On the Japanese market on the 31st, bank stocks surged, leading to a significant rise in share prices. The Bank of Japan (BOJ) decided to implement an additional rate hike during its monetary policy meeting on this day. Bonds were sold off, and the yen fluctuated wildly, rising to about 151 yen per dollar before dropping to around 153 yen.

The BOJ raises the policy interest rate to 0.25% – Governor Ueda states there is no negative impact on the economy.

The BOJ raised the uncollateralized overnight call rate from the previous range of approximately 0 to 0.1% to about 0.25%. This rate hike is the first since the elimination of negative interest rate policy at the March meeting. In a statement, the BOJ explained that considering the current economic and price conditions broadly aligned with forecasts, it judged that “adjusting the degree of monetary easing is appropriate” to achieve a sustainable and stable 2% price stability target.

Additionally, plans to reduce the amount of long-term government bond purchases were announced. The monthly purchase amount, currently about 6 trillion yen, will be reduced by approximately 400 billion yen each quarter, aiming for about 3 trillion yen by the January-March period of 2026.

Bank of Japan Governor Kazuo Ueda (July 31, BOJ headquarters)

Photographer: Akio Kon/Bloomberg

During the post-meeting press conference, BOJ Governor Kazuo Ueda stated that the policy interest rate level of 0.5% was not something he was particularly conscious of. He expressed that even with the rate hike, real interest rates remain very low, indicating that the rate hike would not have a significant negative impact on the economy.

Hiroshi Namioka, Chief Strategist at T&D Asset Management, noted that the market reacted positively to the clearing of uncertainties surrounding monetary policy, which had weighed on Japanese stocks. The market had anticipated increased volatility in interest rates and a stronger yen as the worst-case scenario, but pointed out that currency volatility remained limited while Japanese stocks remained firm.

| Stock, Exchange, and Bond Movements |

|---|

|

|

|

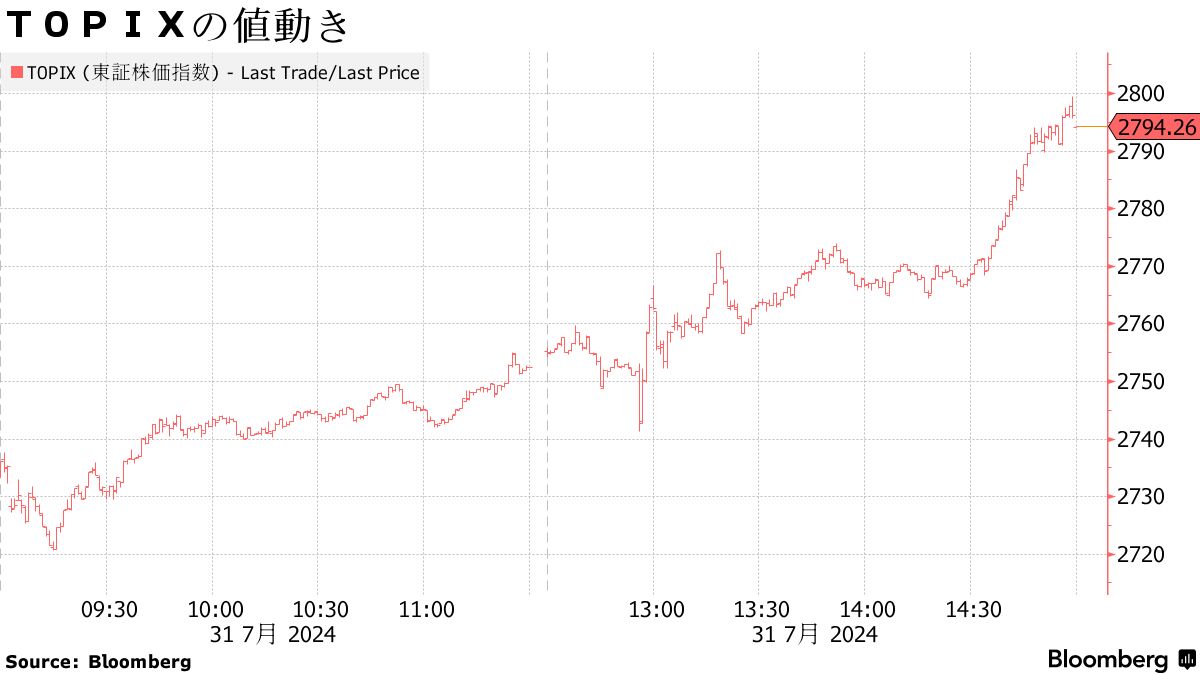

Stocks

Following the announcement of the additional rate hike, the stock market saw significant buying and closed substantially higher. Financial stocks such as banks and insurance companies benefited as the rise in interest rates positively impacted their profits, and semiconductor-related stocks, which had been notably down in the morning, saw a rapid increase as trading closed.

