2024-07-16 21:30:47

- Bitcoin has been in decline since April.

- The dominance charts of Tether and BTC pointed towards a bullish future for the cryptocurrency leader.

At the end of this edition, the price of Bitcoin [BTC] It was trading at $62,500, and there were only a few hours left before the New York session. Although cryptocurrencies trade 24/7, the New York session on Mondays usually features a trend reversal or continuation.

AMBCrypto’s analysis of Bitcoin’s dominance provided clues as to where the broader market could be headed.

Combining this with Tether’s dominance indicated that altcoin bulls could face some difficulties in the coming weeks.

Bitcoin’s dominance represents a verdict

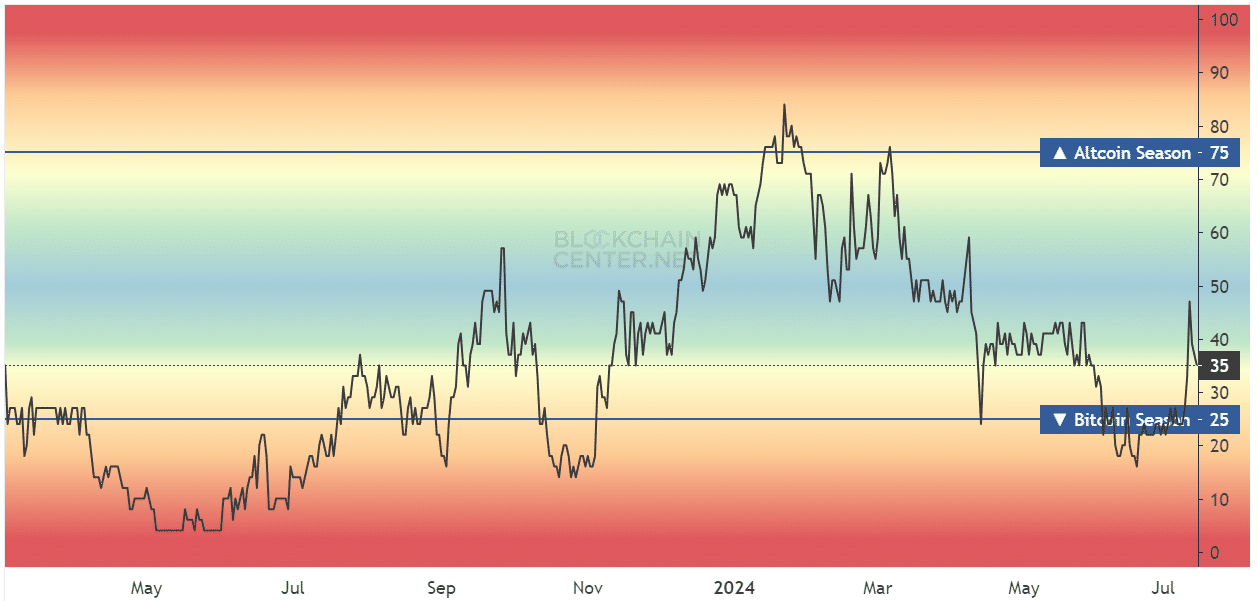

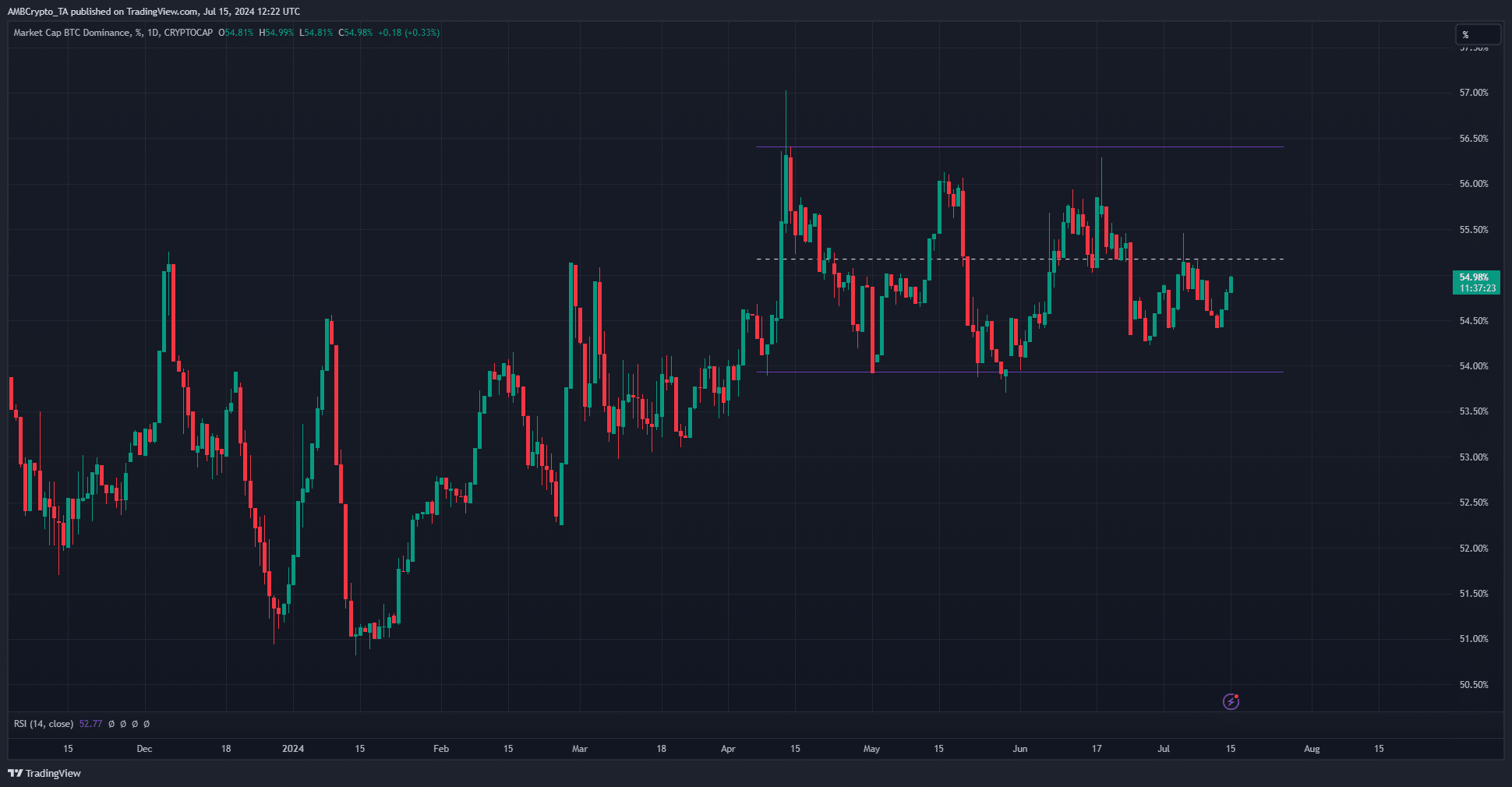

Source: Blockchain Center

In June, the altcoin season index scores were around 25, indicating a strong Bitcoin season. In the last two weeks, this trend started to reverse. The index rose to 46 on July 12, but fell to 35.

This suggested that altcoin season might be around the corner, but other metrics disagreed.

