Read more in Calcalist:

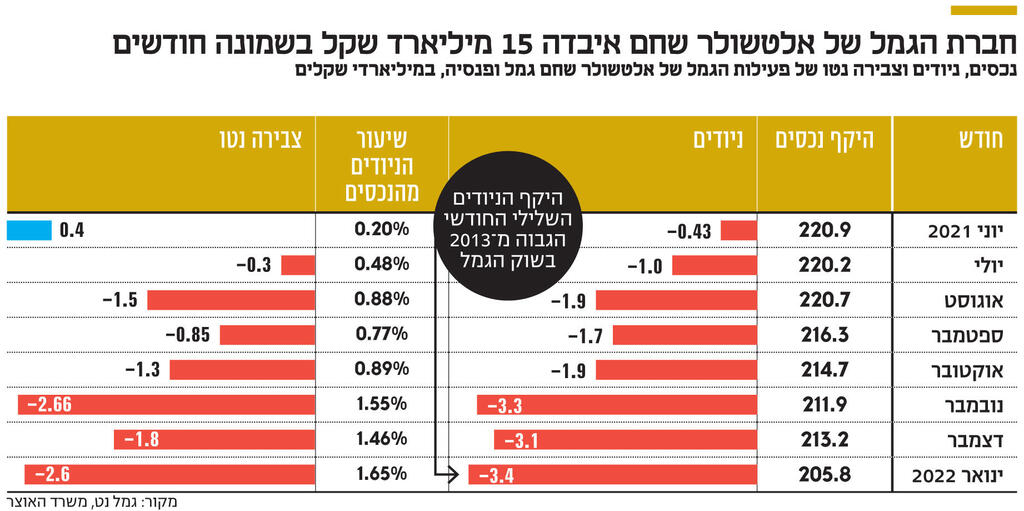

Altshuler Shaham’s provident fund is the largest provident fund company in Israel and currently manages about NIS 206 billion, which constitutes 30.3% of the assets managed in the entire provident fund industry. For comparison, the second largest player is the Phoenix insurance company, which manages NIS 67.5 billion. In other words, the volume of Altshuler Shaham’s mobility last January is 1.6% of the company’s total assets – the highest figure since the provident fund’s activity moved to show negative mobility last June.

2 View the gallery

However, the negative mobility phenomenon of Altshuler Shaham is a process that has characterized the provident company since last June, so on a broader view, in the last eight months the company has lost about NIS 16.8 billion to competitors. In order to get proportions about the size of the crisis plaguing the company, we will note that Analyst, a medium-small provident company in the provident fund industry, currently manages a sum very similar to the one that Altshuler Shaham lost – NIS 16 billion.

The volume of mobility in Altshuler Shaham in 2021 amounted to a negative level of NIS 7.9 billion – the worst figure for the investment house. In fact, 2021 was the first year in which it presented a negative volume of mobility since 2016, when the volume of negative mobility was NIS 260 million.

Leaving customers to competitors hurts the volume of the company’s assets. According to the data that the institutional bodies are required to transfer to the capital market authority, and which are published in the provident system, the company’s net accumulation (weighting of mobility, deposits and yields obtained) in January was negative at NIS 2.5 billion. In total, since the beginning of the crisis, in June 2021, Altshuler Shaham’s net accumulation has amounted to a negative accumulation of NIS 10.5 billion.

Altshuler Shaham Investment House, under the joint management of Gilad Altshuler and Ran Shaham, has increased its control of the provident fund over the years. Between 2017 and mid-2021, clients with capital of tens of billions of shekels moved to the investment house’s provident and pension company, which is managed by Yair Levinstein, as it presented quarter after quarter an excess return over the rest of the market.

2 View the gallery

Right: Altshuler Shaham Provident and Pension CEO Yair Levinstein, and the co-CEOs of Gilad Altshuler Investment House and Ran Shaham

(Photos: Tommy Harpaz, Uriel Cohen)

This is how Altshuler Shaham came to manage NIS 167 billion in capital in the provident fund in May 2021, while dominating half of the study funds and investment provident funds industry. With the acquisition of Psagot’s provident funds in June 2021, the amount of capital managed by the provident company has already increased to NIS 220 billion.

The company’s excess returns were due to the focus on investing in overseas markets and their preference over the domestic market. In 2021, the focus on overseas markets became a shake-up for Altshuler Shaham, as the Israeli stock market generated excess returns over other markets in the world. In the last 12 months, the TA-35 index has risen by more than 23%, while the Nasdaq index has fallen by 2% over the same period.

The breaking point between the savers and Altshuler Shaham’s investment department came when the investment house insisted on holding up to 7% of its assets in the Chinese stock market, which has fallen 5% in the last 12 months.

Between 2017 and 2021, tens of billions of shekels were transferred to Altshuler Shaham, after showing a quarter-on-quarter return on the market. This is how the company managed to manage NIS 167 billion in the provident fund last May

Inflation also caught Altshuler unprepared. The investment house is known for its investments in long-term shekel-denominated bonds. This position benefited Altshuler Shaham as long as low inflation expectations remained. However, starting in the third quarter of last year, expectations reversed – and accordingly shekel bond prices began to fall. Therefore, in recent months, the bond component has also weakened the returns of the investment house’s funds and funds.

Both processes were prominently reflected in the performance of the provident company’s savings. The company’s continuing education fund ended 2021 in the general track at the bottom of the yield table, with a yield of only 10%, compared to an average yield of 14%.

In fact, the provident fund company also opened 2022 on the left foot, with its study fund showing a negative return of 2.15% – the lowest return on the track, which peaked at an average negative return of 1.6%.

Since June 2021, the departure of customers and the negative returns – which have characterized Altshuler Shaham for some of the last few months – have led to a decrease in the volume of managed assets of 220 billion shekels to 205.8 billion.

Compared to the bleeding of Altshuler Shaham, the one who became the big recruiter is Moore Camel, which was issued this month. According to her presentation, 50% of the camels move to her. The company ended January with a positive mobilization of NIS 1.3 billion, thus moving Moore Gamel to more than NIS 31 billion.

Moore’s success in absorbing money from competitors is explained in the industry by a strategic decision by the investment house to work with more agents – and also to pay them as much as possible. According to industry estimates, Moore Provident’s issuance at a value of NIS 660 million stemmed from the investment house’s desire to flood value for shareholders, but also to increase the provident company’s equity. The strengthening of equity will allow the company to increase its expenses, among other things for the payment of commissions to agents, and these in return will continue to attract new customers.

Along with Moore, older companies such as Clal Insurance and Phoenix also recorded high positive mobility. Clal benefited from new customers in the amount of NIS 850 million and Phoenix with mobility in the amount of about half a billion shekels.