The banking index recorded the highest growth rate among TOPIX sectors, with all constituent stocks rising and marking a 4.7% increase, the highest since December 2022. Hiroshi Matsumoto, Senior Fellow at Pictet Japan, indicated that banks are expected to improve their margins in the future, and that “the stock prices are likely benefitting from an optimistic outlook for interest rates. The rate hike came earlier than expected, but it does not mean this is the end of it.”

Bank stocks surged significantly for the first time in one year and seven months, fueled by hopes for margin improvement due to the BOJ’s rate hike (3)

High-tech stocks like Tokyo Electron also soared. Reuters reported in the afternoon that the U.S. might exclude Japan, South Korea, and the Netherlands from new semiconductor export controls being considered against China. Yuho Tsuboi, Chief Strategist at Daiwa Securities, noted that the semiconductor restrictions were “one of the major reasons for the decline in Japanese stocks since late July,” and that the exclusion reports provided “significant buy-back material,” predicting that the rise in semiconductor-related stocks would continue for some time.

Tokyo Electron stocks surged significantly due to reports of Japan’s exclusion from U.S. semiconductor export controls against China (1)

Naoki Fujiwara, Senior Fund Manager at Shinkin Asset Management, commented that the results of the BOJ’s decision meeting were largely as expected, and if the GDP data for the April to June quarter set to be announced on August 15 confirms robust economic conditions, there could be a possibility of the Nikkei Average breaking its record high.

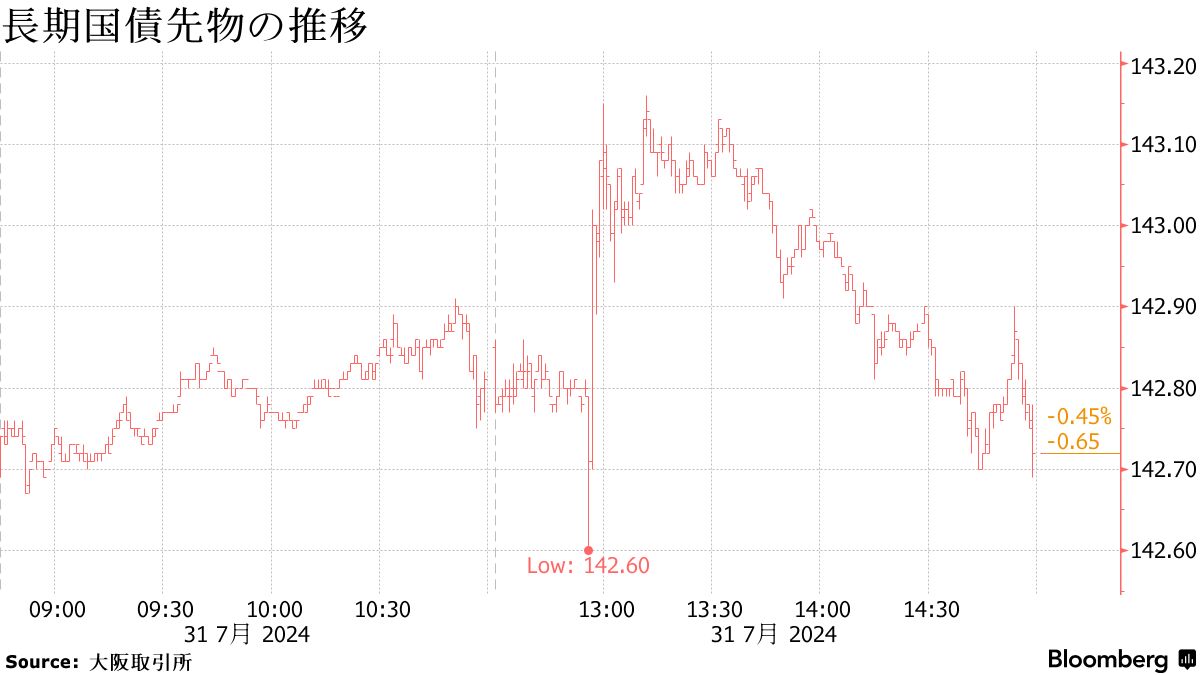

Bonds

The bond market declined sharply. Selling was predominant following the BOJ’s additional rate hike. There were moments of increased buying amid the simultaneous announcement of the bond purchase reduction plan, which caused no surprises.

