2024-05-12 21:23:59

Prepare for Western sanctions by taking lessons from the Ukraine war… Spurring food self-sufficiency

Gold has been said to be the most important safe asset. Above all, because it exists in real life, there is no risk of it turning into a piece of tissue paper overnight. It is also a means of protecting assets in both inflation and deflation situations. If a war breaks out, it can be cashed out at any time and there is no risk of being hacked. This is why the demand for gold has surged every time a global risk occurs. How much gold one possesses is a measure of national power.

Gold price continues to rise

Recently, the price of gold has been soaring every day. This is because as geopolitical instability increases, demand for gold, a safe asset, is increasing. In fact, as the war between Israel and Hamas in the Middle East expanded into an armed conflict between Iran and Israel, the demand for gold increased significantly. On April 12, when Iran’s attack on Israel was imminent, the price of gold reached $2,431.52 (about 3.3 million won) per troy ounce (31.1 g), exceeding the $2,400 mark for the first time.

There are predictions that gold prices will continue to rise. Citibank, a global investment bank (IB), said, “The gold price at the end of the year will exceed $2,500 (approximately KRW 3.4 million) per troy ounce, and within the next 6 to 18 months, the gold price will rise 25% from the current level to reach $3,000 (approximately KRW 4.1 million). “We will break through,” he predicted. Citibank pointed out, “Despite the recent rise in the value of the U.S. dollar, gold prices are showing an upward trend.”

An unusual phenomenon is occurring in the market where the price of gold rises along with the rise in the value of the dollar. This is because central banks in various countries, including China, are purchasing gold in large quantities. Since gold is usually traded in dollars, when the dollar is strong, the price of gold falls, and conversely, when the dollar is weak, the price of gold rises. The amount of gold purchased by these central banks last year was 1,037 tons, the second largest in history after two years ago (1,082 tons). In fact, since last year, gold purchases by central banks in the top five countries account for 87.5% of the total. The top five countries are China, Turkmenistan, Poland, Russia and India.

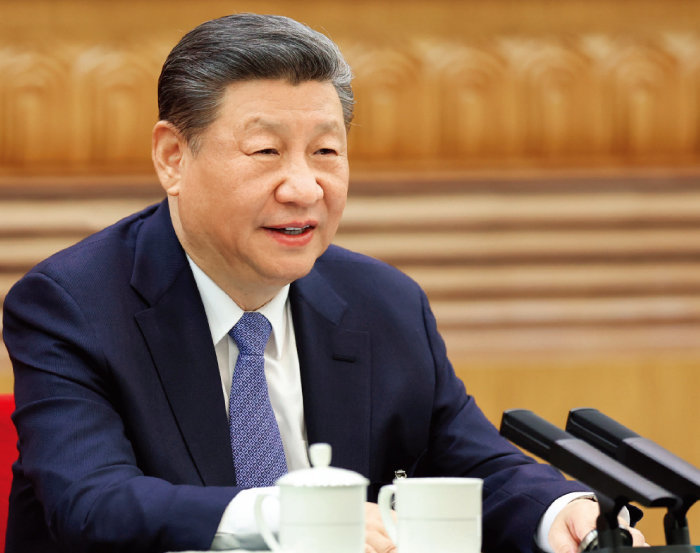

The largest purchaser of gold is the Central Bank of China. Bloomberg of the United States analyzed that China, the world’s largest gold producer and consumer, is playing a large role in the gold price reaching an all-time high of over $2,400 per troy ounce. Currently, China is selling U.S. Treasury bonds and buying gold in large quantities. China is the world’s largest gold miner and importer. According to the World Gold Council (WGC), central banks around the world purchased a total of 1,037 tons of gold last year, of which the People’s Bank of China purchased 225 tons. This amounts to 21.6% of the total purchase volume. It is the highest since 1977, when the Chinese government released statistics. The People’s Bank of China has been purchasing gold in large quantities for 17 consecutive months as of March. It is estimated that China spends at least $1 billion (approximately 1.36 trillion won) every month to purchase gold.

China’s gold reserves were 62.64 million troy ounces (about 1,948 tons) at the end of October 2022, but increased to 72.74 million troy ounces (about 2,262 tons) in March this year. The proportion of gold in total foreign currency reserves (USD 3.245 trillion, approximately KRW 4426.18 trillion) as of March announced by the People’s Bank of China also increased from 3.2% in October 2022 to 4.96% in March. Experts estimate that China’s actual gold reserves are higher as it produces its own gold.

One of the reasons China is actively hoarding gold is to diversify its foreign currency reserves in preparation for uncertainty. China’s state-run English-language newspaper ‘Global Times’ analyzed that as uncertainty in the global market increases, China’s central bank is focusing on gold, a traditional safe asset. Xi Junyang, a professor at the Shanghai University of Finance and Economics, also emphasized, “The main reason why China is increasing its gold holdings is because of uncertainty related to international currencies,” adding, “In particular, fluctuations in the U.S. dollar exchange rate can have an impact on the economy.” Wang Lixin, China representative of the World Gold Association, said, “The purpose of the People’s Bank of China’s increase in gold reserves is to reduce excessive dependence on the dollar by diversifying foreign currency reserves and at the same time reduce the volatility of the assets held through gold’s risk hedging function at a time when global asset volatility is increasing. “He explained.

