As the war in Ukraine intensifies and with it the nuclear threats and reports of deliberate harm to civilians, so do the boycotts of Western governments and Russia’s preparations to run an economy under siege.

Read more in Calcalist:

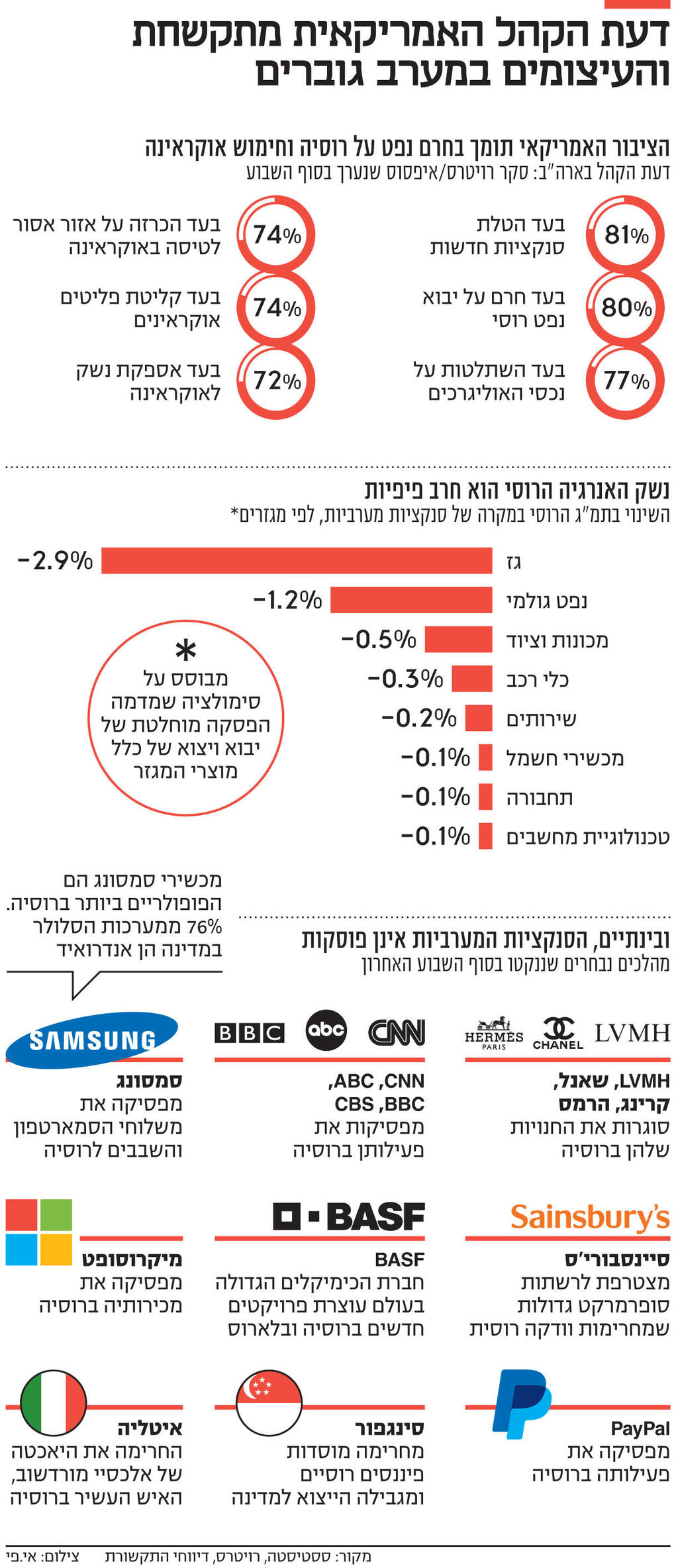

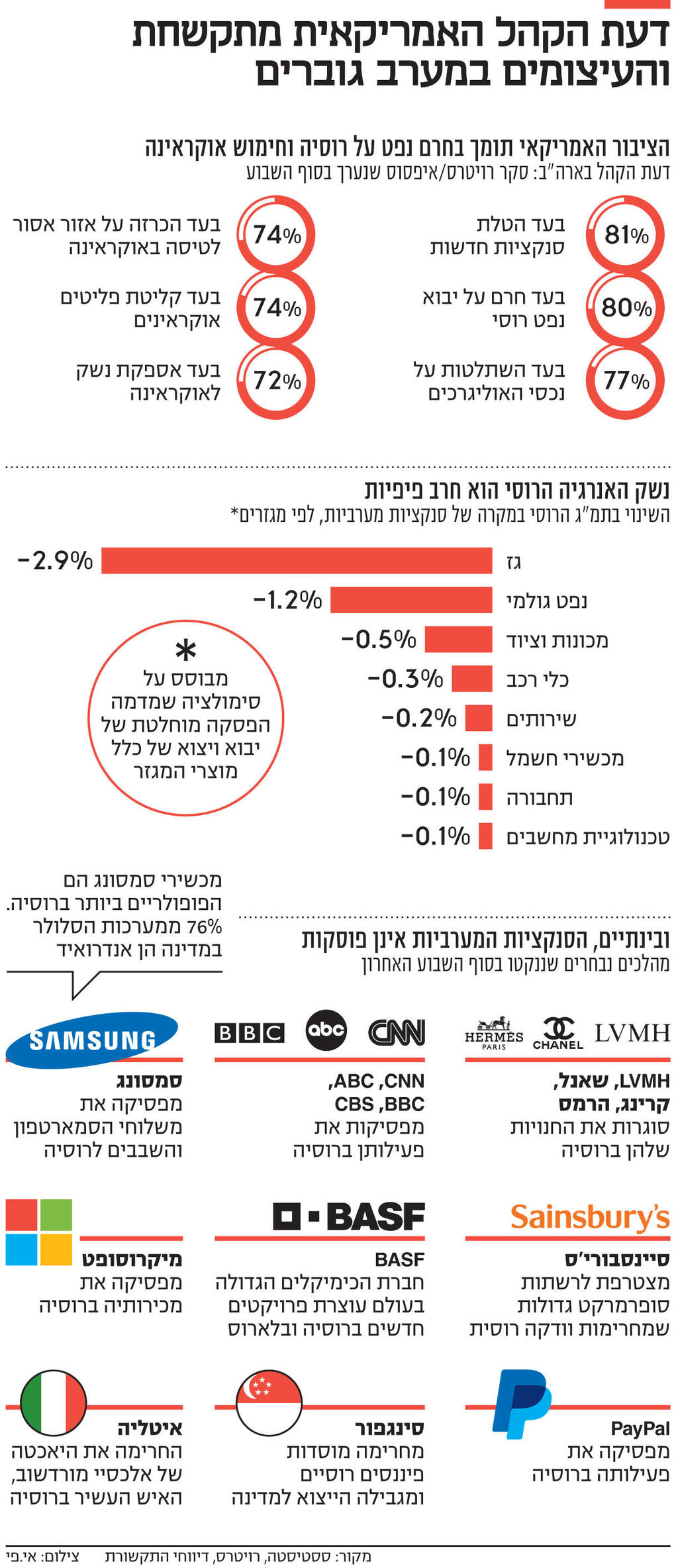

According to the Bloomberg agency, the Biden administration is already working to ban American imports of Russian oil, and a bipartisan agreement on the move has begun in Congress. The Reuters news agency reported that a survey conducted over the weekend in the US shows that 80% of Americans support such a move.

And while Western governments continue to work for Russia’s disconnection from the global financial system, a branch of a Chinese state bank in Moscow reported over the weekend a spike in inquiries from Russian companies seeking to open accounts. “In recent days, 200-300 companies have approached us with a request to open new accounts,” a source at the bank told Reuters. The banker, who declined to identify or identify the bank’s name, said he expects the number of referrals and transactions in yuan to increase.

A Chinese businessman who also asked to remain anonymous noted that the Russian companies he works with all plan to open bank accounts in yuan. “The logic is simple. If you can not use dollars or euros, and the US and Europe stop selling you products, you have no choice but to turn to China. This is an inevitable trend, “he said.

Several state-owned Chinese banks operate in Moscow, including the Industrial and Commercial Bank, the Agricultural Bank and the Construction Bank. Everyone refused to comment on the issue.

3 View the gallery

Demonstration against Russian invasion and ban on flying over Ukraine, in Santa Monica, California

(Photo: AP)