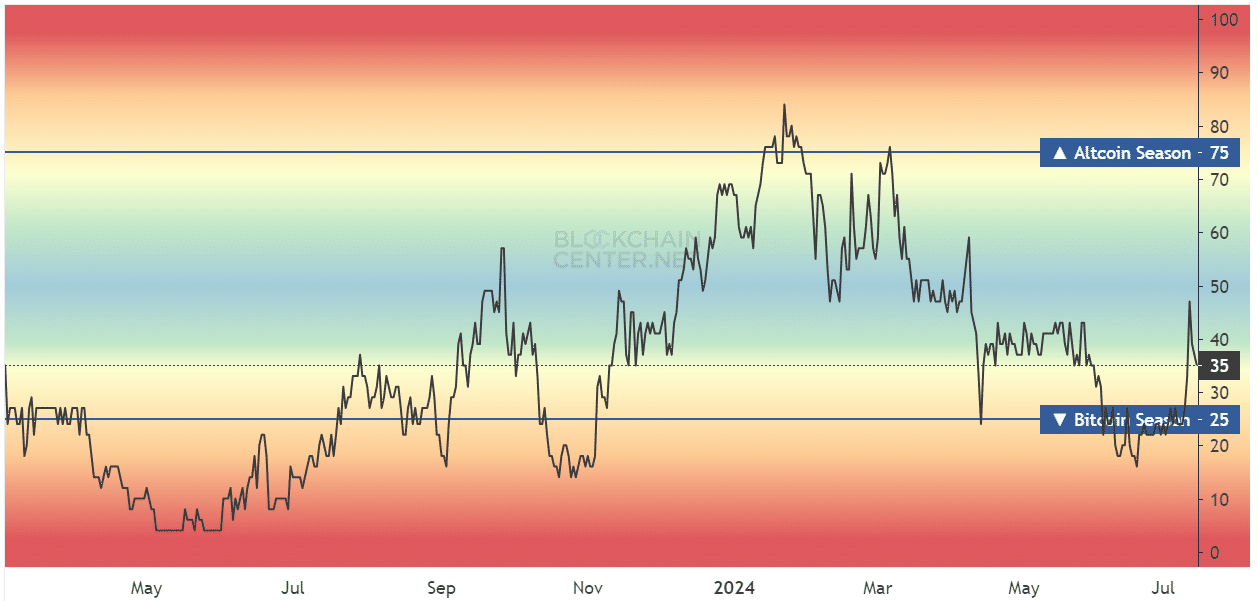

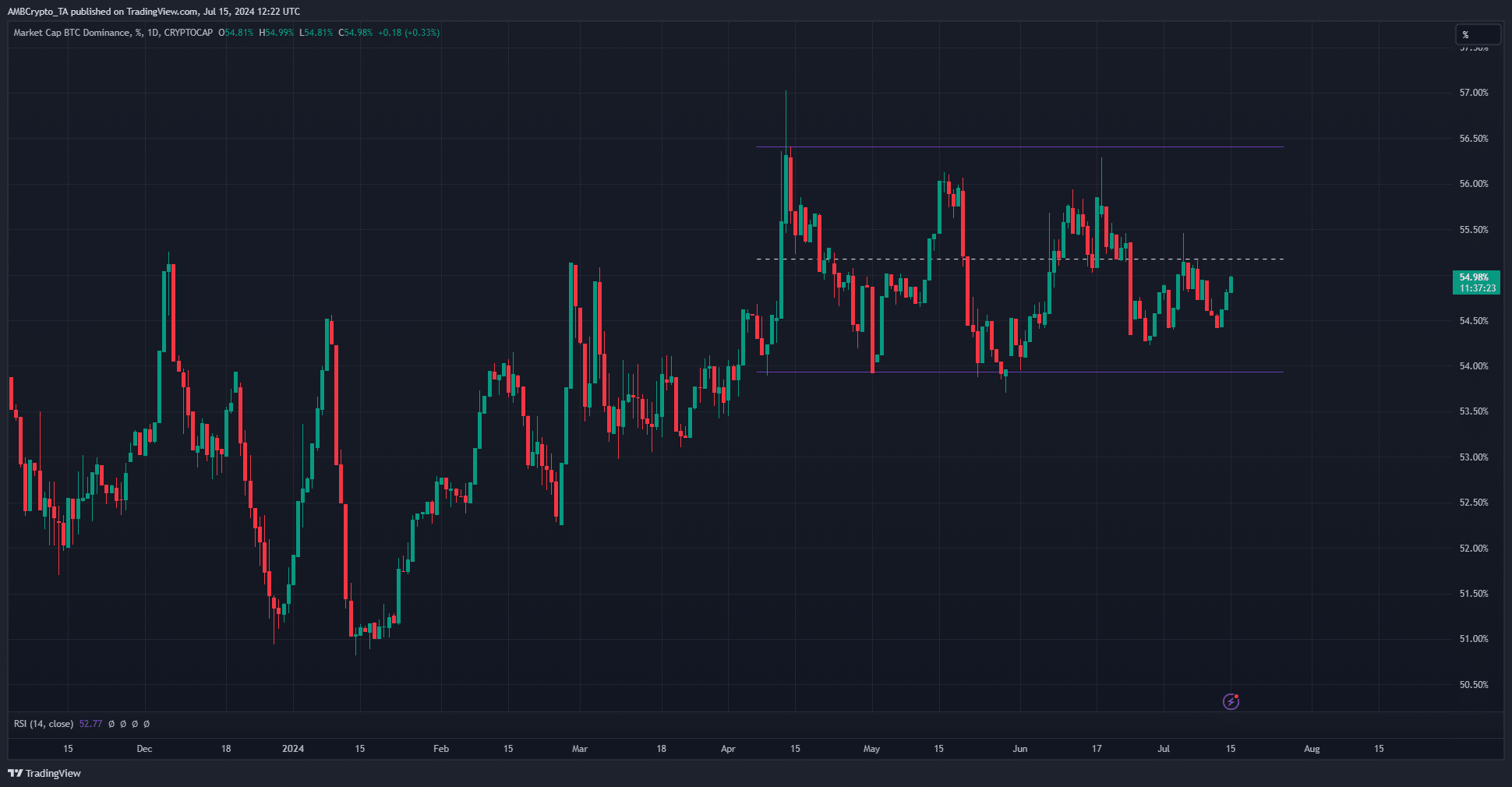

Source: BTC.D on TradingView

AMBCrypto’s analysis of the Bitcoin dominance chart on the daily time frame showed a range formation between 54% and 56.4%. Over the past month, the metric has been below the mid-range level.

The implication was that, like prices, there was no strong trend in the dominance chart. It showed that the altcoin market has suffered along with Bitcoin.

Longer time frames showed that BTC.D was on the rise. This was a sign that BTC betting is likely to overtake the wider market in the third quarter of 2024.

Why will Bitcoin be in the spotlight?