China sells U.S. Treasury bonds and buys gold

In fact, China is steadily buying gold and selling U.S. Treasury bonds. According to the U.S. Treasury, as of the end of February, U.S. Treasury bonds held by the People’s Bank of China amounted to $775 billion (approximately KRW 1,050.1 trillion), a decrease of $22.7 billion (approximately KRW 30.9 trillion) from the previous month. The People’s Bank of China also reduced its holdings of U.S. Treasury bonds by $18.6 billion (about 25.37 trillion won) in January. The People’s Bank of China has been reducing its holdings by selling U.S. Treasury bonds since February 24, 2022, when Russia invaded Ukraine, and has reduced its holdings by 25% so far. As of May 2019, China was the country with the largest holdings of U.S. Treasury bonds in the world, reaching $1.11 trillion (approximately 1,515 trillion won).

It is also worth noting that China has been reducing dependence on the dollar and actively promoting the internationalization of the yuan in order to make its currency a reserve currency. “With the volatility of U.S. Treasury yields increasing, the People’s Bank of China continues to increase its gold holdings, which helps maintain the value of the country’s assets,” said Wang Qing, an economist at Chinese credit rating agency Dongfang Jincheng. He then predicted, “The People’s Bank of China will continue to increase its gold holdings in the future for the globalization of the yuan.” It is undeniable that China has good justification for hoarding gold.

Russia’s invasion of Ukraine also had an impact on China’s hoarding of gold. At that time, the United States united Western countries and took measures to freeze Russian foreign currency reserves held by each country’s central banks. Western sanctions have prevented Russia from using $350 billion (about 477.4 trillion won) in foreign currency. China convened a large number of experts in various fields, including military and economics, and had them analyze Russia’s invasion of Ukraine and the West’s sanctions against Russia. Chinese experts said that if China invaded Taiwan, the United States would impose sanctions similar to those imposed on Russia, and suggested that preparations were needed. In the end, it can be said that the Chinese Communist Party leadership learned a lesson from the West’s sanctions against Russia and decided to sell U.S. Treasury bonds in advance and continue to increase its gold holdings. Gold can be converted into cash at any time, but U.S. Treasury bonds can easily turn into pieces of tissue paper. In other words, it is intended to prepare for US economic sanctions following the invasion of Taiwan.

Jonathan Eyal, deputy director of the Royal Joint Military Institute (RUSI), pointed out that “China’s hoarding of gold is related to its plan to invade Taiwan” and that “it can be seen as a lesson that China learned from Russia’s invasion of Ukraine.” In fact, China’s gold purchases began in October 2022 and continue even though gold prices are soaring. “There is no doubt that the timing and persistence of China’s gold purchases are part of the lessons learned from the Russia-Ukraine war,” Eyal said, adding, “Beijing’s leadership is preparing for a confrontation with the United States.”

China is also actively pursuing a policy of food self-sufficiency. China, the world’s largest grain importer, recently canceled a large number of wheat imports from the United States and Australia. The U.S. Department of Agriculture said in March that China had canceled an order for 504,000 tons of wheat. This amounts to half of U.S. wheat exports to China in 2022, and is the largest cancellation since 1999. Australia’s wheat exports to China were also canceled or postponed by 1 million tons. International food experts believe that this is an aftereffect of the Chinese government strengthening its food security policy in consideration of tensions with the West, including the United States.

“Willingness to endure long-term confrontation”

The Chinese government plans to implement the ‘Food Security Guarantee Act’ starting in June to strengthen domestic grain production and diversify imports. The ultimate goal is to curb the import of corn and other grains used as animal feed, and further achieve self-sufficiency in wheat and rice. Lee Suelian, a senior researcher at Marubeni Research Institute in Japan, pointed out, “China’s move to suppress grain imports is likely to continue in the mid to long term.” Deputy Director Eyal analyzed, “Chinese President Xi Jinping has been campaigning for self-sufficiency, which is a will to endure a long-term confrontation with the United States for years, not just a few months.”

Since last year, the Chinese government has been encouraging self-sufficiency by introducing a responsibility system for farmland protection and food production performance evaluation for the growth and party secretaries in charge of local governments. The hidden intention of the food self-sufficiency policy is to prepare for sanctions from Western countries, including the United States. It was judged that if China invaded Taiwan, Western-led sanctions such as blocking food supply could be imposed. The international community should not overlook China’s ulterior motives, which are hoarding gold and pursuing a policy of food self-sufficiency.

[이기사는[이기사는주간동아 1439호에 실렸습니다]

Lee Jang-hoon, international affairs analyst [email protected]

2024-05-12 21:23:59