June 28, 2022

Aviat is one of Sargon’s competitors and offers to pay $ 235 million for it. Calls for the removal of three directors who she claims are close to chairman Zohar Zispel and thwart the deal: “Responsible for destroying value.” Analyst Oppenheimer Israel: “It’s a lifeline”

Company Soon Networks American, which is one of Sargon’s competitors (CeragonIn the field of wireless transmission, is trying to take over the Sargon board of directors to promote a deal to buy the company for about $ 235 million in cash. Last week, Aviat’s chairman and CEO arrived in Israel for a meeting with Sargon’s chairman, Zohar Zispel, but contacts exploded after Zisapel set a condition that the company refused to accept: a $ 60 million fine if the deal is canceled at Aviat’s fault, and Sargon’s exit without a fine. And it will withdraw from the deal.

Today (Tuesday), the President and CEO of Aviat, Peter Smith, sent a letter to Zohar Zisapel in which he complained that Zisapel set a failing condition: “This is an unacceptable and unacceptable demand in the market. The amount of the fine is about 25% of the full purchase amount. Therefore, we have no choice but to bring the offer directly to the shareholders. ” The appeal to the shareholders was made in the drought Letter to shareholders Of Sargon in which it calls for an urgent convening of the shareholders’ meeting, in order to approve the expansion of the company’s board of directors from 7 to 9 members, while removing from the board of directors three existing members who it claims are thwarting the merger deal.

The battle for the board

Aviat explained that the board has rejected takeover bids it has submitted in recent months. In November 2021 it submitted a purchase offer at a share price of $ 3.25, in April 2022 it updated the offer downwards after the drop in the share price of Sargon, and offered to purchase it in cash at a share price of $ 2.80. In both cases the proposals were rejected. It has recently initiated a new move: it has increased its holdings in Sargon to more than 5%, in order to be entitled to convene a shareholders’ meeting.

Aviat’s next move is well known in the field of takeovers: the buyer is trying to change the composition of the board of directors of the target company so that the new composition will approve the takeover bid. In a letter to shareholders, she explained: “Sargon’s current board of directors was responsible for destroying the share value and ignored opportunities to create more value for shareholders. “The board of directors is above its duty to the shareholders by refusing to maintain constructive contacts with Aviat, which has been trying for months to reach a deal that will give the shareholders immediate and great value.”

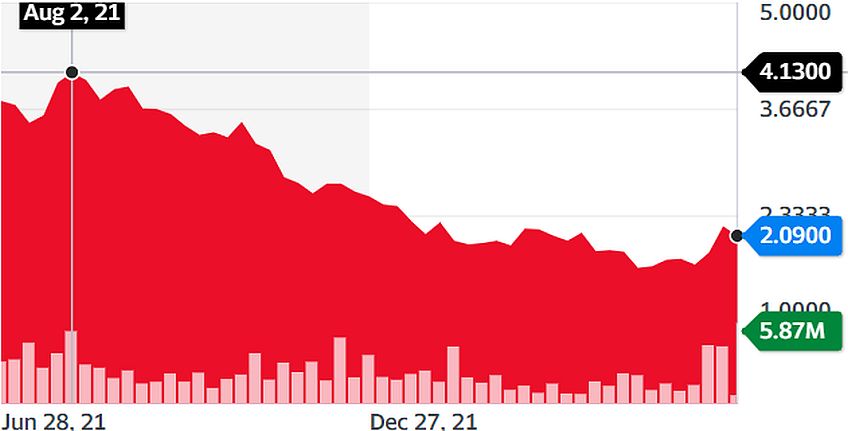

Graph: Sargon stock in the last year and a half. Source: Yahoo finance

Aviat is asking shareholders to remove Ira Felti, Yael Langer and David Ripstein from the board of directors, who they claim are thwarting the deal, because they are very close to chairman Zohar Zispel, and therefore do not enjoy independence in making the decision. In their place, she seeks to appoint the directors on her behalf: Michelle Kleiman, Paul Delson, Jonathan Foster, Dennis Sadlowski and Craig Weinstock.

Felty served as the company’s CEO from 2005-2021, and according to Aviat, “was responsible for a negative return of 21% for shareholders, and for Sargon lagging behind competitors in developing new chips.” Langer has served on Sargon’s board of directors since 2000 and also serves as a consultant at RAD Communications, a company founded by the brothers Yehuda and Zohar Zispel and managed by Yehuda Zispel. David Ripstein previously served as president and CEO of Radcom, which also belongs to the Zisapel Brothers’ Rad Group, and was appointed CEO of Stickspay this month.

Aviat, based in Austin, Texas, is developing microwave solutions for wireless transmission. Its revenues in fiscal year 2021 totaled approximately $ 274 million and net income of approximately $ 110 million. The company is traded on the NASDAQ at a value of $ 284 million. Sargon’s sales in 2021 totaled about $ 291 million and a net loss of about $ 15 million. Sargon is traded on the NASDAQ at a value of about $ 175 million. Smith’s main argument is that a merger between the two companies has created a leading company in the field of wireless transmission, while Sargon alone will not be able to develop: “Sargon’s profit margin is declining, it has no efficient management and the development of its next generation chips is delayed. In light of the shortage in the chip market, we expect that Sargon will continue to delay in bringing the product to market. Aviat’s core chip (developed in collaboration with MaxLinear) is based on more advanced technology than Sargon’s.

Hostile takeover or lifebuoy?

Sargon provides platforms for wireless transmission (Backhaul) that connect remote sites and cellular cells and the network core, and which allow communication operators to expand the network’s capacity. In recent years, the company has experienced quite a few upheavals, from the crisis in the telecom market in India in 2019, which significantly hurt its revenues, to the corona crisis and delays in fifth-generation tenders. In April 2021, CEO Ira Felti left the company, after 16 years in the position, and was replaced by Doron Arazi, who previously served as the company’s CFO.

Sargon’s revenues in 2021 totaled $ 290.8 million, an increase of 10.3% compared to 2020. However, despite the increase in revenue, the net loss amounted to $ 12.2 million. Sargon’s cash register has only $ 17.1 million. In 2022, it expects revenue of $ 305-320 million.

Sergei Vaschonok, a senior analyst at Oppenheimer Israel, actually believes that the takeover bid is a lifeline for Sargon. Speaking to Techtime, he said: “The transmission market is a very competitive market, with very low profit margins. Against the background of the economic crisis, we are expected to see a trend of consolidation and reduction of suppliers. Although Sargon is in a better financial position today than a year ago, the global economy is entering a recession and this will also put the transmission market in crisis. Hardware companies, like Sargon, are particularly vulnerable. It will be very difficult for them to survive alone, and Aviat understands this.

“The merger can benefit both parties. When you unite forces, your power increases, the intervals improve, it can drive higher growth. The subsidiary can also be an attractive target for acquisition by one of the giants. ”

Posted in categories: News, Mergers and Acquisitions, Israeli Industry, Communications

Posted in tags: Aviat, Ceragon, Hostile Takeover, Zispel Glow, Sargon