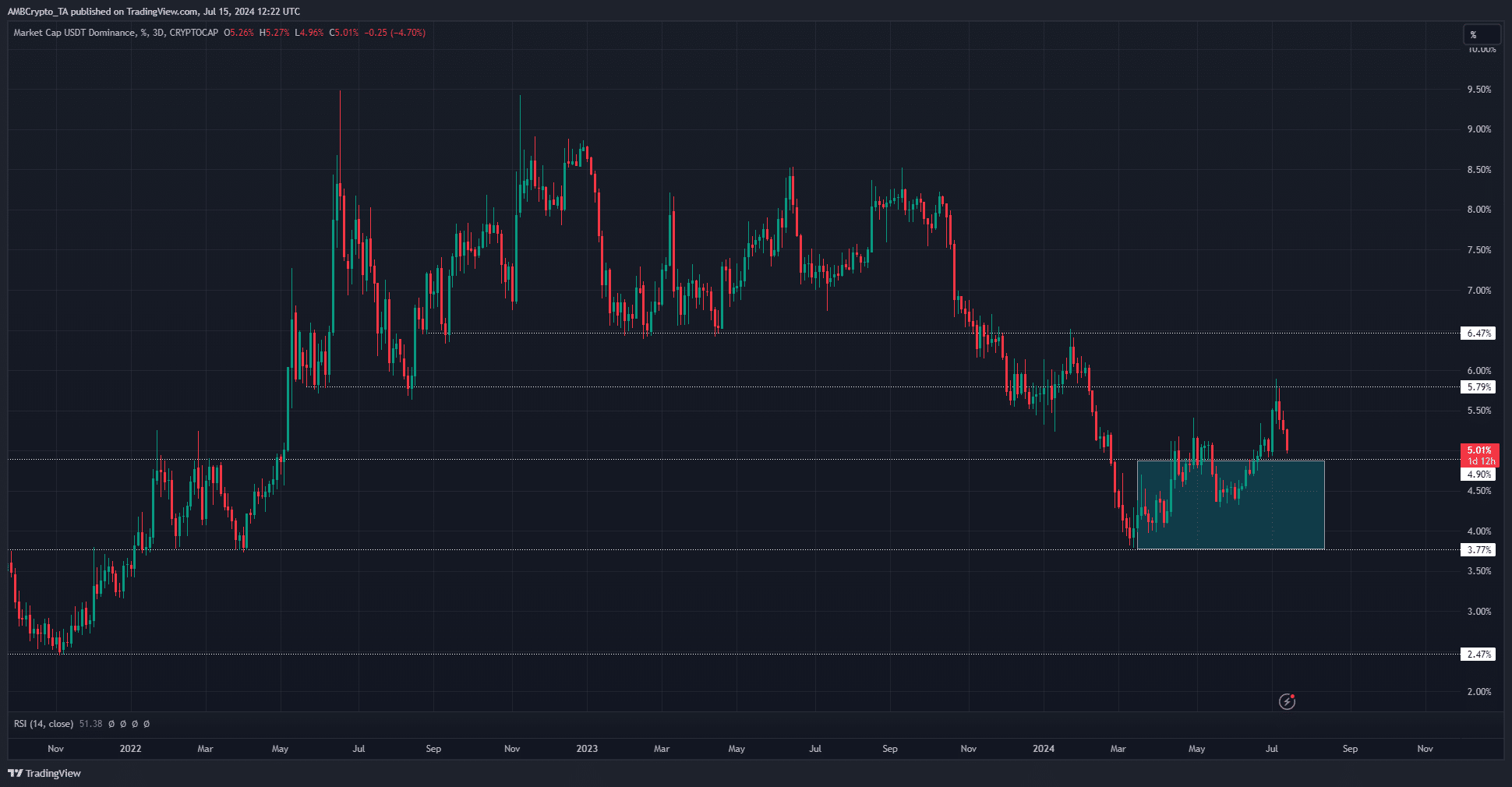

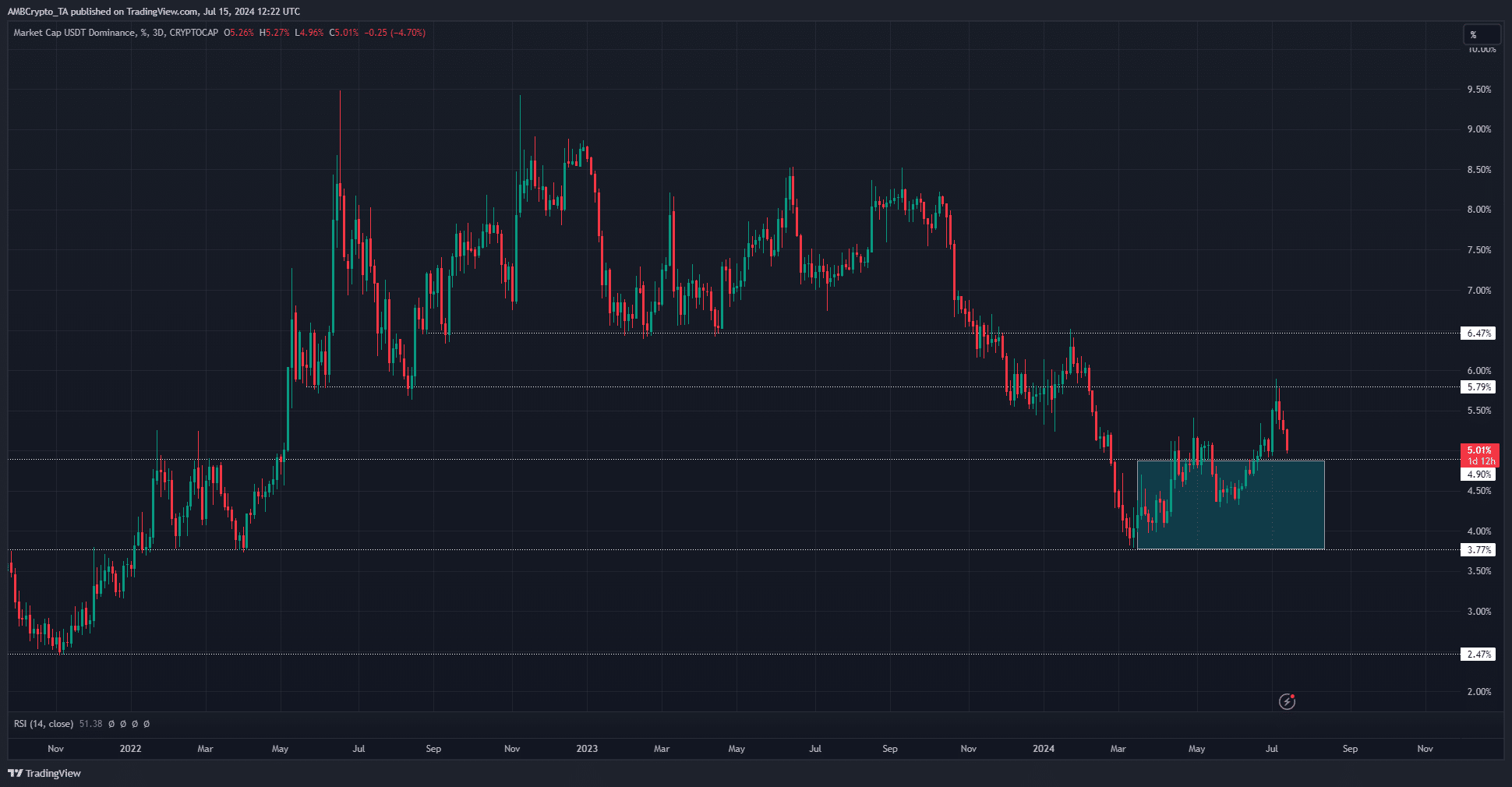

Source: USDT.D on TradingView

Bitcoin is the king of cryptocurrencies and is the main weather plane for understanding market sentiment.

