Posted Jul 28, 2022, 7:14 PM

The opinion is not tender. The High Council of Public Finances (HCFP), a body attached to the Court of Auditors, unveils its analysis of the stability program that Bercy presents this Friday in the Council of Ministers before transmission to the European Commission. Signed by Pierre Moscovici, the first President of the Court, this text pinpoints the lack of determination of the executive as to the budgetary trajectory drawn for the five-year term. A judgment which contradicts the serious commitments repeated by the Minister of the Economy, Bruno Le Maire, before parliamentarians these days.

“The planned public deficit reduction trajectory (…) is not very ambitious in view of France’s European commitments”, estimates the HCFP. “While many Member States, such as France, have a deficit which today exceeds the threshold of 3 points of GDP, countries comparable to France plan to return below this limit from 2025”.

Significant deficit

The High Council notes that the public deficit will remain “significant” in 2023, at 5% of GDP, with zero structural adjustment. Over 2024-2027, it would shrink on average by just over 0.5% of GDP per year to reach 2.9% in 2027, which represents a structural effort of 0.3% per year.

Currently, France can take shelter behind the “general derogation” clause adopted by the EU during the Covid crisis. It allows Member States to deviate from the adjustment path provided for by European budgetary rules. But, as the HCFP reminds us, this clause must expire at the end of 2023. The return to the rules of the Stability Pact is therefore likely to be brutal.

Removal of tax loopholes

The economic assumptions made by Bercy are also considered fragile. “Lower growth would jeopardize the achievement of these objectives”, point out the financial magistrates. The scenarios of an increase in the rate of compulsory levies (to 44% of GDP) and control of public spending also raise eyebrows. To garner more revenue – while lowering taxes – the executive is counting on the elimination of tax loopholes. However, “experience shows the difficulty of implementing” this lever, insists the HCFP.

As the Ministry of the Economy itself explained, the commitment to contain the increase in public spending in volume to 0.6% over the five-year period is of unprecedented magnitude. “Efforts to control expenditure would be based, according to the information sent to the HCFP, mainly on the pension reform and on expenditure reviews, of which neither the parameters nor the timetable were communicated to it”, squeak the magistrates. They consider it “essential” that, within the framework of the next programming law this fall, the executive “gives credibility to the trajectory of public finances adopted by a precise description of the reforms and the expenditure measures that it implies. They also point to the fact that the 0.6% rate takes into account “the supposed cessation of household income support measures taken in response to the energy crisis”.

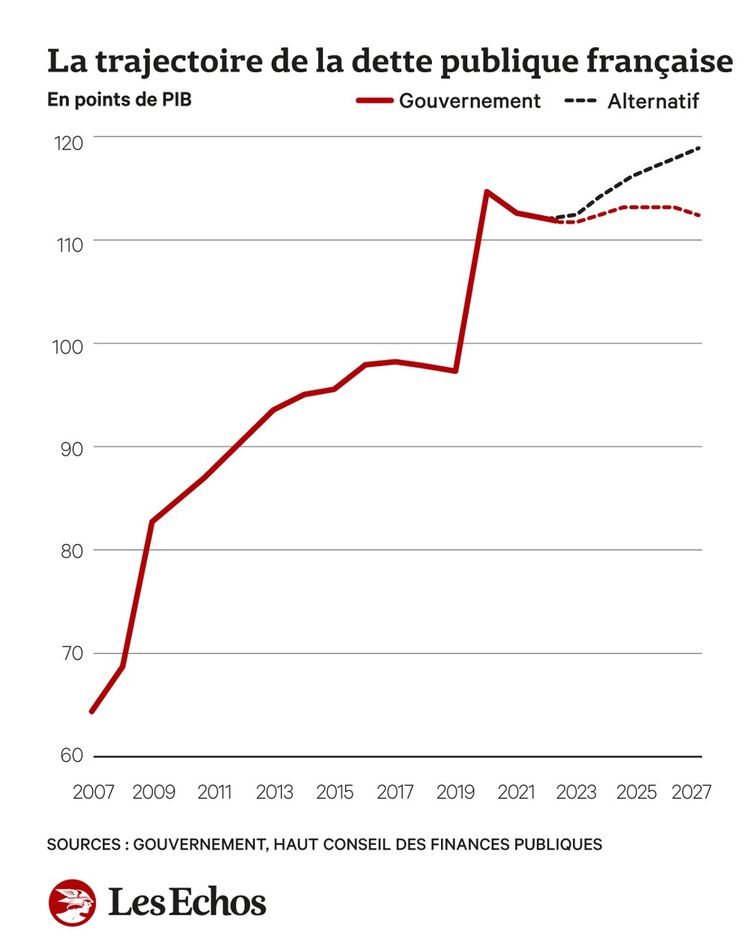

As for the debt trajectory, the HCFP notes that it would be almost stable over the entire period, at a high level (112.5 points of GDP in 2027). “France’s public finance situation would thus continue to deteriorate compared to other comparable countries in the euro zone,” he laments.

Macroeconomic projections

While the executive expects GDP to rise by 2.5% in 2022 and 1.4% in 2023, its forecasts are considered “a little high” given the risks that have accumulated in recent times. Such dynamic growth next year also assumes a drop in the household savings rate which, according to the magistrates, “is not certain”. The projections of most forecasters are also more cautious with regard to 2023. Conversely, the inflation forecast for these two years – respectively 5% then 3.2% – seems “underestimated”.

The HCFP is surprised that these forecasts are based on an “unusual” assumption of a drop in the price of oil, from 110 dollars per barrel in 2022 to 98 dollars in 2023. This is not the “usual practice”.

For the institution, Bercy overestimates the potential growth of France, namely its long-term growth, by counting on an increase of 1.35% per year from 2022. The “production gap” hypothesis ( output gap) – i.e. the difference between the country’s actual production and potential production – retained by the executive is also criticized. It is based on “very advantageous hypotheses of a positive contribution from foreign trade” as well as on the maintenance of a high level of investment by households and businesses, despite the tightening of financing conditions, objects the HCFP. Based on a less favorable potential growth scenario (1.1%), the High Council stresses that the deficit would still exceed 4% of GDP in 2027.

The executive assumes: the reforms – pensions, unemployment insurance, RSA – “will be favorable to growth”, he argues, stressing that his growth forecasts are very close to those of the Commission European. He also hopes that as soon as activity is better, the French will decide to spend part of the additional savings (116 billion euros at the end of 2021) accumulated during the Covid crisis. And assures that “the public finance programming law will present in more detail the way in which we will achieve these objectives. »