant part of Delek’s refueling and trading complex operations takes place on Saturdays and holidays. Shufersal, on the other hand, adheres to Shabbat and avoids any activity, which led it in the past to close stores that operated in the Arab sector and were accordingly open on Shabbat. Unlike Super Pharm, which is active on Saturdays, Shufersal refrains from opening the Pharm Be stores on Saturdays and pays a price in the sales line. The importance of the ultra-Orthodox sector to Shufersal can be learned from the entanglement it encountered several months ago, when it turned out that the chain discreetly operates a dedicated online site for the sector, offering prices tens of percent lower on some products sold to the general public on the company’s official online site. It can be hung that all the fuel companies are active and operate convenience stores on Shabbat and yet the ultra-Orthodox sector does not boycott them, but, it is different when a body like Shufersal, the core of its activity in the food market based on kashrut and rabbis, enters the arena.

The potential damage of this move if the heads of the ultra-Orthodox sector decide that it is a red line for them can be learned from the price paid by Blue Square, when it acquired the AMPM chain of convenience stores in 2006. What began with demonstrations outside the branch, continued with a boycott of the ultra-Orthodox sub-chain Shefa Shuk, which in those days rolled in sales of about a billion shekels and ended with its closure.

It is hard not to notice that Shufersal is harmed by the fact that it has no core of control. The events of recent months, Aberkhan’s resignation, which was interpreted as dismissal by Wadmani, continued abandonment of executives, and a murky atmosphere in the company’s corridors, take a toll on the market leader and create a big headache for the institutions that hold it and understand that under Wadmani and Bloch, Shufersal is perceived as weak and confused. Against this background, Avi Levy’s managerial experience, as well as his understanding of real estate that Shufersal marked last month as a new growth engine, can calm the situation and produce, at least ostensibly, a certain calm in the organization.

3 View the gallery

Right: Former Shufersal CEO Itzik Aberhahn and Yiftach Tower Chairman Ron Tal. The business wheel turns for him

(Photos: Abigail Uzi, Tal Shachar)

But a board of directors that operates without a core of control has no real interest in bringing about a controlling shareholder on its own initiative. The institutional owners of the chain must act, but they also understand that they must differentiate between the atmosphere of Shufersal’s disintegration, which is reflected not only in the feelings of managers and employees, but also in the conduct of outsiders such as property owners who offer Shufersal competitors The fact that even if Shufersal’s sales fell sharply, it would still lead the market by a margin of competitors.