A large influx of capital into BTC is needed before it can be rotated into altcoins, making the altcoin season legendary.

Tether’s dominance chart showed a pullback as BTC prices rose over the past three days. This suggested a market-wide price rally over the weekend.

However, USDT.D is expected to resume its downtrend after this bounce, which could be great news for Bitcoin prices.

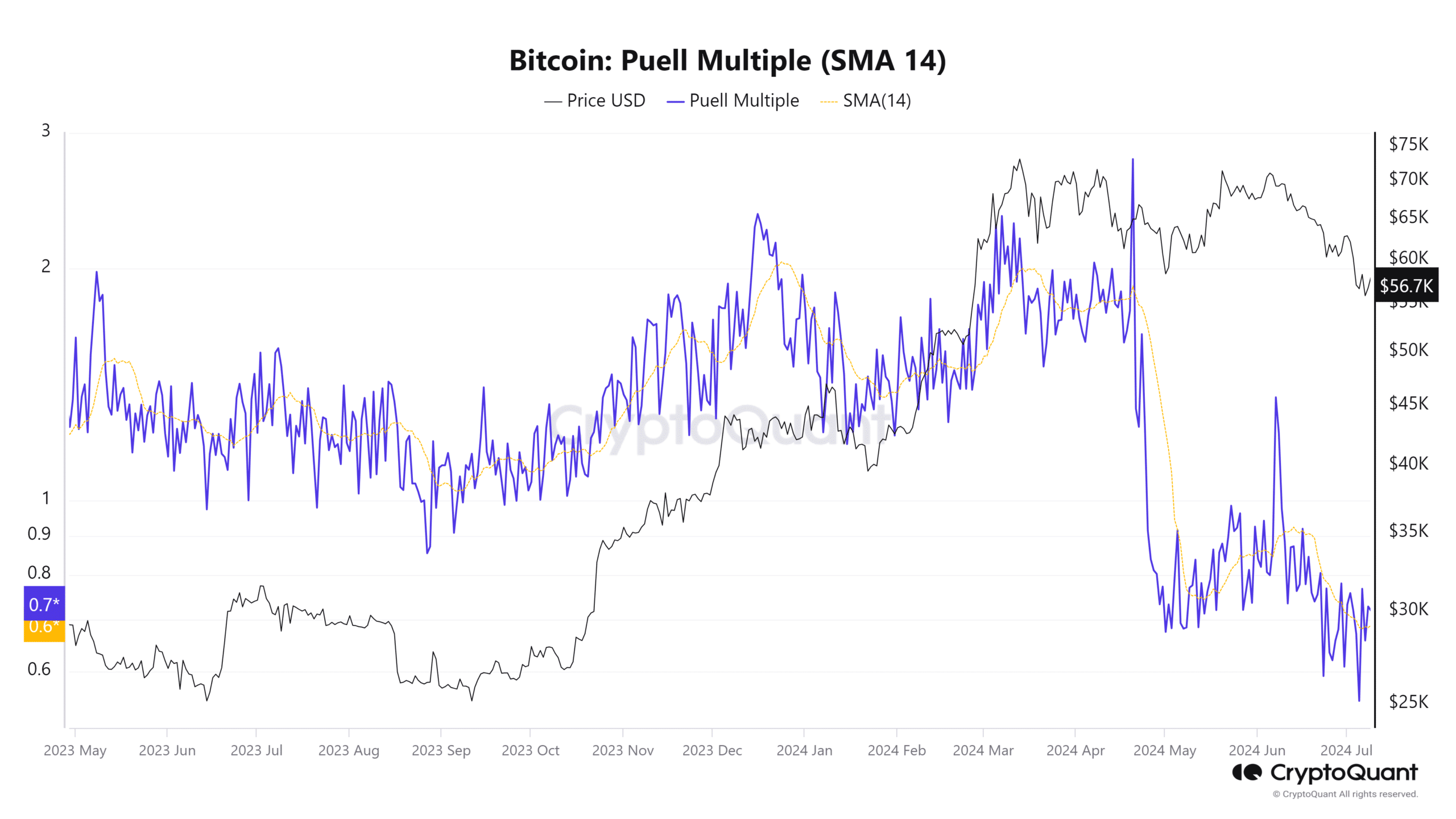

