2024-05-10 10:11:49

Market interest rates rise due to delay in US interest rate cut

Top 5 commercial banks‘ loan interest rates: 5.7%

Household loans increase again after a month

Banks adjust interest rates and strengthen management

Mortgage interest rates are on the rise again, with the upper end of fixed-rate home mortgage loan interest rates at major commercial banks rising to the late 5% range. This is interpreted to be because market interest rates have risen due to uncertainty over the timing of the U.S. benchmark interest rate cut, and as household loans have increased again, banks have begun to adjust interest rates.

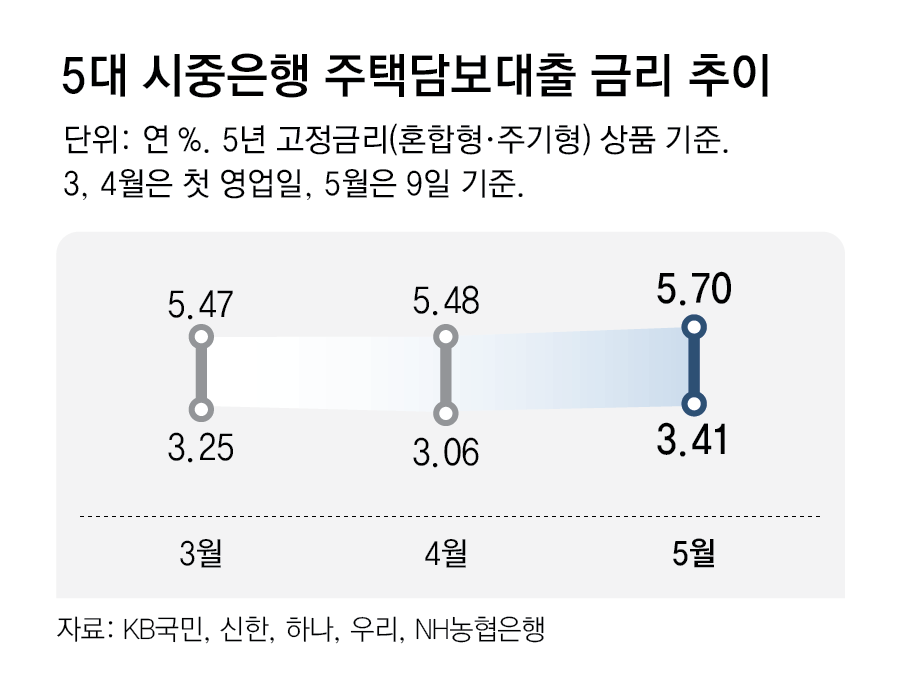

According to the financial sector on the 9th, as of this day, the interest rates for fixed-rate mortgages such as periodic and mixed types of the five major commercial banks, including KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup, were 3.41 to 5.70% per annum. Unlike early March (3.25-5.47%) and early last month (3.06-5.48%), when interest rates were maintained at a similar level, both the upper and lower interest rates rose.

The average interest rate on new loans issued by banks is also entering the 4% range. In the case of new mortgage loans (installment repayment method with a maturity of 10 years or more) handled by the five major banks, the average interest rate of the four banks was in the late 3% range until February, but in a new month, Hana Bank (3.71%) and NH Nonghyup Bank The average interest rate of the three banks except (3.89%) was in the 4% range.

This is because the interest rate on bank bonds, which is the standard for calculating the interest rate on fixed-rate mortgage loans, has risen due to the delay in lowering the U.S. base interest rate. According to the Korea Financial Investment Association, the interest rate on 5-year bank bonds (unsecured, AAA) on the 9th was 3.834% per annum, up 0.097 percentage points from the 1st of last month (3.737%). On the 25th of last month, the annual rate soared to 3.976%.

The growing need for household loan management also had an impact. The household loan balance of the five major commercial banks, which had decreased for the first time in 11 months in March of this year (KRW 693.5684 trillion), returned to an upward trend, increasing to KRW 698.03 trillion at the end of last month. The balance of mortgage loans increased by more than 4 trillion won in one month, leading to an upward trend in household loans.

In particular, banks are making efforts to expand periodic mortgage loans. This is because last month, the Financial Supervisory Service initiated new administrative guidance to establish a target ratio for the banking sector’s own fixed interest loan. Accordingly, banks must set the proportion of their own mortgages, excluding policy mortgages, to 30%, which are either purely fixed with a contractual maturity of 5 years or more or with an interest rate fluctuation cycle of 5 years or more. Unlike the hybrid type, in which a fixed interest rate is applied for a certain period of time and then converted to a variable interest rate, the periodic type is a loan in which the fixed interest rate changes at regular intervals.

Banks are encouraging customers to sign up by treating periodic interest rates at a lower level. An official from the banking sector explained, “It is a common trend in the banking sector to lower interest rates on cyclical products as a policy measure in order to meet the target set by the Financial Supervisory Service.”

As high interest rates become longer, the number of consumers preferring fixed interest rates is increasing. As a result of the Korea Housing Finance Corporation’s ‘Housing Finance and Home Loan Survey’ last year, the proportion of households willing to use mortgage loans that preferred fixed interest rates over variable or mixed interest rates was 52.9%, an increase of 3.9 percentage points over the past year. On the other hand, the proportion of people preferring variable interest rates is decreasing every year.

Reporter Kim Soo-yeon [email protected]

-

- great

- 0dog

-

- I’m so sad

- 0dog

-

- I’m angry

- 0dog

-

- I recommend it

- dog

Hot news now

2024-05-10 10:11:49