China has reiterated its opposition to Western sanctions, saying they are ineffective and that it will continue to maintain routine economic and trade ties with Russia. Accordingly, Pasco, one of Russia’s largest transportation and logistics companies, said last week that it would receive yuan from customers. The Financial Times reported at the same time that Chinese investors are flocking to buy the so-called Sino-Russian trading concept shares, estimating that Beijing will increase trade with Russia to soften the blow of sanctions. More than a dozen Chinese stocks in the trading-related industries have soared since the invasion of Ukraine, some by 10% for six consecutive days. “The premise is that all of these will benefit massively as a result of the increased trade,” he explained to an Asian analyst at one of the European banks. Investors were also affected by Chinese announcements indicating official support for Moscow, including a recent statement by Chinese customs that trade restrictions on Russian wheat imports would be lifted.

During Russian President Vladimir Putin’s visit to Beijing last month, the two countries pledged to increase bilateral trade to $ 250 billion a year. The Russian president has also unveiled new oil and gas deals with China worth nearly $ 120 billion.

3 View the gallery

Although economists predict that sanctions will push Russia into a deep recession this year amid rising inflation, it is estimated that given the warm relations with China, the Russian economy will not crash. Danny Glazer, a former assistant secretary of the U.S. Treasury Department who now oversees sanctions and now works for consulting firm K2 Integrity, said in a podcast of the OMFIF think tank that the West’s speed of response was a “revolution” designed to crush the Russian economy. He warned, however, that Western sanctions might not change Putin’s military goals and the question would be “how much pain is Russia willing to endure.”