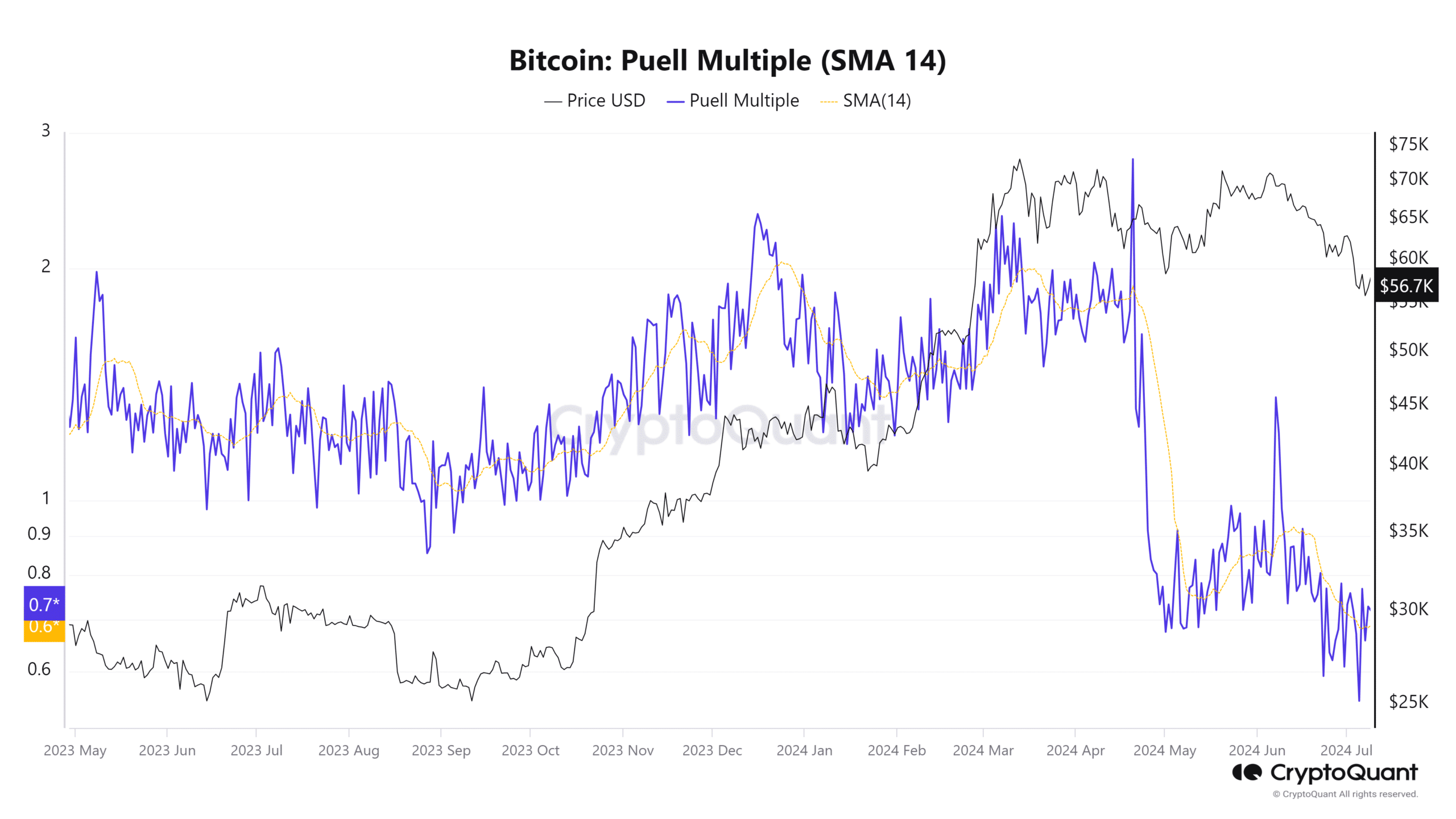

Source: Cryptoquant

Puell’s multiple is a measure of the profitability of mining pools compared to the previous year. At press time, the metric was at 0.72. A reading of 0.5 or less would be a strong buy signal.

This was another sign that Bitcoin price appreciation is coming in the coming months.

This is an automatic translation of our English version.

#Bitcoin #Dominance #Shows #Altcoin #Season #Heres