In the long-term government bond futures market, the center-month contract for September dropped to 142.60 yen, 77 cents lower than the previous day shortly after the afternoon session began. It later recovered to 143.16 yen.

Kazuhiko Sano, Chief Bond Strategist at Tokai Tokyo Securities, stated that in the BOJ’s announcement, the continuation of rate hikes is contingent on whether the economy and price forecasts align, indicating a hawkish stance; however, he noted that the market remains calm. He anticipates the next rate hike to happen “as early as December or January next year, with a 25 bp increase likely being factored in. However, the market’s incorporation of expectations two years ahead is weak, leading to persistent upward pressure on mid-term bonds like the five-year bond.”

Newly Issued Government Bond Yields (as of 3 PM)

| 2-year Bond | 5-year Bond | 10-year Bond | 20-year Bond | 30-year Bond | 40-year Bond | |

|---|---|---|---|---|---|---|

| 0.450% | 0.660% | 1.055% | 1.830% | 2.175% | 2.440% | |

| Change from the previous day | +8.0bp | +7.5bp | +6.0bp | +5.0bp | +6.0bp | +5.0bp |

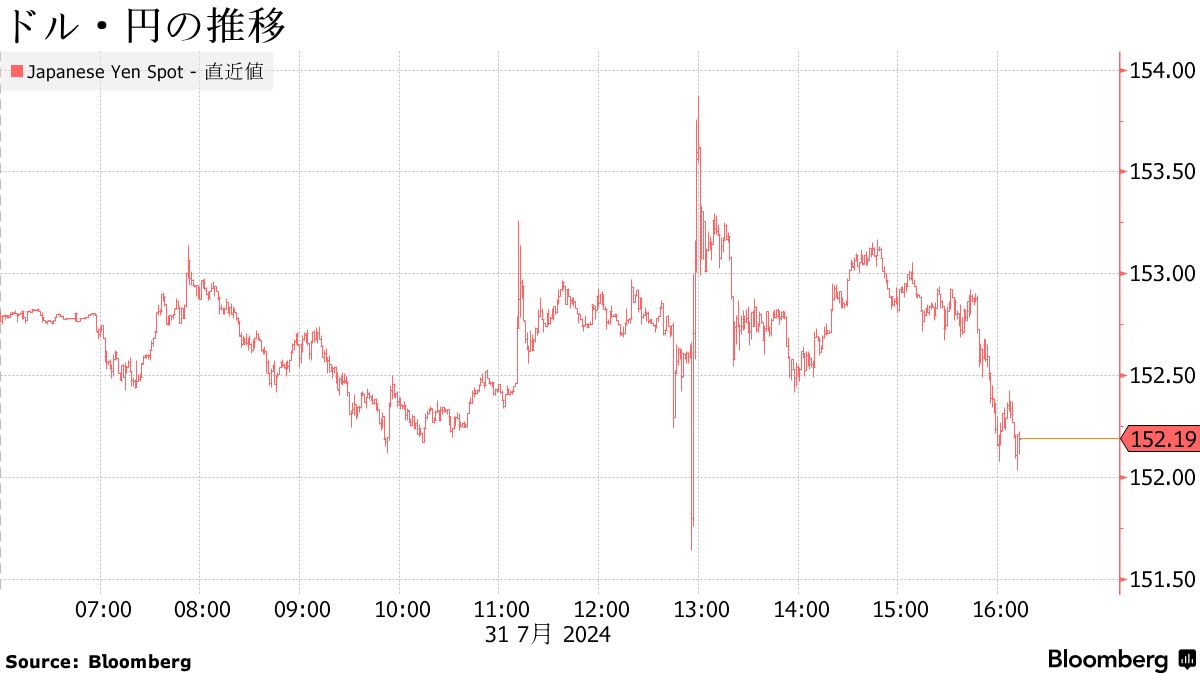

Exchange Rates

The yen experienced volatile trading. Following the BOJ’s additional rate hike decision, the yen was initially bought, but selling pressure emerged as the previous forecast reports had already priced in this outcome. It then turned to increase again, trending upward even during Governor Ueda’s press conference.

Yujiro Goto, Chief Currency Strategist at Nomura Securities, stated that the yen’s movement was a “sell-the-fact” reaction as expectations had heightened prior to the announcement. He also noted that the statement’s content was aimed at sustaining rate hike expectations and that inflation forecasts were revised upward, making the yen likely to strengthen.