Kremlin spokesman Dmitry Peskov acknowledged last week that the Russian economy was facing a “serious blow,” but the government was working to minimize the possibility of capital flight from Russia by restrictions imposed on the sale of foreign residents’ assets and the transfer of money abroad by locals.

The Financial Times estimated that once Russia completes its adjustments to the initial crisis period, sanctions are expected to have a chronic impact on it, given its growth and imports restrictions. Russia’s economy will become much more isolated, but the country will continue to enjoy a surplus of trade thanks to energy exports.

Goldman Sachs Investment Bank estimates that by the end of the year, sanctions on the Russian central bank, which will hurt the ruble, will raise inflation to 17 percent. This figure is in line with the measures taken by the Central Bank of Russia, which more than doubled its interest rate to 20% last week. Goldman Sachs lowered Russia’s growth forecast for 2022 from 2% before sanctions to minus 7%, with local public and private spending expected to fall by 10% or more.

3 View the gallery

Joe Biden. The oil boycott is not expected to have much of an impact on U.S. fuel prices

(Photo: Paul)

But Clemens Graff, the bank’s Central and Eastern European economist, warned that the immediate crisis Russia would experience would subside within six to nine months when it would earn enough from selling oil and gas to offset the sanctions imposed on foreign exchange reserves.

The West’s intention is to make sanctions affect Russia similar to the sanctions imposed on Iran. These measures have focused on reducing Iran’s revenues from oil exports to zero. But economists expect Moscow to be able to run a siege economy similar to that run by Iran, using hard currency from the sale of oil and gas to be used to import from countries like China that will not boycott it. (See Commentary)

As for the key question – boycotting the Russian energy industry – so far Western leaders have made it clear that they will not do so, for fear of harming their economies. However, according to recent reports, the White House and Congress are now working in the opposite direction. Senators Joe Menchin, a Democrat from West Virginia, and Lisa Morkowski, a Republican from Alaska, last Thursday proposed advancing bipartisan legislation banning Russian energy imports in response to Moscow’s own “energy weapon.” Senators like to say: If Russia threatens to close shards, it should be wary of this double-edged sword. As the world’s largest energy exporter, Russia exports about 5 million barrels of crude oil a day, about half to Europe, and another 2.7 million barrels of petroleum products. Its energy export receipts in 2021 totaled more than $ 235 billion, representing nearly half of the country’s export revenues. In other words, official Western sanctions on Russian oil, if taken, would severely hurt the invading power.

Some believe that this is not necessary. This is in view of the fact that about two-thirds of oil buyers are already boycotting Russia, and therefore an official embargo will have a limited immediate effect that will only shake up markets and jump oil prices to new highs. As the Financial Times’ Christian Malk, head of energy strategy at JPMorgan, explained, even without official sanctions, the lack of buyers and full warehouses could in any case force Russia to reduce oil production. Such a move would have devastating consequences for Russian production capacity, as it is difficult to reactivate closed wells.

And indeed it turns out that reality is stronger than anything. Many Western banks, refineries and shipyards are in fact already taking self-sanctions and acting as if official steps have already been taken against Russian oil. Some of the largest buyers of crude Russian oil have canceled shipments and orders from Russia and also banks, insurance companies and shipping companies have decided not to conduct business with it. According to the consulting firm Energy Aspects, about 70% of Russian crude oil has no buyers. Ural, which is considered the flagship of Russian crude oil, was therefore sold last week at a record discount of more than $ 18 a barrel.

Analysts estimate that a boycott of Russian oil will not have a major impact on the price of fuel in the United States. Since the beginning of the year, however, Russian oil imports have dropped to just 13.5 thousand barrels per day, and it is estimated that the US could easily replace the oil products on which it relies on imports from Canada or Mexico. Russia supplies 10% of the continent’s refined products and more than 20% of its crude oil.

The question of boycotting Russian gas is even more complex: through three main pipelines, Russia exports to Europe a third of its gas worth about $ 450 million a day. In contrast to the situation in the oil market, since the invasion of Ukraine European buyers have continued to place orders for Russian gas and even sought to sign long-term contracts with the government Gazprom, due to the cheap price of its gas.

However, companies with short-term contracts have already started looking for alternative sources of supply. The rise in demand therefore last week caused a 50% jump in natural gas prices in Europe, which reached 185 euros per megawatt hour, an all-time high.

The EU has made it clear it wants to reduce its dependence on Russian oil and gas by speeding up the search for alternative supplies and faster development of renewable energy sources. However, experts emphasize that unlike the oil sector, where the Western world can build on Saudi Arabia as an alternative supplier to Russia, in the case of gas there is no alternative source of Russian gas in the short term in the world. It is therefore estimated that the EU will not be able to stand behind an official step of boycotting gas from Russia.